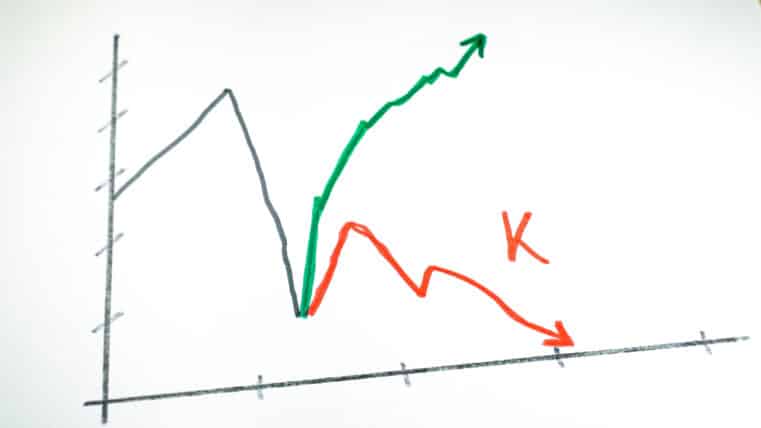

Stagflation Alarm: Inflation Still Hot While Growth Slows—And the Fed Is About to Make It Worse

The Ghost of the 1970s Is Back—And No One Wants to Talk About It

Stagflation—a toxic mix of high inflation and stagnant growth—was once thought to be a relic of the 1970s. But look around. Inflation is stubborn. Prices on essentials—food up 3.2%, shelter up 3.6%, electricity up 6.2%—keep grinding higher. Meanwhile, job growth is softening, productivity is slowing, and real wages have been largely flat when adjusted for inflation.

So why is the Fed even considering a rate cut? Because the labor market is showing signs of weakness. That’s right—instead of fighting inflation, they’re choosing to fight unemployment. The trade-off? Your purchasing power continues to erode while your grocery bill climbs and your rent devours half your paycheck.

If this sounds like policy whiplash, that’s because it is.

The Illusion of Controlled Inflation

Fed Chair Jerome Powell recently hinted at rate cuts, arguing that the labor market is becoming a more urgent concern than inflation. But this is a dangerous gamble. We’ve never sustainably brought down inflation by loosening monetary policy. Not in the 70s, not in the 80s. Rate cuts in this environment are like throwing gasoline on a fire and praying it goes out.

Just look at the numbers:

- Energy prices rose 0.7% in August.

- Auto repair costs are up 8.5% year-over-year.

- Airfare jumped 5.9% in a single month.

These are not flukes—they’re systemic inflationary pressures, and the Fed knows it. But rather than confront this reality, policymakers are betting that inflation will "cool" while they juice the economy with cheap money again.

This isn't monetary policy. It's wishful thinking—and it puts your savings, retirement, and financial independence at risk.

Why This Time Is Different—and Worse

Unlike previous periods of inflation, the government has now locked itself into unsustainable fiscal deficits. We're running trillion-dollar shortfalls during what’s supposed to be an "economic recovery." And instead of tightening, the Fed is gearing up to monetize even more debt.

The consequences? A weaker dollar, higher consumer prices, and the stealth taxation of every dollar you hold. If you're still trusting the banking system to preserve your wealth, you're playing a dangerous game.

How to Protect Yourself: Bill Brocius’ 7-Step Plan

This is why my mentor, Bill Brocius, has been warning for years: the next crisis won’t be a typical recession—it’ll be a currency event. The kind that renders savings accounts irrelevant, demolishes pensions, and sends people scrambling for real money: gold, silver, Bitcoin—anything the government can’t print.

Bill’s ebook, “7 Steps to Protect Your Account from Bank Failure,” is essential reading. It’s not about fear—it’s about being ready.

And for those who want deeper insights into how the Fed’s current trajectory will play out, join Bill’s Inner Circle Newsletter. For just $19.95, you get access to weekly breakdowns, asset allocation strategies, and early warning signals that no mainstream outlet will touch.

Subscribe to the Inner Circle here

Or pick up his eye-opening book, “End of Banking As You Know It,” and learn why today’s financial system is a ticking time bomb.

Final Word

Stagflation isn't coming—it's already here. And the Fed’s next move may lock it in for years to come. Don’t wait for the headlines to catch up. By then, it’ll be too late.

Get informed. Get prepared. And get out of the way of this train before it hits.

—Eric Blair