Bank of America Poll Shows Investors Doubt Stock Market Rally Will Last

EDITOR NOTES: Global stock markets may be up over 30% from their March lows, but have you ever considered who might be behind the buying? We know that institutional and retail investors aren’t always in sync, the former holding a significant resource and knowledge advantage over the latter. With that in mind, a recent poll of BofA fund managers reveals a stark contrast between the “big players” and the rest of the crowd. Around 75% of the surveyed managers are highly skeptical of the current uptrend, suspecting it to be nothing more than a bear market rally. If that’s true, and if everything we’re seeing in the markets in this recent surge is fueled more by sentiment than fundamentals, then we may be in for a much steeper decline.

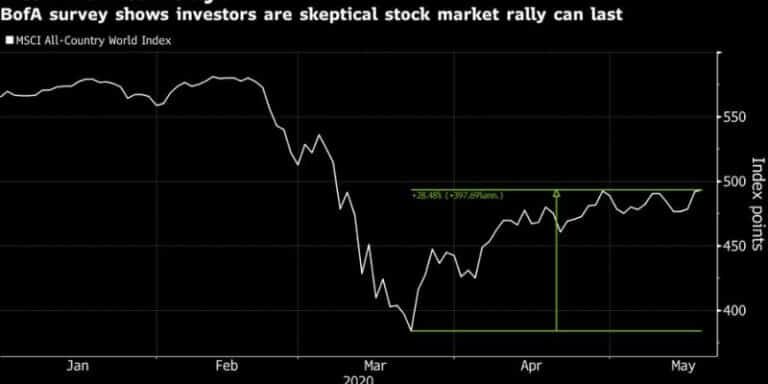

(Bloomberg) -- Global stocks may be up almost 30% from their March lows, but most fund managers in a Bank of America Corp. survey remain skeptical that the gains can last and aren’t expecting a quick economic recovery from the coronavirus crisis.

In the May 7-14 poll, 68% of investors called the rebound in equities a bear-market rally, or a short-term and fast bounce in stocks before they fall to new lows. Only a quarter believe that equities have entered a new bull market. Just 10% of the surveyed fund managers expect the economic recovery to be V-shaped, or quick and sharp, in contrast with 75% who predict a U- or W-shaped rebound that will take longer.

On the bright side, global growth expectations surged in May, with a net 38% of fund managers predicting the world economy will strengthen over the next 12 months, according to the BofA survey. At the same time, investors don’t see global manufacturing PMI rising beyond 50 -- the level that signals expansion -- before November.

Risk assets around the world have surged over the past two months on powerful monetary and fiscal support measures and spurred by optimism that growth can rebound as major economies relax lockdowns. However, continuing inflows into money-market and bond funds signal that many investors have avoided returning to equities amid fears about a second spike in infections and the lasting damage to corporate earnings.

The latest BofA survey showed a small reduction in cash levels to 5.7%, which is still well above the 10-year average of 4.7%, while bond allocation jumped to the highest since the 2009 financial crisis. Exposure to equities in May rose 10 percentage points to a net 16% underweight after hitting the lowest level since 2009 last month, according to BofA. Fund managers are long U.S. equities and short euro-zone stocks, the poll shows.

With the coronavirus continuing to dominate global headlines, the survey showed that investors see a second wave of the pandemic as the biggest tail risk for markets. A breakthrough in developing a vaccine is viewed as the most likely catalyst for a V-shaped recovery.

Since so many traditional fund managers have been staying away from risk assets, BofA’s survey provides a glimpse of which market players have been driving the rally in stocks. The responses shows hedge funds this month boosted their exposure to equities to a net 34% long position, bringing their allocation close to the levels seen before the February market collapse.

BofA polled 194 fund managers overseeing $591 billion in assets during the global survey.

Originally posted on Yahoo! Finance

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.