BRICS Gold Reserves & the Coming Currency War: Why the Dollar’s Days Are Numbered

The World is Rebalancing—and It’s Not in the Dollar’s Favor

Let me ask you something: when was the last time you saw over a dozen major economies aggressively accumulating gold… while simultaneously dumping U.S. Treasuries? Coincidence? Not a chance.

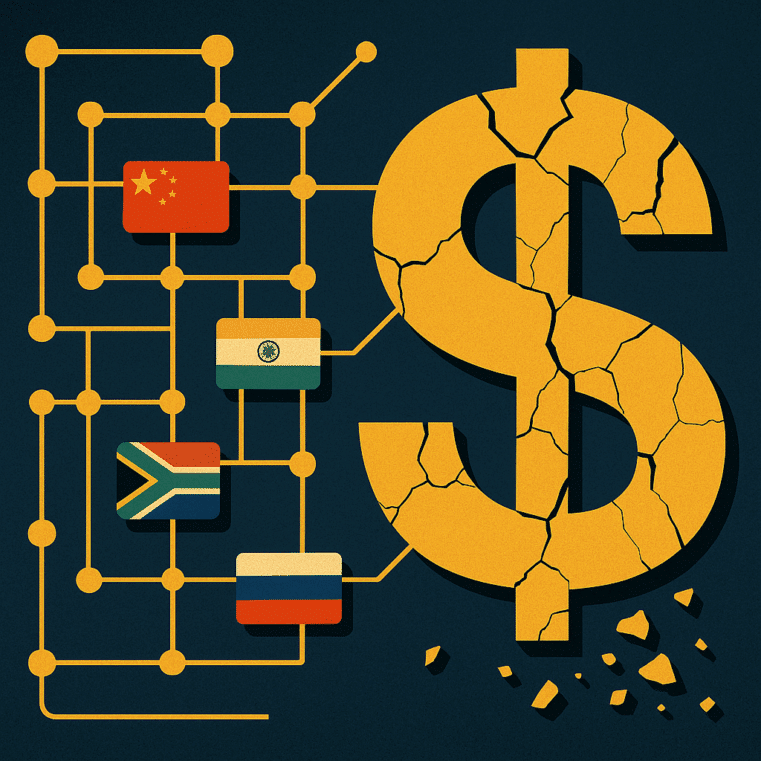

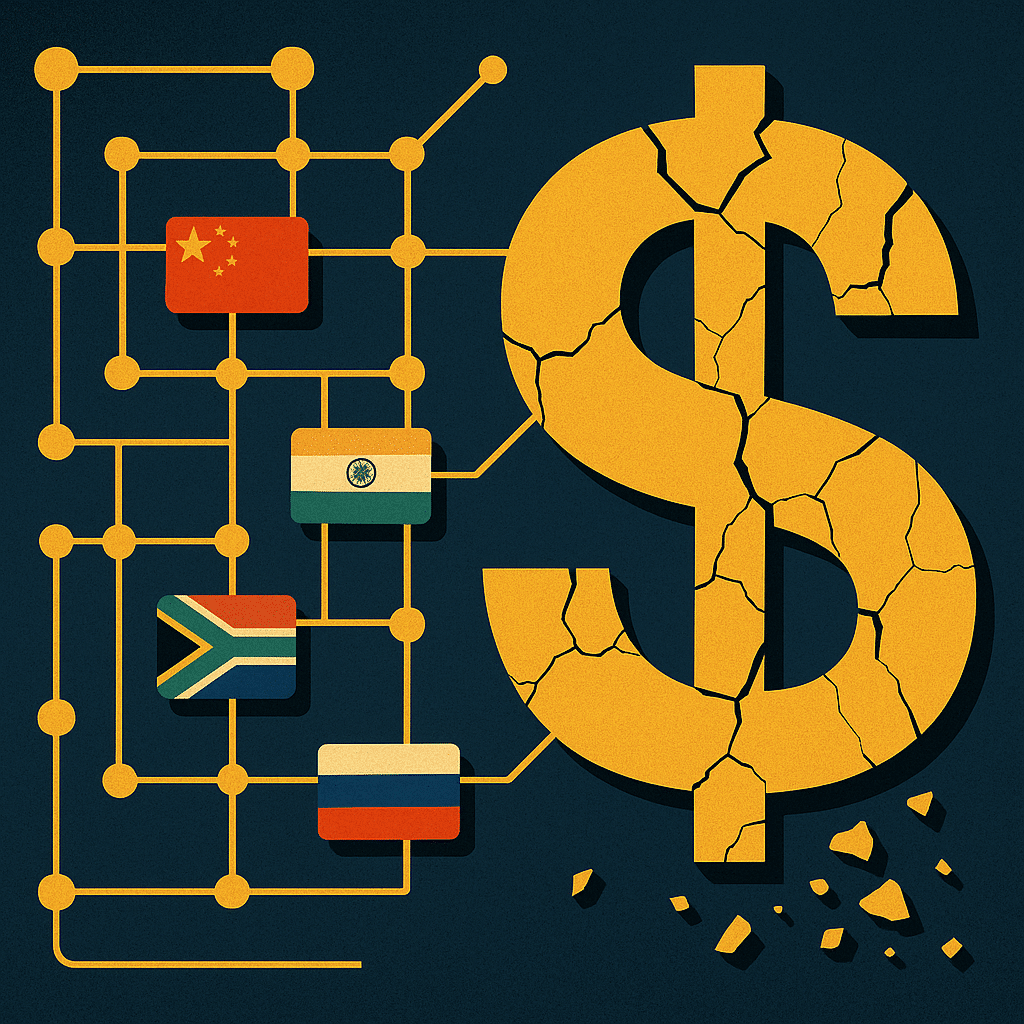

The BRICS alliance—Brazil, Russia, India, China, South Africa, and now joined by the likes of Egypt—isn't just building reserves. They're building an alternative system. With over 6,000 tonnes of gold now under their collective belt, BRICS controls roughly 21% of global central bank gold holdings, with China and Russia hoarding the lion’s share .

So what does it mean when the two largest geopolitical opponents to U.S. hegemony suddenly become gold bugs?

It means the clock is ticking.

Not just for the dollar—but for the entire fiat structure built atop it.

Gold as the Kill Switch to Dollar Dominance

If gold is a “barbarous relic,” as Keynesians love to chant, why are the world’s most authoritarian regimes hoarding it like it’s the Ark of the Covenant?

Because they understand what most Western economists have forgotten: gold is independence. Gold doesn’t default. It doesn’t inflate. It doesn’t require permission from the IMF or the Federal Reserve to function.

And when paired with bilateral trade in local currencies—as BRICS nations are now actively doing—it becomes the foundation of a new global settlement layer, one that operates outside the reach of U.S. sanctions, SWIFT restrictions, and central bank manipulation.

They're not just diversifying—they’re defecting.

The BRICS Currency: Gold-Backed or Gold-Washed?

Talk of a BRICS “gold-backed currency” has sent shockwaves through the financial world. But don’t be fooled. While Jim Rickards and others have rightly pointed out that this won’t be a traditional gold standard—you won’t be cashing in your BRICScoin for gold at a central bank counter—it will likely be gold-referenced.

That distinction is crucial.

Because even a loosely pegged currency, priced in gold, creates a psychological shift. It signals to the world that BRICS is playing the long game—while the dollar clings to its past.

Let me be clear: This new monetary system won’t need to outperform the dollar. It simply needs to provide a credible alternative. And gold provides the credibility fiat cannot.

The Real Risk Isn’t BRICS—It’s the Response

Here’s where things get dangerous.

What happens when the U.S. loses the ability to weaponize the dollar? When sanctions become irrelevant? When the Fed can’t export inflation anymore?

