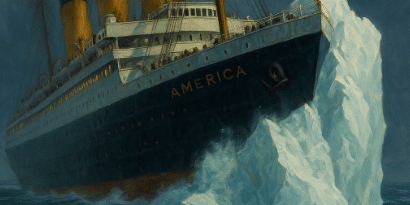

America: A Ship That’s Hit the Iceberg

The Titanic Analogy Isn’t a Metaphor Anymore

You’ve heard the analogy before—America as the Titanic, plowing full speed into an iceberg of unsustainable debt and delusion. Well, guess what? That iceberg isn’t in the distance. We already hit it. And while the hull’s split open and water pours in, the political class is still waltzing, handing out medals for rearranging deck chairs.

The federal debt is now an uncontrollable firestorm, and yet the circus in D.C. fiddles on, hoping you’ll blame the “other party” instead of recognizing the entire system is rigged to implode. Blame’s irrelevant now. Action is the only currency that matters.

Recession Denial: Welcome to the Silent Depression

You don't need an economist to tell you what your gut already knows. Prices are up, wages are stagnant, and your savings are worth less every month. Nearly half the country believes we’re heading into a recession—but they’re late to the party. We've been in one.

This is a manufactured stagnation: engineered inflation, predatory debt traps, and a culture addicted to spending while broke. Americans are being crushed under the weight of their own habits, encouraged by media lapdogs and government parasites to “keep consuming” as the floor drops out.

The Tax Trap: $4 Trillion of Lies and Medicaid Shell Games

Washington is debating a so-called “tax reform” bill that’s nothing but a fiscal suicide note. The bill proposes to slap on another $4 trillion in national debt, and both parties are too compromised to stop it. Behind the buzzwords like “job creation” and “healthcare equity” lies a system begging to be looted one last time before the crash.

Medicaid expansion? It’s a Trojan horse—millions of able-bodied people added to the rolls with no safeguards. SALT deduction wars? Just another distraction. And Trump? He says don’t touch Medicaid, but the real damage was already done when we let entitlements become vote-buying schemes.

Tariffs, Walmart, and the Great Inflation Cover-Up

Walmart just confirmed what many of us already knew: these tariffs aren’t punishing China—they’re punishing you. Higher prices at checkout? That’s your economic warfare dividend, courtesy of political theater.

The cost of gold is spiking. That’s not an investment trend—it’s a panic signal. Faith in the U.S. dollar is evaporating, and Walmart’s CFO is openly admitting they can’t absorb the shock anymore. Translation: brace for impact.

Housing Market: The Bubble That Won’t Pop—It’ll Just Rot

Home sales are tanking, inventory’s up, and mortgage rates have crossed into no-man’s-land. Buyers are walking, sellers are dreaming of 2021, and homeowners are locked into rate-prison from the pandemic. Welcome to zombie real estate.

This isn't just a correction—it’s a long, slow collapse fueled by systemic lies about affordability, stability, and economic health. And it started long before tariffs. This is rot, not rupture.

Buy Now, Starve Later

Here’s a nightmare: Americans are now using "buy now, pay later" schemes to put food on the table. Yes, groceries. Klarna is collapsing. Defaults are rising. Delinquency is no longer a poor choice—it’s the norm.

This isn’t consumer behavior. It’s a cry for help. But the system doesn’t care. It would rather you max out your credit than question why eggs cost as much as tech gadgets used to.

Crypto: When the Digital Becomes Dangerous

Forget market volatility—the real crypto threat is physical. A breach at Coinbase exposed addresses of high-net-worth users. The result? Real-world threats, targeted crime, and the dawning realization that digital wealth doesn’t mean physical safety.

You think hackers are the only problem? Think again. Governments want this chaos so they can roll out centralized digital currencies—like FedNow—with the promise of “security” and the reality of surveillance.

California’s Insurance Scam and the Wildfire Grift

Out West, residents are being roasted twice: once by flames, and again by their insurance companies. State Farm is jacking premiums 30% after already doing it once this year. Fire victims are getting stiffed, lowballed, and tossed into court just to get what they’re owed.

This is the new American deal: pay more, get less, and fight for scraps. All while the suits in Sacramento and D.C. pretend they’re here to help.

Red Tape or Ruin: The Los Angeles Case Study

Only six—six—homes have been approved for rebuilding after 16,000 were destroyed in recent fires. Meanwhile, China is building military outposts at light speed. That’s not incompetence. That’s bureaucracy as a weapon of stagnation.

America has become a paper-shuffling empire too bloated to respond to crisis. But foreign powers? They're prepping for global dominance. While we drown in permits and zoning laws, they lay the groundwork for the future.

Debt Tsunami: The Final Countdown

Debt-to-GDP could hit 200%. At that point, it's not a country—it’s a Ponzi scheme. But hey, keep buying $2 candy bars and doom-spending on Amazon. Keep watching TikToks about "side hustles" while your purchasing power vaporizes.

The American consumer is being hollowed out, one impulse buy at a time, and no one in power will save you—because they can’t. They’re too busy looting the vault.

Final Thought: Get the Damn Life Jacket

The iceberg’s been hit. The alarms are sounding. But you still have a choice—prepare or perish. This isn’t fearmongering. It’s a battle cry for sovereignty in the age of collapse. Build your lifeboat now. Stock up. Get your money out of centralized control. And for God’s sake, pay attention.

You want real answers? Start with "Seven Steps to Protect Yourself from Bank Failure" by Bill Brocius—download it here.

The clock’s ticking.