Bundesbank Transfers Gold from New York and Paris

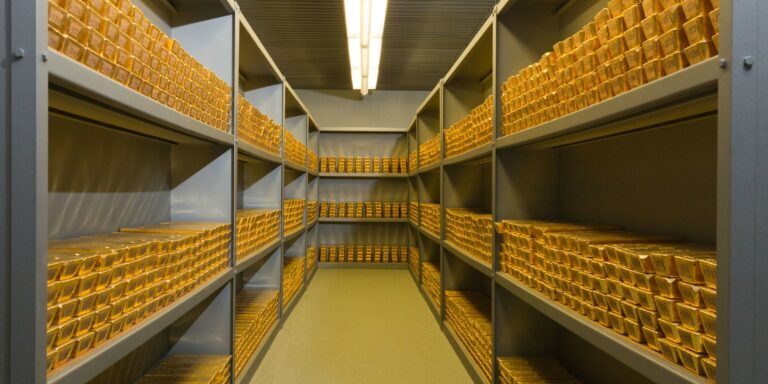

The Deutsche Bundesbank, established in 1957 as the central bank of the Federal Republic of Germany, successfully continued its planned transfers of gold bullion in 2016, when more than 216 tons of gold were transferred to Frankfurt am Main from storage locations abroad. A total of 111 tons of gold bullion was transferred from New York and 105 tons of gold from Paris.

ABCNews reports that during the Cold War, Germany held much of its gold reserves abroad for fear it could fall into the hands of the Soviet Union if the country were attacked. Another reason for storing gold reserves abroad was to have gold located in close proximity to foreign currency markets in London, Paris and New York.

The Deutsche Bundesbank originally announced its gold storage plan in 2013, with a goal toward storing half of Germany’s gold reserves in its own vaults in Frankfurt am Main by 2020. This gold storage plan required a phased transfer to Frankfurt am Main of a total of 300 tons of gold bullion from New York and 283 tons of gold bullion from Paris by the end of last year. The realization of the plan effectively means there will no longer be any German gold reserves in Paris.

According to a recent Wall Street Journal article, “When Germany announced four years ago that it would repatriate some of its gold reserves from France and the U.S., it said the decision was to improve reserve management practices and auditing. The move, however, followed a grass-roots campaign by the tabloid press, which played on fears that the euro crisis could ultimately put the country’s gold reserves at risk.”

As of December 31, 2016, the Bundesbank’s gold reserves were stored at the following locations globally: 1,619 tons at Deutsche Bundesbank, Frankfurt am Main (47.9%); 1,236 tons at Federal Reserve Bank, New York (36.6%); 432 tons at Bank of England, London (12.8%); and 91 tons at Banque de France, Paris (2.7%).

The Deutsche Bundesbank manages the integrity of German gold reserves throughout the entire transfer process – from when the bars are removed from the storage locations abroad until they finally are securely stored in Frankfurt am Main. Once they arrive in Frankfurt am Main, all the transferred gold bars are carefully and meticulously inspected and verified by the Deutsche Bundesbank. After the conclusion of the inspections of transfers, the Bundesbank verifies the absence of any irregularities regarding the authenticity, fineness and weight of the gold bars.

According to Anthony Allen Anderson - VP of Sales and Marketing at GSI Exchange offered the following commentary on the transfers, "Deutsche Bundesbank recognizes that even for national banking systems 'home storage' can be a desirable solution, which many gold IRA investors have already discovered for themselves."