Bitcoin Decouples from Stocks, Gains Momentum Toward Historic $100K

This week, Bitcoin surged back above $96,000, recovering from a brief pullback that had some investors wondering if the rally had run its course. Spoiler alert: it hasn’t. With just weeks left in the year, Bitcoin is up 126%, leaving analysts and investors increasingly confident that the $100,000 mark is within reach.

As of Wednesday, Bitcoin climbed nearly 6% to $96,676.70, according to Coin Metrics. Ether, the second-largest cryptocurrency by market cap, surged more than 9% to $3,636.46. The broader crypto market followed suit, with the CoinDesk 20 index gaining 7%.

Bitcoin’s Rally Gains Momentum

What’s driving Bitcoin’s meteoric rise? For starters, institutional adoption is at an all-time high. Companies like MicroStrategy, which uses Bitcoin as a treasury reserve asset, saw its stock climb 9% in tandem with Bitcoin’s price. Even retail trading platforms like Coinbase and Robinhood are getting a boost, with their shares rising 6% and 3%, respectively.

Alex Thorn of Galaxy Digital attributes Bitcoin’s strength to a combination of factors:

- Institutional and corporate adoption: More big players are entering the market.

- Nation-state interest: Governments are starting to explore Bitcoin as a reserve asset.

- Pro-crypto policies: The incoming Trump administration is viewed as more crypto-friendly.

However, Thorn also warned that potential regulatory actions from the outgoing Biden administration could create short-term volatility. Still, he remains bullish on Bitcoin’s long-term trajectory.

Decoupling from Traditional Markets

One of the most significant developments this week is Bitcoin’s decoupling from traditional stock markets. While the Nasdaq, S&P 500, and Dow Jones all slipped into the red, Bitcoin surged ahead.

This divergence underscores Bitcoin’s growing role as a hedge against inflation and economic instability. In a world where fiat currencies are losing value and governments are buried under mountains of debt, Bitcoin is increasingly seen as “digital gold.”

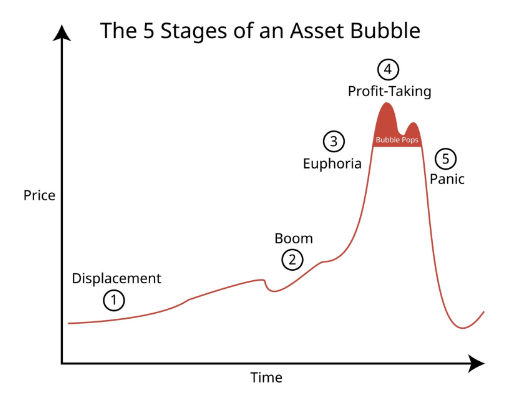

Investors in Uncharted Waters

Fairlead Strategies’ Katie Stockton told CNBC this week that Bitcoin investors are navigating uncharted waters. With no historical resistance levels above $96,000, there’s little technical guidance for what lies ahead.

“Bitcoin tends to stair-step both to the downside and to the upside,” Stockton explained. “It sees sharp runups, followed by periods of consolidation. Investors should be prepared for volatility but keep an eye on the long-term potential.”

Support levels are currently holding around $74,000, but the $100,000 milestone remains the big psychological target.

Ether Joins the Party

While Bitcoin is grabbing the headlines, Ether is quietly outperforming. The cryptocurrency has risen 59% since the November election, driven by the growth of decentralized finance (DeFi) and Ethereum’s upcoming network upgrades.

For many investors, Ether represents the “tech stock” of the crypto world, offering exposure to the rapidly expanding blockchain ecosystem.

What’s Next?

With Bitcoin up 126% this year and Ether not far behind, the crypto market is clearly in a bull cycle. But this isn’t just about price speculation—it’s about a paradigm shift in how people view money and value.

Here’s what to keep in mind:

- Volatility is normal: Don’t panic during dips; they’re part of the journey.

- Adoption is key: Watch for news about institutional investments or nation-state involvement.

- Long-term focus: Bitcoin and Ether have proven to be resilient, even in uncertain times.

Protect Your Wealth Today

As Bitcoin inches closer to $100,000, now is the time to evaluate your financial strategy. Are you prepared for the next phase of the financial revolution? Download Bill Brocius’ free eBook, "Seven Steps to Protect Yourself from Bank Failure," to learn how to diversify your portfolio with gold, silver, and crypto.

Click here to download: [Insert UTM link]

Stay Ahead of the Curve

Subscribe to Dedollarize News for the latest insights on protecting your wealth in today’s volatile economic landscape. [Insert UTM link]

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.