Banks Panic as Trump Targets Interest Rates — But Don’t Cheer Yet

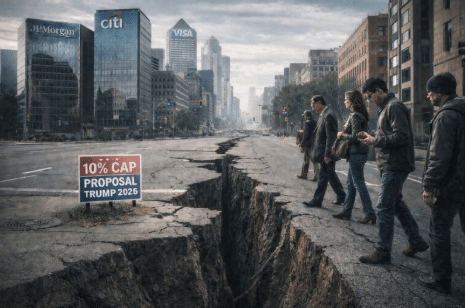

On Friday night, Donald Trump announced a one-year cap of 10% on credit card interest rates. By Monday morning, Wall Street was in full-blown retreat. Capital One stock plunged nearly 7%. Citigroup, JPMorgan, Visa, Mastercard, American Express — all down. The financial press spun the story as a misguided populist move that could “harm the economy.”

But here’s the real headline: the mere suggestion of capping credit card rates was enough to send the entire consumer finance complex into a tailspin.

Don’t cheer. This isn’t a win for consumers. It’s a flashing red warning sign that the entire system is rotten, fragile, and utterly dependent on harvesting interest from a population trapped in debt.

Why the Panic? Follow the Profits

Let’s be clear: banks don’t lend to help you. They lend to milk you.

The average credit card APR in America sits near 20%. For subprime borrowers, it climbs above 30%. These rates have nothing to do with inflation — they’re predatory by design. Credit card portfolios are among the most profitable assets on bank balance sheets. And when the political winds shift, even momentarily, toward limiting that profit stream, the illusion of financial stability cracks wide open.

Trump’s 10% cap would make most of these loan books unprofitable overnight. And that tells you everything you need to know about the health of the modern banking system. It’s not built on productivity, innovation, or savings — it’s built on extracting rent from a financially cornered population.

Banks Say It’ll Hurt You. That’s the Lie.

Industry insiders were quick to release a joint statement claiming the cap would “devastate” families and small businesses. They argue it would cut off credit access, reduce card rewards, and cripple consumer spending.

Let’s translate that: “We’ll retaliate if our profits are threatened.”

If banks stop issuing cards to subprime borrowers under a capped rate, that’s not a failure of regulation — that’s proof that their business model only works when they can price-gouge the most vulnerable.

But don’t fall for the populist trap, either. Trump’s move, while politically flashy, doesn’t attack the root issue. It doesn’t dismantle the credit system. It doesn’t restore sound money. It’s a Band-Aid on a gangrenous leg — a temporary cap in a system designed to keep you dependent.

The Real Threat: Digital Financial Control

While the media debates the feasibility of enforcing this cap, few are asking the deeper question: Why are Americans drowning in credit card debt to begin with?

Short answer? Inflation, stagnation, and the Federal Reserve's war on the dollar.

Long answer? A system where the average household now carries over $10,000 in credit card debt, while wages remain flat and the dollar buys less every year. This is not accidental — it’s the engineered result of a debt-based monetary regime that forces citizens to borrow just to survive.

And the endgame is already being prepared: central bank digital currencies (CBDCs), programmable money, and total surveillance over every dollar you spend.

If you think a 10% APR cap is controversial, wait until the same central planners decide whether you’re allowed to spend your money on beef, Bitcoin, or ammunition.

Conclusion: Get Out Before the Reset

Don’t get distracted by temporary policies. This panic in the banking sector reveals a deeper rot — and the tightening grip of centralized control. What they fear isn’t Trump. It’s you waking up to the con.

The banking system is not your friend. It’s a liability. And as we barrel toward a cashless, programmable monetary future, the only safe move is out.

That’s why Bill Brocius — a man I trust more than any Wall Street analyst — put together the Digital Dollar Reset Guide. It breaks down exactly how the financial system is shifting beneath our feet and shows you how to defend your wealth, your privacy, and your future.

Download it now before it disappears

You don’t need a 10% rate cap.

You need total financial independence.