Why Bitcoin Exceeding “Tulip Mania” Levels Doesn’t Matter

The Bitcoin craze has often been compared with the 17th century “tulip mania” bubble. Whether such a comparison is valid, one thing we can do is to look at the actual levels and percentage gains.

What you are about to see may surprise you.

A month ago, when the price of Bitcoin was only at $7,500, Convoy Investments produced a chart comparing the largest asset bubbles in history to the “Tulip Mania” phenomenon.

This chart went viral:

As you can see, the Bitcoin surge was higher than all historical bubbles except for “Tulip.”

But now, only a month after the chart above was published, Bitcoin’s price surged even higher. When Convoy’s analysts, Howard Wang and Robert Wu, updated their chart to reflect this change, what they came up with astounded them.

In their commentary, they write: "its price has now gone up over 17 times this year, 64 times over the last three years and superseded that of the Dutch Tulip’s climb over the same time frame."

The updated chart:

This reminds us of what Mike Novogratz (cryptocurrency pioneer) once said: “This is going to be the biggest bubble of our lifetimes.” And of course he invested hundreds of millions into the cryptospace. He also stated his belief that Bitcoin will hit $40,000 and that Ethereum will increase three times its price to around $1,500.

Wang, on the other hand, expressed a more balanced view:

“I continue this topic and discuss a main driver of bubbles. When we see a dramatic rise in asset prices, there is often an internal struggle between the two types of investors within us. The first is the value investor, “is this investment getting too expensive?” The second is the momentum investor, “am I missing out on a trend?” I believe the balance of these two approaches, both within ourselves and across a market, ultimately determines the propensity for bubble-like behavior...”

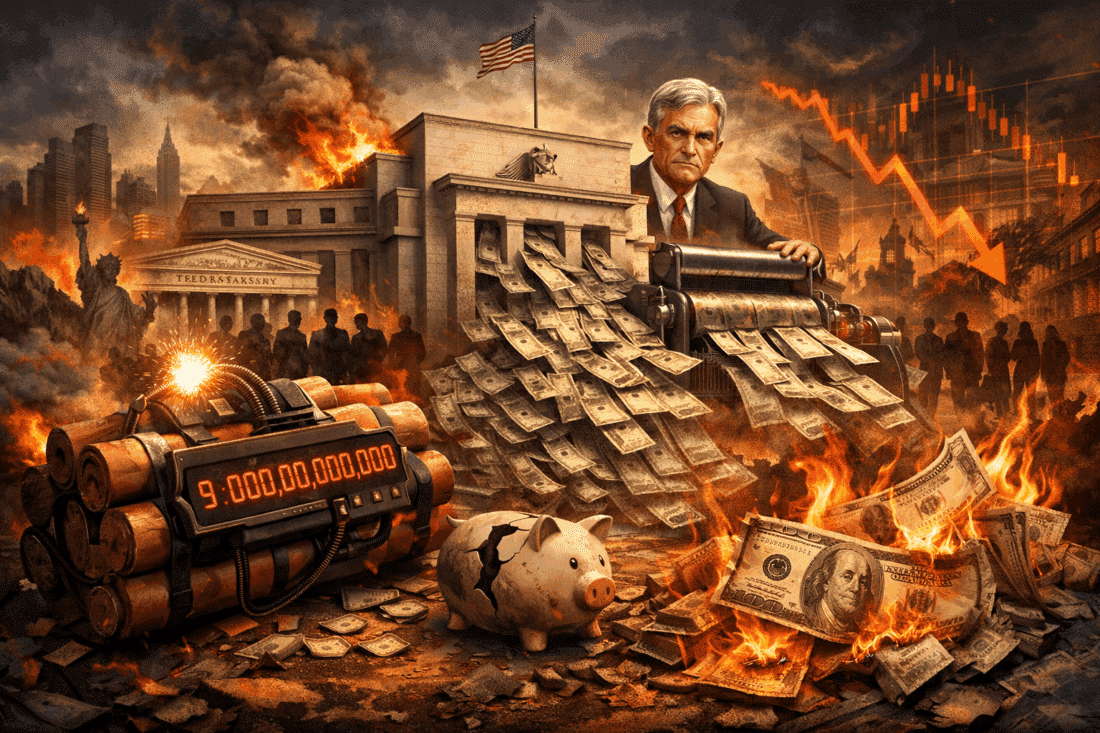

It should be apparent to all of us that we are witnessing an asset bubble unlike any we’ve seen before. And the central banks are responsible for indirectly creating the conditions for this bubble. No investor would seek an alternate currency if a national currency was reliable--one whose value rested partly on limited supply, one that guaranteed a reasonable degree of privacy, and one whose circulation was not subject to manipulation.

But here are a couple of “unpopular” but smarter ways to view this bubble:

- Too many people focused on the “mania” when they should have been focusing on the “intrinsic value” of the tulips.”

Today, tulips still have the same “intrinsic value” as they had before and after the “mania.” Tulips are decorative “flowers.” They did not present any new technological (i.e. medical) applications ” nor did they engender any approaches that would have impacted industries, driving demand beyond sentiment. The mania may have inflated tulip prices, but it did not change the “real” value of tulips.

- Like “Tulips,” Bitcoin’s price may be in a massive bubble, but its fundamental value--as a viable technology, currency, and global disruptor--remains.

Bitcoin has its own unique kind of value as both a currency and technology. Its comparison with “Tulip mania” is a bit problematic: unlike tulips, Bitcoin is a new technology, it engenders new technologies and uses, and it has the power to disrupt industries (via blockchain) and entire monetary systems on a global scale.

Tulips have a use with relatively limited potential.

Bitcoin, on the other hand, exhibits pure potential.

The world cannot use Bitcoin or blockchain without changing the fundamental nature of the world itself.

Of course, if you want to play it safe, neither gold nor silver prices are in a bubble: meaning, they present opportunities to buy gold or buy silver at value prices, both are tangible and scarce, and both are the ultimate measure of real intrinsic value.

But in the end, Bitcoin, blockchain, and cryptocurrencies--whether you like them or not--are no longer things to be ignored, lest you risk obsolescence.