Bitcoin and Gold Gain Appeal as FDIC Reports 63 Banks at Risk

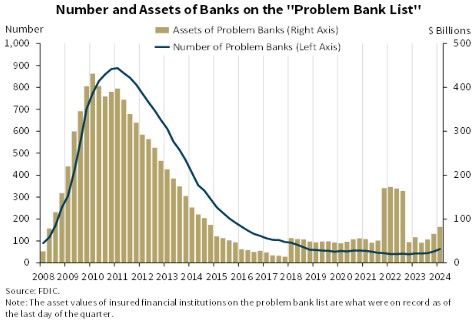

Investors in the U.S. have started to seriously reassess their perspectives on Bitcoin (BTC) and gold after the quarterly report from the Federal Deposit Insurance Corporation (FDIC) showed that at least 63 banks were on the brink of insolvency in the first quarter of 2024, up from 52 banks on the “Problem Bank List” during the third quarter of 2023.

“The number of banks on the Problem Bank List, those with a CAMELS composite rating of ‘4’ or ‘5,’ increased from 52 in fourth quarter 2023 to 63 in first quarter 2024,” the FDIC said. “The number of problem banks represented 1.4 percent of total banks, which was within the normal range for non-crisis periods of one to two percent of all banks. Total assets held by problem banks increased $15.8 billion to $82.1 billion during the quarter.”

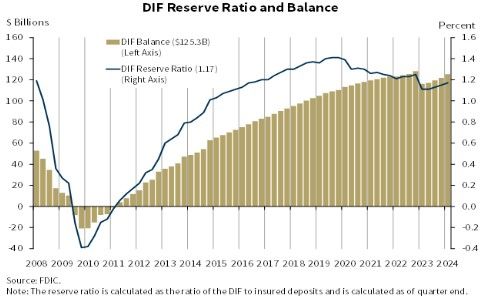

The number of problem banks, combined with a low reserve ratio, is a major source of concern for investors with large bank accounts, as any major economic flare-up could easily wipe out the Deposit Insurance Fund (DIF).

“The DIF balance was $125.3 billion on March 31, up $3.5 billion from the end of the fourth quarter. Insured deposits increased by 1.1 percent, about half of typical growth in the first quarter,” the report said. “The reserve ratio, or the fund balance relative to insured deposits, increased by two basis points to 1.17 percent. The reserve ratio currently remains on track to reach the 1.35 percent minimum reserve ratio by the statutory deadline of September 30, 2028.”

While the DIF is legally only required to have a minimum reserve ratio of 1.35 percent, meeting that goal will do little in the eyes of investors since there is no way the fund would be able to cover the losses of even a minor bank run.

The report also showed that banks are collectively sitting on $517 billion worth of unrealized losses, up $39 billion from the previous quarter.

“Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase,” the FDIC said. “This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in the first quarter of 2022.”

Investors have kept a close eye on the health of the banking industry ever since March 2023, and the sudden collapse of Silicon Valley Bank, the liquidation of Silvergate Bank, and Signature Bank being forced to close operations by New York regulators.

To stop the spreading contagion, the Federal Reserve created the Bank Term Funding Program, offering banking loans of up to a year in return for posting “qualifying assets” as collateral. The Bank Term Funding Program stopped accepting new loan applications on March 11, and the stress on banks has already started to tick higher, prompting many investors to look for more secure places to store their wealth.

Another aspect highlighted by the report was the struggles consumers faced during the first quarter of 2024.

“Driven by write-downs on credit cards, the industry’s quarterly net charge-off rate remained at 0.65 percent for the second straight quarter, 24 basis points higher than the prior year’s rate,” the FDIC said. “The current net charge-off rate is 17 basis points higher than the pre-pandemic average. The credit card net charge-off rate was the highest rate since third quarter 2011.”

Despite gold’s rally to new record highs, investors were seen shifting funds toward interest-bearing deposits as a way to combat high inflation.

“The shift away from noninterest-bearing deposits toward interest-bearing deposits continued, as interest-bearing deposits increased 1.7 percent quarter over quarter and noninterest-bearing deposits declined for the eighth consecutive quarter,” the report said. “Estimated uninsured deposits increased $63 billion in the quarter, representing the first reported increase since fourth quarter 2021.”

The report concluded that “the banking industry continued to show resilience in the first quarter,” but “still faces significant downside risks from the continued effects of inflation, volatility in market interest rates, and geopolitical uncertainty.”

“These issues could cause credit quality, earnings, and liquidity challenges for the industry,” the FDIC warned. “In addition, deterioration in certain loan portfolios, particularly office properties and credit card loans, continues to warrant monitoring. These issues, together with funding and margin pressures, will remain matters of ongoing supervisory attention by the FDIC.”

This article originally appeared on Kitco News