Big Banks Conspire to Tarnish the Value of Silver

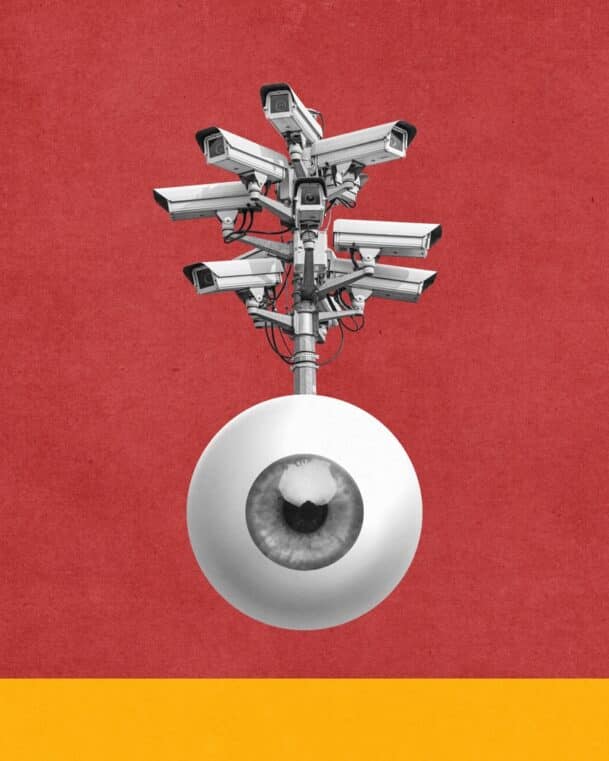

In the past few years, distrust of financial institutions has risen considerably as more consumers and investors have seen many financial institutions accused of collusion or corruption in one way or another and paying massive settlements to lawyers and government regulators subsidized by shareholders. A study released by Market Strategies International found that 31 percent of American households feel stuck in a relationship with one or more financial services companies they distrust.

The precious metals markets are not immune from greed (and are often driven by it) but sometimes companies cross the line.

According to a recent article in Reuters, investors accused several well-known financial institutions of conspiring to rig silver prices. In a scenario right out of a spy movie, the claimants asserted that Deutsche Bank, HSBC Holdings Plc, and the Bank of Nova Scotia held secret meetings every day to discuss how to fix sliver pricing. Such meetings were called The Silver Fix.

The result -- Deutsche Bank AG has now agreed to pay $38 million following U.S. allegations that it illegally conspired with other banks to fix silver prices.

Reuters reported that the paperwork on the case was filed in Manhattan federal court and was certainly not the first lawsuit to accuse banks of conspiring to rig rates and pricing in the financial markets. Now the settlement goes to the courts to ascertain if Deutsche Bank has to pay.

The settlement had been expected since April, “…though terms had yet to be disclosed…lawyers for the investors say the deal will likely be an "ice breaker" that will serve as a catalyst for other banks to settle,” according to Reuters.

Vincent Briganti, a lawyer for the investors, said the deal provides "substantial monetary compensation plus cooperation from Deutsche Bank in the continued prosecution of this important case against the non-settling defendants."

This rigging of silver pricing, investors claim, has been happening since at least 1999. Investors claim the banks have suppressed prices on roughly $30 billion of silver and silver financial instruments traded each year, and enabled the banks to pocket returns that could top 100 percent annualized, according to Reuters.

According to Reuters and court reports, U.S. District Judge Valerie Caproni ruled the investors had sufficiently, "albeit barely," alleged that Deutsche Bank, HSBC and ScotiaBank violated U.S. antitrust law by conspiring to depress the Silver Fix from 2007 to 2013.

For investors, the outcome of the settlement will likely lead to greater oversight of the silver industry and more transparent silver pricing that better reflect the true value of the precious metal -- whether you buy silver online or from a local dealer.