We’re not talking about just a financial realignment—we’re talking about a geopolitical earthquake. The end of the petrodollar is already underway. BRICS’ gold reserves are simply the foundation for a post-dollar world.

But Washington won’t go quietly.

Historically, major shifts in global reserve currencies have been accompanied by conflict—monetary, political, and sometimes military. The risk isn’t just the collapse of confidence in the dollar, it’s the chaos that precedes the collapse.

Ask yourself: why has the U.S. been so aggressive about launching FedNow and pushing for a central bank digital currency (CBDC)? Why is cash under attack, privacy being eroded, and gold ownership increasingly scrutinized?

Because the empire is tightening control before it loses it.

My Forecast: Two Parallel Systems—Then Convergence by Force

What’s unfolding isn’t a peaceful divorce from the dollar—it’s a Cold War in slow motion. My prediction? Two parallel financial systems will emerge:

- BRICS Gold + Local Currency Settlement: For trade outside of U.S. influence.

- Western CBDC + Surveillance Finance: Tied to ESG scores, FedNow rails, and digital IDs.

Eventually, these systems will collide, forcing nations—and individuals—to choose sides.

Don’t wait for the announcement. Position yourself now for a world where the dollar is no longer the center of gravity.

Here’s What You Can Do Right Now:

- Diversify into gold-backed assets. Not ETFs, not paper contracts—real, physical, sovereign-minted gold. Think Gold American Eagles, not IOUs from Wall Street banks.

- Reject the coming CBDC trap. Once you're inside the digital cage, it’s game over. They will control how, when, and where you spend your money.

- Educate your community. Most people are sleepwalking into a monetary trap disguised as convenience. Be the alarm bell they desperately need.

Final Thought

If you think BRICS is just about international trade, you're not paying attention. This is a full-scale monetary rebellion. And while the media is obsessing over inflation and interest rates, the real war is being fought with bullion and bilateral deals.

In the end, gold doesn’t lie.

And when the dust settles, it won’t be the most printed currency that wins—it will be the most trusted.

🔻 Call-to-Action 🔻

The financial landscape is shifting faster than most realize, and those who fail to prepare risk being left behind. If you’re ready to take control of your financial destiny, I’ve got two resources that can help you start today:

👉 Download my free book, "Seven Steps to Protect Your Bank Accounts"

📚 Get a discounted hardcover of "The End of Banking as You Know It" by Bill Brocius – available for just $19.95 (normally $49.95).

Prepare now—or pay later.