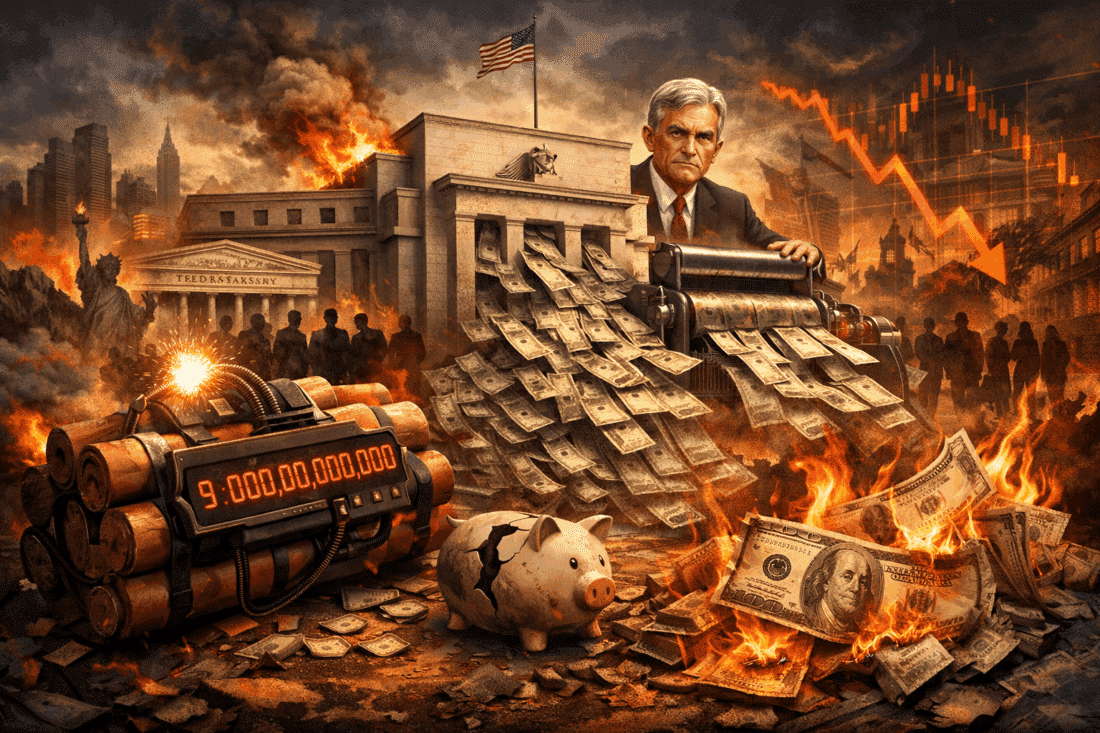

BRICS Nations Dumping U.S. Treasuries: Smoke or Fire?

What Just Happened? BRICS Nations Cut $28.8 Billion in U.S. Treasuries

According to a report from ING (a trillion-dollar bank, mind you—not a Reddit doomcaster), several BRICS nations have trimmed their exposure to U.S. government debt:

- China sold $11.8 billion

- India sold $12 billion

- Brazil sold $5 billion

That’s a total of $28.8 billion in just one month—October 2025—casually framed by ING as a "continuing fall of Treasury holdings."

Some of this, ING claims, is “geopolitical.” Some is “supporting the rupee.” But the through-line is unmistakable: they're backing away from U.S. paper.

Is This a Crisis in the Making?

Let’s not jump the gun—but let’s not fall asleep, either.

Yes, $28.8 billion is a drop in the ocean compared to total U.S. debt (over $34 trillion now and climbing).

And yes, the private sector is still buying—for now.

But here’s what matters: This isn't a blip. It's a trend.

The BRICS bloc is slowly laying the groundwork to de-dollarize—building payment systems, alternative alliances, and bilateral trade agreements that bypass the U.S. financial system altogether. Treasuries are the canary in the coal mine.

The Private Sector Is "Picking Up the Slack"—But For How Long?

ING paints a reassuring picture. They say the private market is "more than willing" to absorb BRICS' sales.

Great—until it’s not.

Private investors chase yields and safety. If confidence in the U.S. fiscal trajectory erodes—if rates spike, inflation rears up again, or the Fed goes wobbly—those buyers can disappear faster than you can say “bond vigilante.”

And if that happens while foreign buyers are walking away? The cost of borrowing explodes. That means higher rates on mortgages, credit cards, business loans—everything. The debt burden becomes a tax on the middle class.

Why Are the BRICS Selling Treasuries Anyway?

🔹 Geopolitical Hedge

India, for instance, may be shoring up its currency. But don’t miss the bigger story: BRICS is a political alliance as much as an economic one. Reducing reliance on the U.S. financial system is part of the playbook.

🔹 Avoiding Sanctions Exposure

After the U.S. weaponized the dollar against Russia, every other non-aligned country got the message: If you're not on Team America, your dollars aren't safe.

🔹 Building a Parallel System

BRICS is laying bricks—literally—for CBDCs, gold-backed settlement platforms, and cross-border trade rails that don’t involve SWIFT, the dollar, or Washington.

This Treasury sell-off is just a mile marker on that road.

Is the Dollar at Risk? Maybe Not Quite Today—But...

Let’s be clear: the dollar isn’t dying tomorrow.

It’s still the global reserve currency. U.S. Treasuries are still the deepest and most liquid asset pool in the world.

But history says reserve currencies don’t last forever. Rome had the denarius. Britain had the pound. Now we have the dollar—and we’ve abused the privilege.

Debt monetization. Endless deficits. Political dysfunction. Dollar dominance is strong, until it’s not.

The BRICS aren’t about to crater the dollar next week—but they are preparing for a post-dollar world. The question is, are you?

What Should Americans Be Worried About?

This isn’t panic time—but it is wake-up time. Here’s what to watch:

- A sustained, coordinated BRICS drawdown of Treasuries over several quarters.

- A major geopolitical event triggering sanctions retaliation.

- A failed Treasury auction or rapidly rising interest rates due to weak demand.

- Emergence of a credible alternative settlement system (like a BRICS CBDC or gold-backed platform).

Any of these could trigger a shift in sentiment—and once confidence in U.S. debt goes, it’s gone fast.

Final Word: Smoke Today, Fire Tomorrow

Let’s not kid ourselves. America’s financial house is built on the assumption that foreigners will always want our debt. That assumption is cracking.

The BRICS aren’t panicking—they’re planning. They’re reducing exposure while the dollar still looks strong, preparing for what comes after.

Are you?

📢 Get Ready Now

Download your free copy of the Digital Dollar Reset Guide by Bill Brocius.

If you understand what silver’s telling you, then you know the financial noose is tightening. This isn’t just about metal anymore — it’s about control. Programmable money, central bank surveillance, and the end of privacy are no longer future threats. They’re here.

The Digital Dollar Reset Guide is your field manual for surviving what comes next.

👉 Download the Digital Dollar Reset Guide Now

Because owning silver is step one. The real fight is for your financial sovereignty. And it starts now.