CBO Projection: US Debt Will Top 107% Of GDP By 2023

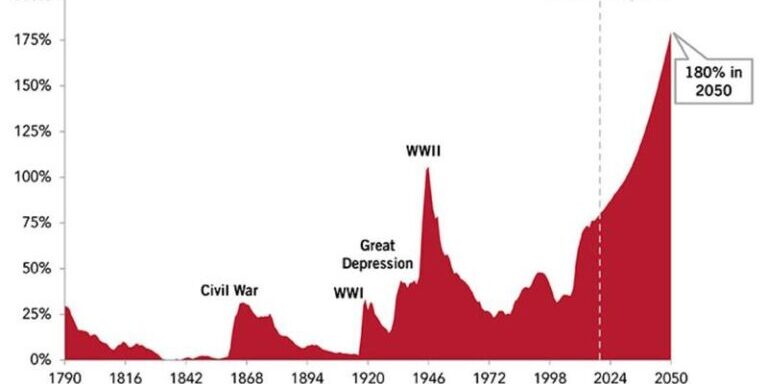

EDITOR NOTE: The Congressional Budget Office is projecting US debt to swell upwards of 107% of GDP in three year’s time. Currently US debt has already exceeded its highest levels, last seen during WWII. What’s alarming is the rate of this trajectory, one indicating that the debt-to-GDP ratio will be undergoing an explosive expansion in the years to come, one that’s likely to transform a soon-to-be catastrophic scenario into an apocalyptic one in the not-so-distant future.

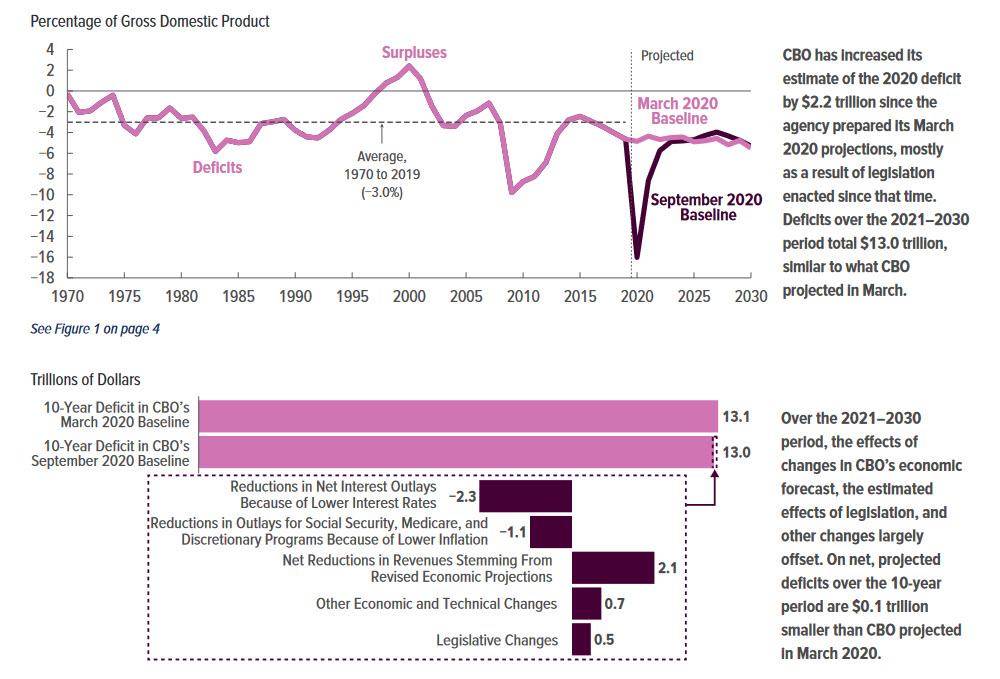

On Wednesday, in the latest update to its 2020-2030 budget outlook, the CBO said that it now projects a federal budget deficit of $3.3 trillion in 2020, "more than triple the shortfall recorded in 2019" as a result of the economic disruption caused by the 2020 coronavirus pandemic and the enactment of legislation in response.

Hitting 16.0% of GDP, the 2020 deficit would be the largest since 1945. And since debt compounds, the massive surge in leverage means that the average deficit over the 2021–2030 period will also rise by at least 2% more than annual deficits have averaged over the past 50 years.

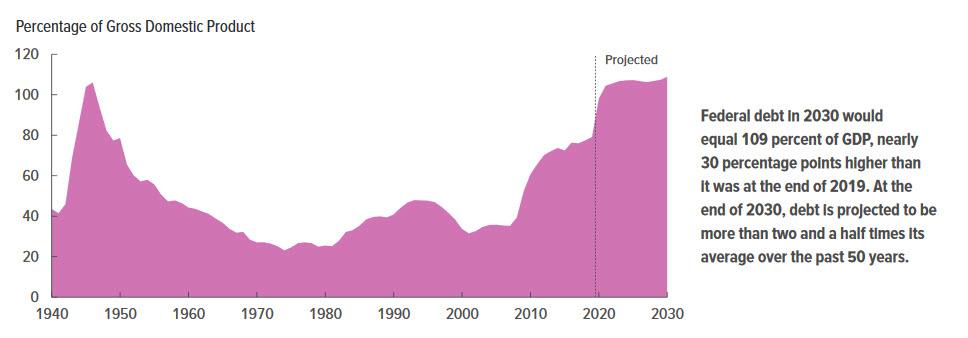

And speaking of the Federal debt, it is projected to rise sharply to 98% of GDP in 2020 (this excludes the social security debt) and will exceed 100% in 2021 and increase to 107 percent in 2023, the highest in the nation’s history.

