Analysts Eye $2500 Surge for Gold But Not Until Steep Market Dip

(Kitco News) - The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end.

In an interview with Kitco News, Chantell Schieven, Head of Research at Capitalight Research, said that not only is gold technically overbought, but it has also started its historical seasonal weak period. In this environment, Schieven noted that she sees gold prices potentially falling back to $2,150 an ounce, representing the March breakout level.

Although Schieven is looking for a correction in gold in the next few months, she remains a long-term bull. She said she is raising her year-end price target to $2,500 an ounce, up from $2,400 an ounce.

The comments come as June gold futures start the week with a more than 2% loss, last trading at $2,349.10 an ounce.

At the start of the year, Schieven was the most bullish analyst who participated in the London Bullion Market Association’s annual price forecast.

“It’s been kind of surprising to see gold take out all these levels, and while I do think it goes higher, I do think we need to see a bit of a pullback,” she said. “I don’t think gold goes all the way back to $2,000 or below, but we could see $2,100 before the end of the summer.”

Schieven said that the most significant reason she has turned near-term cautious on gold is due to shifting interest rate expectations that are supporting higher bond yields and a stronger U.S. dollar. Markets are now pushing back the start of the Federal Reserve’s easing cycle until after the summer.

According to the CME FedWatch Tool, markets see less than 20% chance of a rate cut in June. At the same time, the chance of a rate cut in July has dropped below 50%.

“Gold has broken a bit away from its fundamental drivers, and I think we are starting to see these drivers come back into focus, which can be negative for gold,” she said.

However, Schieven added that the gold market has become significantly more nuanced than just following bond yields and the U.S. dollar. Although the Federal Reserve is not expected to cut rates during the summer, it's unlikely to raise interest rates.

“The Federal Reserve will eventually cut rates this year. I expect to see them cut rates after the 2024 election, and that is when we will see gold prices climb higher and push towards $2,500 an ounce. The summer lows could prove to be a good time to buy for long-term investors.”

At the same time, Schieven said that she expects inflation to play a more critical role in gold’s price action. She pointed out that with the Federal Reserve holding firm on its monetary policy, higher interest rates mean that real rates will rise, lowering gold’s opportunity costs as a non-yielding asset.

“Ultimately, the Fed, even with their hawkish comments, continue to leave themselves room to lower interest rates,” she said. “They will be lowering interest rates even as inflation remains stubbornly above the 2% target. The Federal Reserve can’t afford to maintain higher interest rates because of rising debt levels.”

Looking beyond U.S. monetary policy, Schieven said that she expects gold to remain an attractive safe-haven asset. Although the global economy has seen relatively better-than-expected growth so far this year, Schieven said she has not entirely dismissed the threat of a recession.

She added that rising U.S. debt will strangle economic growth as more money is thrown at just servicing its debt. In March, economists at Bank of America noted that U.S. national debt is rising by $1 trillion every 100 days. Schieven pointed out that this is a significant reason why central banks will continue to buy gold.

“Nobody wants our debt right now,” she said. “As the debt grows, it's not surprising that central banks want fewer U.S. dollars and want to diversify their holdings.”

Finally, Schieven said that U.S. geopolitical instability as the 2024 election draws closer will also provide new support for gold.

“I don’t really know how to put this, but neither choice is that great. No matter who gets elected, deficits will still rise, and the U.S. dollar will still be devalued,” she said. “Those things are not good for the U.S., but they are certainly good for gold.”

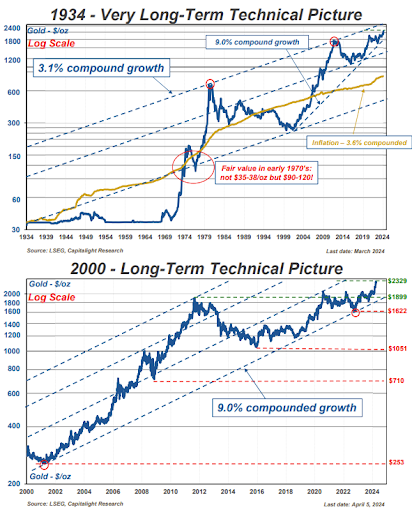

Looking through higher volatility this year, Schieven said that gold remains in a long-term uptrend. She pointed out that during the 1970s, higher inflation, economic uncertainty, and geopolitical turmoil caused gold prices to double.

While that might be an unlikely scenario today, Schieven said that it is not out of the question.

“We do not think it is out of line to look for a $3300+ gold price over the next 5-6 years,” Schieven wrote in a recent report.

This article originally appeared on Kitco News

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.