BRICS’ Currency Crisis: The Greenback’s Hidden Triumph in Oil Wars

The Dollar’s Undying Grip: BRICS’ Currency Dreams Meet Hard Reality

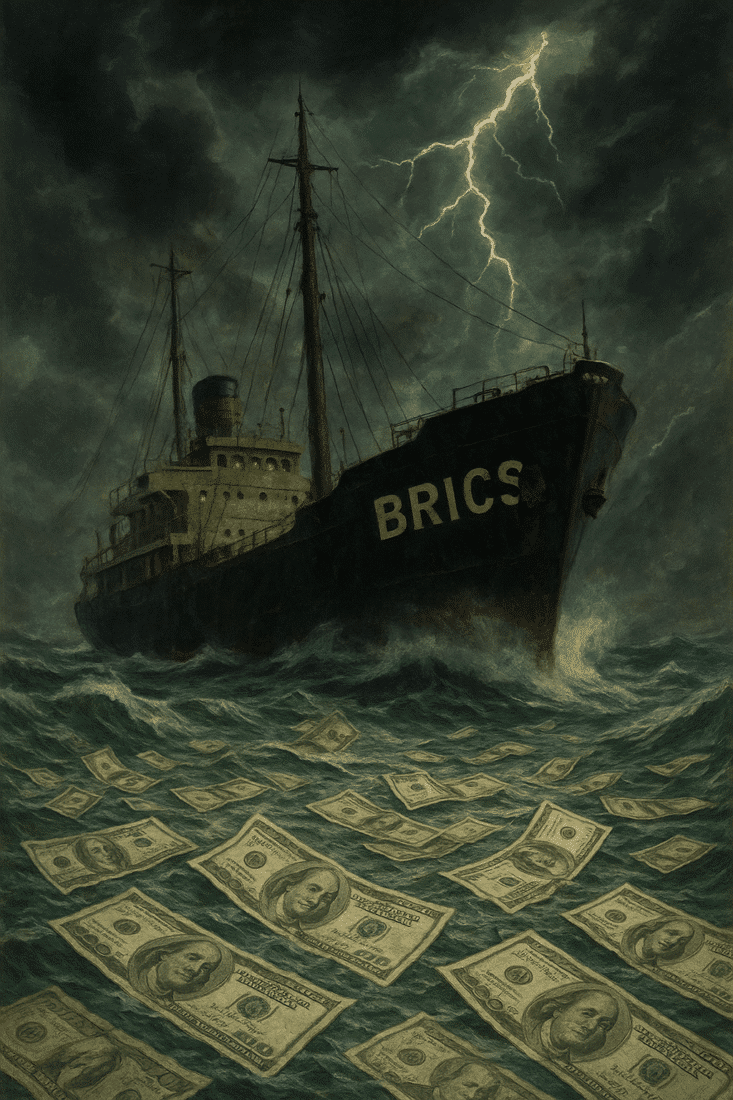

Introduction: The Bold De-Dollarization Gambit

Have you ever wondered what happens when ideology collides with market realities? In the past year, the BRICS nations—an alliance of Brazil, Russia, India, China, and South Africa—have championed the idea of replacing the US dollar in oil transactions with local currencies. This, they argue, would sever the dollar’s grip on global trade and restore monetary sovereignty to member nations. But as the Nigerian naira’s woes reveal, wishful thinking doesn’t change the iron laws of energy economics.

Analysis: Nigeria’s Costly Currency Experiment

Last October, Nigeria declared a radical shift: oil refiners would only accept the naira for domestic oil transactions. The goal was to strengthen the national currency and reduce dependence on the dollar. Instead, the policy triggered a swift and painful backlash. The naira plummeted in value almost overnight, pushing refiners to the brink of bankruptcy as they scrambled to meet dollar-denominated obligations.

Nigerian oil firms, battered by the mismatch between local currency devaluation and international dollar payments, began openly rejecting the mandate. Unions and business lobbies leaned on the government to reverse course, desperate to halt the hemorrhaging of profits and preserve their balance sheets. And so, the grand experiment to dethrone the dollar in the oil trade ended as quickly as it began—a stark reminder that the greenback’s hegemony is more than a relic of history; it is a reflection of brutal market forces.

Why the Dollar Dominates: The Real Oil Story

What the BRICS alliance seems to ignore is that oil, more than any other commodity, is priced in confidence and stability. The dollar, backed by the world’s largest economy and a deep, liquid financial system, offers exactly that. Local currencies, by contrast, are too volatile, too vulnerable to domestic political and economic shocks to serve as a reliable standard for international trade.

Even in an era of multipolar aspirations and anti-dollar rhetoric, the oil trade clings to the greenback for a reason: it’s the last bulwark of trust in a world of fragile paper promises. BRICS can push their currency experiments all they like, but the dollar’s foundation in energy markets is a reality they cannot wish away.

Solutions and Predictions: Lessons for the Future

The lesson from Nigeria’s fiasco is crystal clear. In the realm of oil and energy, stability trumps nationalism. Local currencies might have their place in domestic transactions, but on the global stage, the dollar remains king.

For individuals watching these power plays unfold, the takeaway is simple: don’t get caught in the crossfire of ideological battles. Diversify your assets. Hedge your savings with real, tangible stores of value—assets like gold, silver, and other inflation-resistant vehicles that stand apart from the currency games of governments.

Looking ahead, I predict more of these currency misadventures as BRICS and other nations seek to challenge the dollar’s supremacy. But until they can offer something as stable and trusted as the greenback, these efforts will continue to fail, leaving individuals and companies to bear the cost of ideological gambits gone wrong.

A Call to Action: Your Wealth, Your Responsibility

The global monetary order is shifting, but the dollar’s role in oil markets remains unassailable for now. Don’t be lulled by political promises of local currency revolutions—history shows they’re fraught with danger.

If you’re serious about protecting your wealth from the fallout of these failed experiments, I urge you to act now:

👉 Download my free book, "Seven Steps to Protect Your Bank Accounts," and learn practical strategies to secure your financial future. Get your copy here:

https://offers.dedollarizenews.com/?utm_source=7steps_ebook&utm_medium=ebook&utm_campaign=gsi&utm_term=static&utm_content=mr_anderson

👉 Or, if you prefer the heft of a hardcover, grab a discounted copy of "The End of Banking as You Know It" by Bill Brocius here:

https://offers.dedollarizenews.com/eotnews/book?utm_source=DedollarizeNews&utm_medium=article&utm_campaign=gsi&utm_term=static&utm_content=mr_anderson

In this era of relentless monetary upheaval, standing still is not an option. Let’s ensure that when the next dollar challenge emerges, you’re on the side of stability and strength.