When Bull Markets End | Historic Results

Should our current bull run sustain itself, it will soon shift from record-setting to record-shattering.

The longest S&P bull market lasted 117 months (March 1991 – October 2000). Our current bull market, which started in March of 2009, is approaching its 107th month.

It’s little surprise that institutional soothsayers, the latest one being Morgan Stanley, are warning investors that, like Icarus, investors may be flying too close to the sun.

Gold, Bitcoin, and altcoins are up. But why should mainstream investors pay attention to those assets when they’re seeing profits accumulate in their stock portfolios? It’s too easy to say that most investors pay too much attention to the present at the expense of the future.

But are they “really” seeing what’s happening in the present, or are they seeing only what they want to see?

Here’s a snapshot of what’s happening in our current market.

- How many times the Dow hit record highs last year: 71 times; that’s like hitting highs more than once in every single week.

- In the S&P’s 90-year history, never had it risen every single month of that year, except for 2017.

- The S&P had one large pullback in 2017—a mere 2.8%; its smallest in 22 years.

- At the start of 2018, the S&P, during its first five trading sessions, was reaching record highs every day; this hadn’t been the case since 1964.

- And according to the “Cyclically Adjusted Price-Earnings,” something we covered in an article last year, our ratios are higher than both 1999 and 1929 levels; a sign that the market may break to the downside sooner than later.

If the market tumbles, how bad can it be? That’s what many investors are now asking themselves. But since nobody can predict the future, we’re consigned to looking back to the past. What typically happens during the first year of a bear market? What kind of damage might we expect?

Here’s a historical snapshot of each bear market’s year one since 1900.

The chart shows us that the markets typically gain an average of 16% during the last year of a bull run, and loses an average of -16% during the first year of a bear turn.

It’s also important to pay attention to the variances. Our current bull market is lengthier than most, meaning that the eventual decline may be on the steeper side.

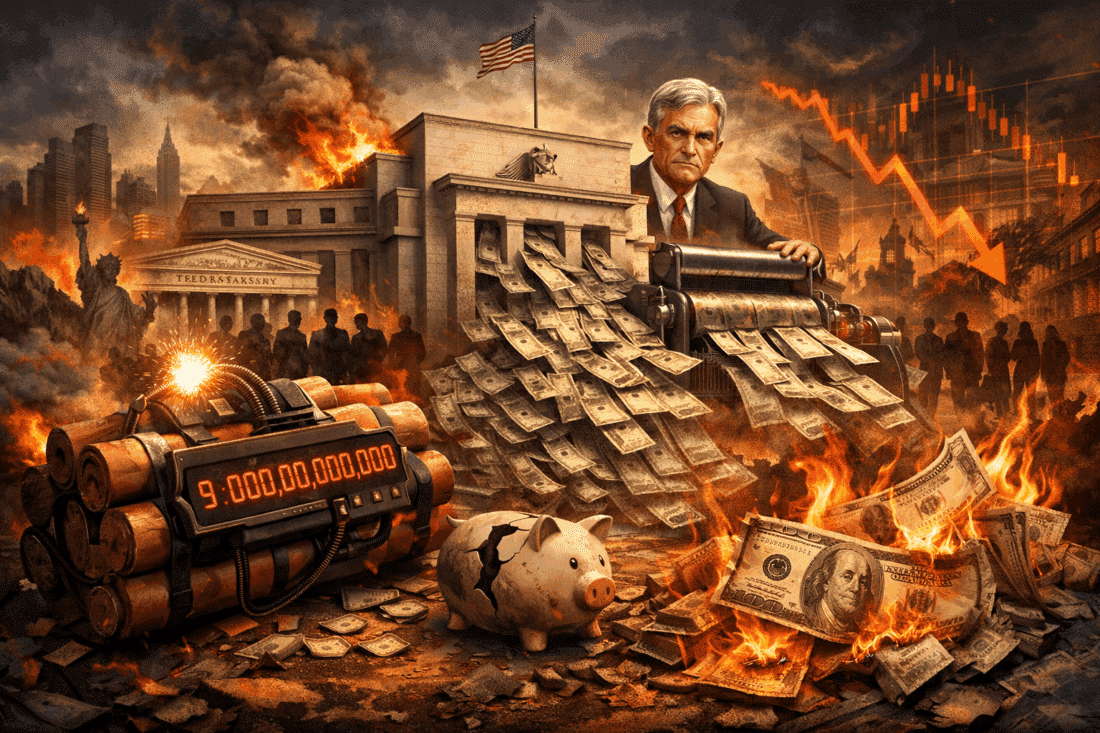

The bottom line is that a major shift is coming. The exact timing and depth of the decline is unknown.

It’s also important to note that the stock market is not the only overpriced market. So too are bond and real estate markets. Currency markets have been tampered with by central bankers across the globe, making them questionable for investors seeking a safe haven.

So, you should ask yourself “When should I prepare for this bear turn; and what should I invest in”?

The most robust solutions come in the form of the old and the new. Buying gold and buying silver are the oldest forms of money; both have proven their value throughout history. Bitcoins and altcoins, though highly speculative assets, enjoy the privilege of operating beyond government control and intervention. They too serve as effective hedges in an inflationary environment.

We prefer both solutions; the old and the new. But whatever you decide, just remember that change is coming, and that it’s best to prepare for it soon.