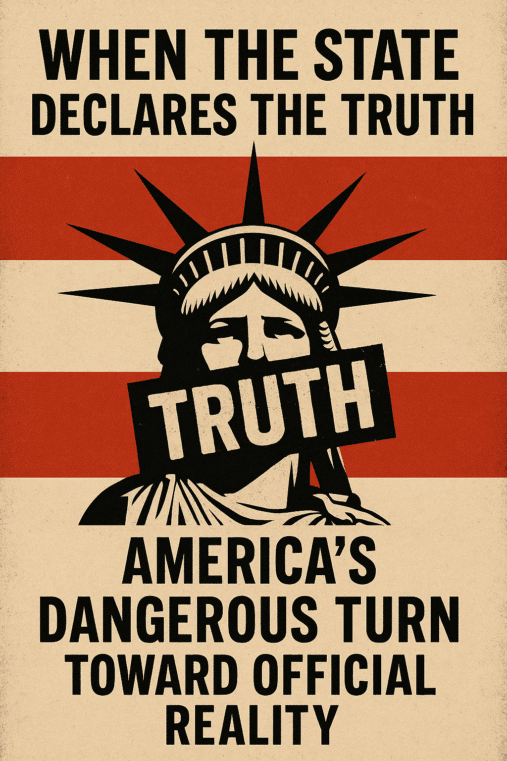

The BIS Offline Handbook: A Step Towards a Global CBDC Takeover

EDITOR'S NOTE: In an era where the digital revolution is reshaping financial transactions, the rise of central bank digital currencies (CBDCs) has emerged as a critical topic of discussion, with both promising prospects and alarming risks. One significant concern is the potential for CBDCs to grant central banks a monopoly over all money, allowing them to exert unprecedented control over economies, and consequently, over citizens' lives. Furthermore, the advent of CBDCs carries the risk of enabling government surveillance of its citizens' financial transactions, posing a significant threat to personal and transactional freedoms.

Despite these significant concerns, the Bank of International Settlements (BIS), in a questionable move, has partnered with Consult Hyperion to release an offline handbook on CBDCs for offline payments. The handbook, which is the product of the BIS Innovation Hub Nordic Center, seemingly downplays the risks associated with CBDCs, and instead focuses on exploring the logistical aspects of their implementation in areas without reliable internet access. This is troubling, given the BIS's influential position in the global financial ecosystem, and its potential to sway central banks towards the adoption of CBDCs without adequately addressing their profound implications for personal freedom and financial privacy. It is imperative that the BIS, and indeed all stakeholders in the financial world, exercise a greater degree of caution and critical examination when promoting such potentially disruptive technologies.

(Kitco News) - As countries around the world continue to progress with the development, testing and rollout of central bank digital currencies (CBDCs), the Bank of International Settlements (BIS) is looking to help facilitate the process with the release of a comprehensive handbook on CBDCs for offline payments.

The handbook, compiled in partnership with Consult Hyperion, was created by the BIS Innovation Hub Nordic Center as part of Project Polaris to explore how central banks can implement CBDCs in areas without reliable internet access.

“Central banks considering the potential implementation of CBDCs with offline functionality must take into account a complex matrix of issues including security, privacy, likely risks, the types of solution, their maturity and applicability, and operational factors,” the statement accompanying the handbook said. “This handbook addresses these issues as well as objectives for resilience, inclusion, cash resemblance, accessibility and other desired attributes.”

According to a survey conducted by the BIS, virtually all central banks consider offline functionality to be important, with 49% of central banks surveyed considering offline payments with retail CBDCs to be vital and an additional 49% deeming it advantageous. The degree to which CBDCs will be provided or used offline will vary significantly by country, region, demographics and specific contexts, which will influence the solutions chosen.

“The research for this handbook has found there is no one-size-fits-all solution, with each country having multiple reasons for providing offline payments with CBDC,” the handbook said. “The types and suitability of solutions for offline payments will vary by country depending on local requirements.”

Included in the handbook is an explanation of the technology components that facilitate offline payments, a set of design criteria for risk management, privacy, inclusion and resilience, and a set of considerations that central banks can use to inform their planning, policy development, technology and business requirements, procurement activities and future operations.

The goal of the handbook is to help central banks “understand the available technologies and security measures; understand the main threats, risks and risk management measures; understand the privacy issues, inclusion needs and resilience options; understand the design and architecture principles involved; and gain perspective on potential operational and change management issues.”

On the technological side, the BIS found that offline payment solutions can operate in three modes: fully offline, intermittently offline and staged offline.

Source: Kitco News

Each central bank has been tasked with determining which mode is optimal for its population and whether it is feasible to operate more than one mode at a time.

Offline payment solutions can be based on tamper-resistant hardware, software or a combination of both hardware and software. Each country will need to determine whether software-based or hardware-based solutions are most appropriate for their populations.

“Where possible, existing technologies and infrastructure should be leveraged to enable offline payments with CBDC; however, any solution should adapt to new requirements and leverage new technologies over time,” the BIS said.

“CBDC systems, like all digital payment systems, must work for everyone in society, whenever and wherever individuals and businesses need them,” said Beju Shah, Head of the BIS Innovation Hub Nordic Centre. “The ability to pay when offline could ensure this is achieved by providing a layer of resilience, as well as supporting inclusion, accessibility and privacy objectives. Implementing offline payment capabilities will require a deeper understanding of the technologies, security threats, risks and mitigating measures, as well as design criteria for privacy, inclusion and resilience. This handbook is intended as a guide to central banks starting this work.”

Originally published by: Jordan Finneseth on Kitco News