Back-to-School Debt Crisis: Inflation Shrinks Wallets, Not Shopping Lists

The back-to-school shopping season is in full swing, with the hefty bills to prove it.

Nearly one-third — 31% — of back-to-school shoppers said that buying supplies for the new year will put them into debt, according to a new report by Bankrate, which polled more than 2,300 adults in July.

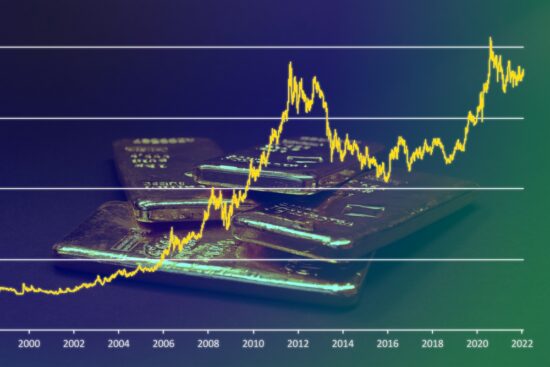

Higher prices are partly to blame: Families are now paying more for some key back-to-school essentials such as backpacks ahead of the new school year. CNBC used the producer price index — a closely followed measure of inflation — to track how the costs of making certain items typically purchased for students has changed between 2019 and 2024.

On the upside, most families say back-to-school shopping is less of a strain in 2024 compared with a year earlier, Bankrate found.

Overall, inflation continues to retreat. The consumer price index, a key inflation gauge, rose 2.9% in July from a year ago, the U.S. Department of Labor reported. That figure is down from 3% in June and the lowest reading since March 2021.

“Shoppers aren’t clutching their wallets nearly as tightly this year,” said Ted Rossman, Bankrate’s senior industry analyst. “It’s important not to let your guard down, though.”

Back-to-school spending may hit nearly $40 billion

Families with children in elementary through high school plan to spend an average of $874.68 on school supplies, just $15 less than last year’s record of $890.07, according to the National Retail Federation.

Altogether, this year’s back-to-school spending, including for college students, is expected to reach $38.8 billion, the NRF also found. That’s the second-highest tally ever, after last year’s $41.5 billion marked the most expensive back-to-school season to date.

More than 75% of parents said they believe schools ask them to buy too much during back-to-school season, according to a report by WalletHub.

Parents ‘influenced’ to splurge

Despite having to navigate tight budget constraints, 85% of parents said they could be influenced to splurge on a “must-have” item or brand, another survey by Deloitte found. In May, the firm polled more than 1,100 parents who will have at least one child in grades K through 12 this fall.

According to Casey Lewis, a social media trend expert, low-rise jeans; Adidas Campus sneakers, which cost as much as $110 at adidas.com; and Jester backpacks from North Face, retailing for $75 or more, are topping students’ wish lists this year.

“There’s a lot of pressure to have the right look,” Lewis said. And as trends cycle through faster and faster, “young people have even more pressure to keep up,” she added. “It feels like their popularity and perceived coolness rides on the products they have.”

How to save on back-to-school shopping

Consumer savings expert Andrea Woroch advises families to shop for gently used clothing, sporting goods, school supplies and certified-refurbished electronics on resale sites, use a price-tracking browser extension or app and apply coupon codes. There are a growing number of online retailers that offer children’s product overstock, open-box and returned goods, often at a significant discount.

If you are buying new, try stacking discounts, Woroch recommended, such as combining credit card rewards with store coupons and cash-back offers while leveraging free loyalty programs. For example, you can get 50% off with 2% cash back at Old Navy and 20% off with 1.5% cash back at Office Depot, among other deals.

Otherwise, shop your own stock, Woroch said. “Rip out pages in a partially used notebook, collect scattered markers and crayons to make a full set and clean up last year’s backpack and lunch tote.”

This article originally appeared on CNBC.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.