Alarming Losses Signal Deepening Crisis in U.S. Banking

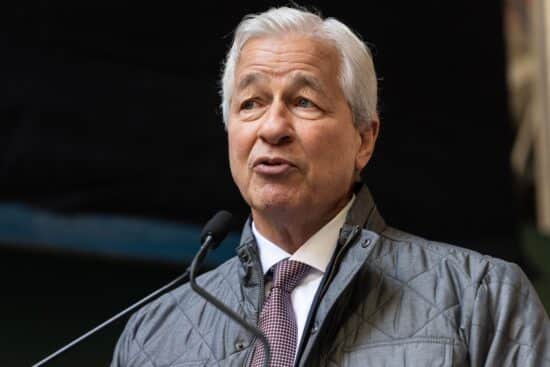

The two largest banks in the US are declaring a loss of $4.5 billion in debts. JPMorgan Chase reported net charge-offs of $2 billion in Q1 2024, those debts being unrecoverable. Bank of America reported $1.5 billion in net charge-offs. This is an increase from $807 million a year prior. As the BRICS bloc pushes for de-dollarization this year, they’ll likely be elated with this news.

“Bank of America is seeing ‘cracks’ in the finances of borrowers with below-prime credit scores whose household spending is affected by higher interest rates and inflation, Chief Financial Officer Alastair Borthwick told analysts on an earnings call. The losses come from credit card debt that will likely never be paid, according to Bank of America.

Furthermore, BofA and JPMorgan aren’t the only major banks suffering from these unrecoverable debts. Net charge-offs are also on the rise at Citigroup and Wells Fargo. According to the Federal Reserve, most banks are now tightening lending standards for most types of loans.

The Federal Reserve says in its poll of senior loan officers: “Banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.”

Despite the unrecoverable debts, JPMorgan Chase earned $49.6 billion in profit last year, while Bank of America earned $24.9 billion. However, the losses signal just how much inflation affected US citizens last quarter, with many going into debt. If banks in the US are reporting such debts, the BRICS alliance may see this as a major win. The US dollar is growing increasingly fragile, and banks are suffering the consequences.

This article originally appeared on Watcher.Guru

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.