$83 Billion Gold Discovery in China: What It Means for Your Wealth

When you hear about a massive gold discovery—1,000 tonnes worth $83 billion in this case—it’s easy to assume this might flood the market and drive down prices. But don’t let the headlines fool you. While this find in China’s Hunan Province is significant, its impact on the global gold supply is more of a ripple than a wave.

Let’s dig into what this discovery means and why gold is still your safest bet in uncertain times.

The Numbers Behind the Find

Here’s the scoop: Chinese geologists in Pingjiang County have detected over 40 gold veins in the Wangu gold field. At least 300 tonnes of gold have been confirmed so far, with reserves stretching as deep as 2,000 meters. According to state-run media, the entire deposit is estimated to weigh around 1,000 tonnes.

To put that into perspective, the US Geological Survey estimates that humanity has discovered 244,000 metric tons of gold to date. This new discovery only adds about 0.123% to the global total. So, while $83 billion is an eye-popping number, this isn’t a game-changer for supply.

Why Gold Prices Are Still Climbing

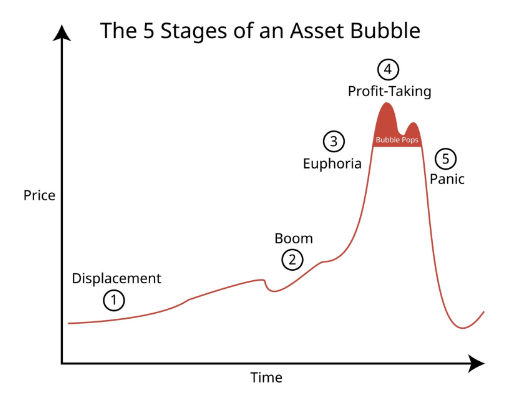

Even with this discovery, gold prices have been surging. Gold is up about 28% this year, jumping from $2,360 per ounce to nearly $2,787 at its peak in late October. Why? Because the drivers of gold’s value—geopolitical instability, inflation, and central bank greed—are stronger than ever.

Sure, more gold in the ground means there’s more potential supply. But it takes years (even decades) to extract, refine, and bring new gold to market. In the meantime, demand is skyrocketing as countries battle inflation and ordinary folks seek shelter from fiat currencies losing value.

Let’s not forget: China has been one of the world’s biggest gold buyers. With their central bank stockpiling, don’t be surprised if much of this newly discovered gold stays within China, further fueling their reserve strategy.

What Does This Mean for You?

The big takeaway here is simple: gold isn’t getting less valuable anytime soon. In fact, this discovery might even strengthen the case for gold as a long-term hedge against economic chaos. The new gold won’t dilute the market overnight, and prices are still on an upward trend.

If you’ve been holding off on adding gold (or silver) to your portfolio, now’s the time. Waiting for prices to dip could leave you in the dust as gold continues to cement its place as the ultimate financial safe haven.

Take Action Now

We’re living in an age of uncertainty. Between inflation, geopolitical tensions, and now the race for global gold dominance, the writing’s on the wall: diversify your assets.

Download Bill Brocius’ eBook, "Seven Steps to Protect Yourself from Bank Failure," and discover why precious metals should be a cornerstone of your wealth strategy.

When governments play games with your money, gold and silver don’t just protect—they empower. Don’t wait for the next financial storm to hit.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.