Some more specifics from the latest report:

Deficits: the CBO estimates that the deficit will total $3.3 trillion in 2020, or 16.0% of gross domestic product (GDP)—the largest shortfall relative to the size of the economy since 1945. The deficit is projected to generally narrow through 2027 and then begin to grow, totaling 5.3 percent of GDP in 2030. Deficits remain larger than their average over the past 50 years throughout the 10-year period.

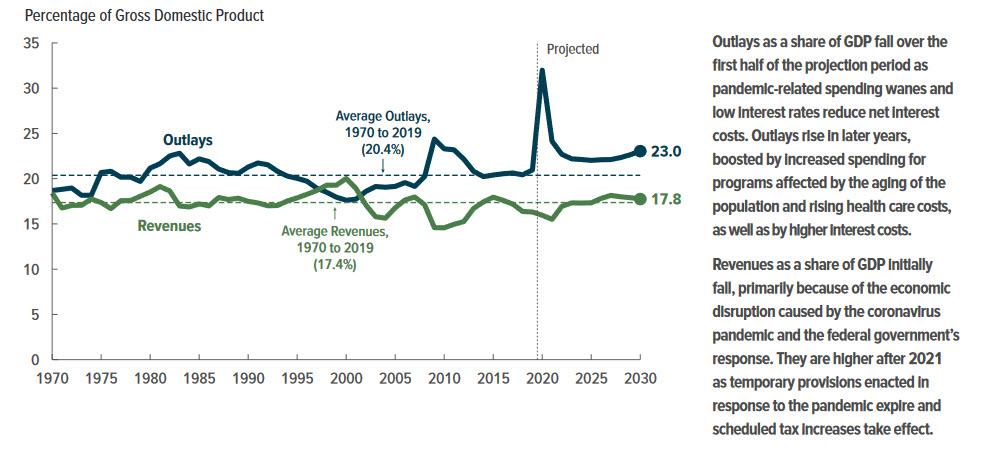

Outlays and Revenues: Whereas deficits are expected to surge in the coming years, one can't say the same thing about revenues. Outlays in 2020 are projected to be about 50 percent greater than spending in 2019, equaling 32 percent of GDP—the highest since 1945. In CBO’s projections, they decline to 23 percent in 2030, still well above their 50-year average. Revenues are estimated to equal 16 percent of GDP in 2020. After falling slightly next year, they are higher thereafter, reaching almost 18 percent of GDP by the end of the projection period.

Debt: Fiscal conservatism is dead, and here's why: according to the CBO, federal debt held by the public (excluding the trillions in debt funding social security) is projected to increase to 98% of GDP in 2020 (compared to just 79% in 2019 and 35% in 2007, before the start of the last recession). It would exceed 100% in 2021 and rise to 107% in 2023, the highest in the nation’s history. The previous peak occurred in 1946 following the large deficits incurred during World War II.

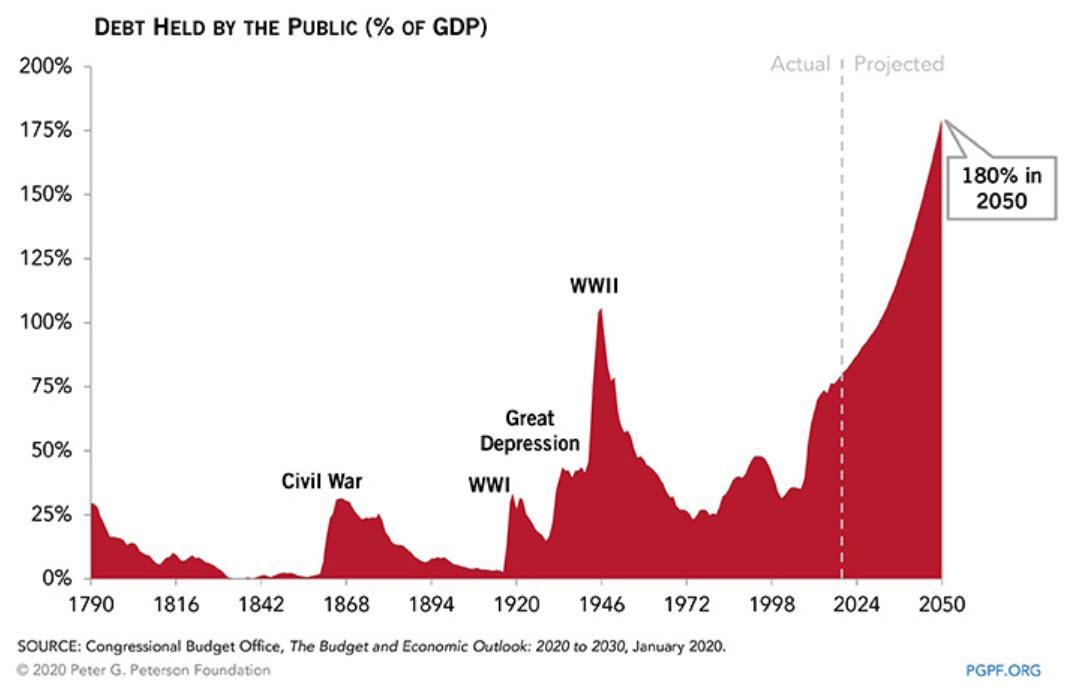

Unfortunately, the CBO limited its forecast to "only" 2030 and did not conduct a longer-term estimate. Had it done so, it would unveil that the US debt picture, already catastrophic, is now simply apocalyptic.

Why? Because this is what it predicted for the long-term US debt trajectory in February, well before the covid fiscal crisis:

One thing we know for a fact is that the trajectory of debt over the next few decades is far, far higher and is also why it is virtually assured that the US will not avoid the one trigger event that on previous occasions has eased an unsustainable US debt burden: war.

Originally posted on ZeroHedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.