401(k) Rebellion: Trump Just Blew Up the Wall Street Retirement Scam

The Executive Order That Could Break the 401(k) Monopoly

On August 7, 2025, Trump signed an executive order that could shatter the old guard’s grip on your retirement. For decades, Americans have been force-fed the same Wall Street garbage: stocks, bonds, and bloated mutual funds run by BlackRock and Vanguard cronies. Now, for the first time in modern history, the federal government is formally allowing alternative assets—precious metals, crypto, and private equity—inside your 401(k).

It's a seismic shift. But like any move in the chessboard of state power, you’ve got to read the fine print and prepare for the counterattack.

Gold: From Fringe to Frontline

Let’s not sugarcoat it—this could light a fire under the precious metals market.

- Demand Shock Incoming

There’s over $7 trillion in 401(k) plans. If just 5% moves into gold or silver, we’re talking a full-blown supply crisis. Vaults will fill, premiums will spike, and the COMEX will scramble to maintain illusionary paper claims. - Gold Gets Legitimized

They called us "paranoid" for holding gold. Now the government is writing it into retirement law. That’s not a hedge anymore—that’s a revolution in portfolio construction. - Boom for Physical Bullion

IRS-approved gold bars, Eagles, and silver rounds could become retirement staples. If your vault isn’t set up already, you’re behind.

Crypto: Trojan Horse or Financial Freedom?

Crypto’s inclusion in 401(k)s could be a double-edged sword. On one side, it opens the floodgates for mainstream adoption. On the other, it invites the very surveillance and regulation crypto was meant to escape.

Don’t forget: every asset they approve, they also track. Expect KYC on steroids, custodial chains of control, and “approved wallets” that only play nice with federal backdoors. The FedNow surveillance machine is just licking its lips.

The Bureaucratic Delays Begin

Sure, Trump signed the order—but now the real delay tactics start. The Department of Labor and the SEC have been ordered to "issue guidance"—translation: bury this thing in red tape.

Key questions still unanswered:

- Fiduciary Landmines: What happens when plan sponsors refuse to touch gold or crypto, citing legal risk?

- Custody Control: Who gets to hold your assets—and who gets to watch you hold them?

- Disclosure Theater: How many hoops will investors jump through just to touch real money?

Gold might sail through these hurdles. Crypto? Not so lucky.

Wall Street’s Quiet Panic

Behind the scenes, traditional financial institutions are sweating. The old model—confiscate your wealth slowly through inflation and fees—is cracking.

- Bullion dealers are prepping vault expansions.

- Crypto firms smell a breakout moment.

- Banksters are trying to kill this with “compliance” bombs.

The average investor? Confused—but curious. They sense the system’s rotten, but they haven’t yet learned how to opt out.

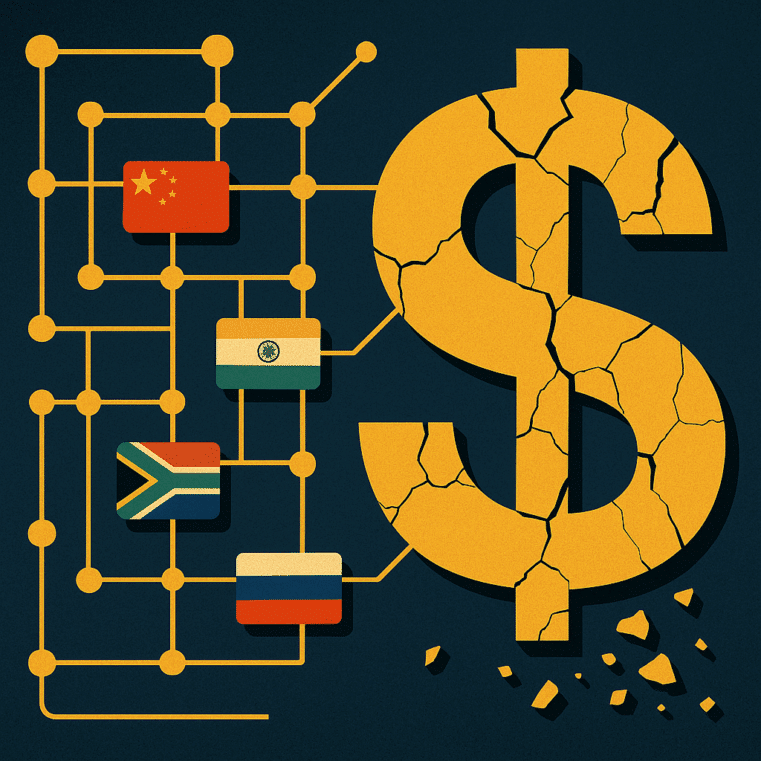

The Real Game: Sovereignty

This isn’t just about retirement accounts. This is about sovereignty. Control. Escape. When you own gold, you own value outside their matrix. When you hold Bitcoin privately, you’re your own bank. And when you diversify your 401(k) into these assets, you're slipping out of their grasp—even if just a little.

Trump’s executive order didn’t just change the investment landscape—it cracked a window in the prison wall. Now it’s up to you to climb out before they seal it shut.

Take Action Now

You want to survive what’s coming? Start by securing your financial independence. Download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius and learn how to move off the digital plantation before the trap slams shut.

👉 Download the free guide here

Before they shut the door for good.