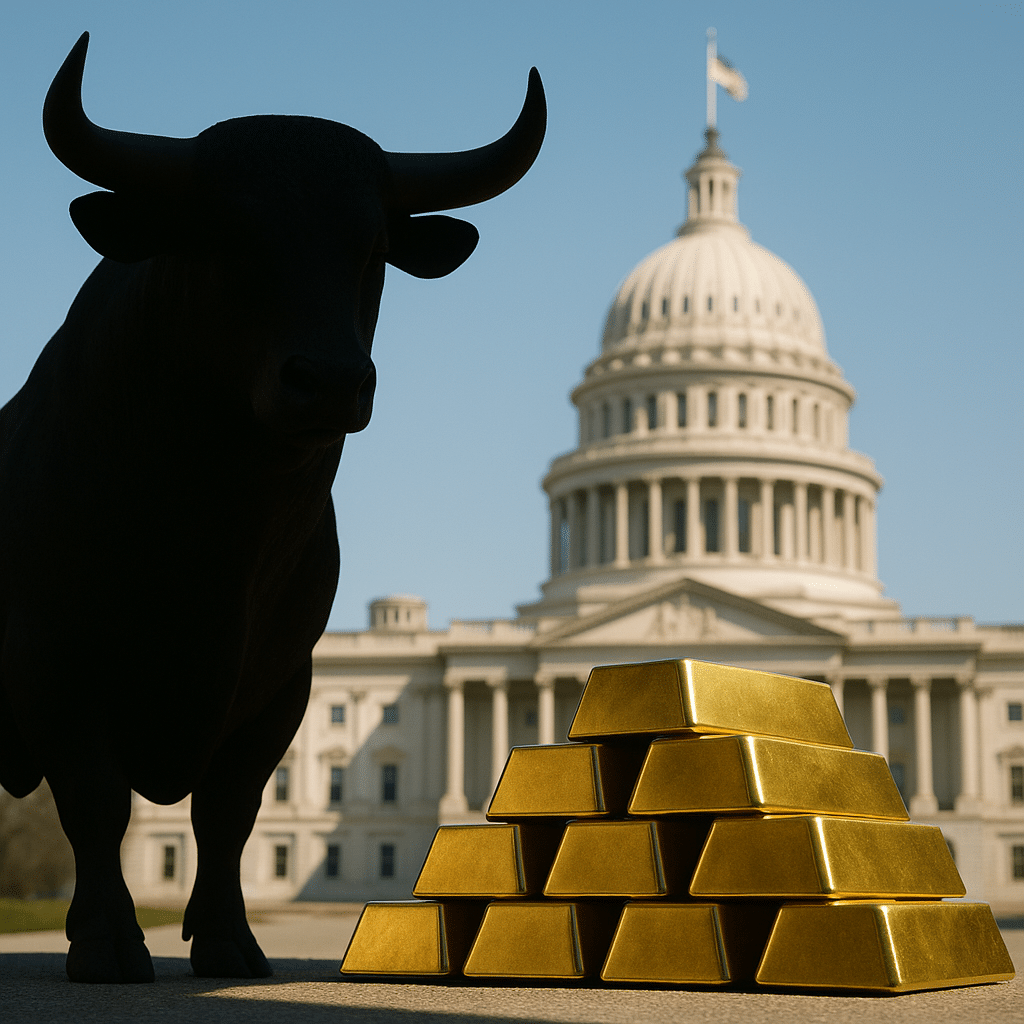

Inside The Central Banks’ Secret Agenda to Suppress Gold

Many investors accept the idea that gold is a reliable store of value. They might not be able to explain precisely why it's so valued; they may not understand its history of monetary function, but most will tell you that gold is a "safe haven."

The problem is that many of the same people who believe that gold has intrinsic value also believe that holding “paper gold,” such as a gold ETF, is the same thing as holding the physical metal.

There's nothing further from the truth (more on that later). But this shows one instance in which investors have fallen into an illusion trap, one set long ago by central banks.

That gold isn’t a viable means of exchange for anything other than large ticket items creates the impression that gold may be a store of value that happens NOT to be a form of practical money; similar to diamonds.

But central banks don't suppress the price of diamonds. They do, however, collude to suppress the price of gold; and this collaborative price manipulation has been standard practice since at least 1968.

Why do central banks want to suppress gold? It's obvious... because they view it as a competing international currency.

If gold were to function in a market, it would play a major role in determining the value of all other international currencies. It would also determine interest rate levels and values in government bonds.

Central banks, therefore, need to defend against gold and prevent it from circulating in the free market, as gold would usurp their control over national currency; namely, their power to manipulate their own national currency.

The Bank for International Settlements (BIS), known as the central bank for central banks, has been manipulating gold prices since the 1960's. The BIS has the privilege of being answerable to no one about their activities. That is, except for their central bank members.

Throughout the 1960’s, BIS, the US Treasury, and a host of European central banks were responsible for fixing and maintaining gold’s price to $35 an ounce. These efforts were done in plain view of the public.

And it remained a consistent practice until the US Treasury ran out of gold for delivery in 1968.

Now with the threat of “free market” gold looming, central banks throughout the 1970’s suppressed gold through demonetizing it and dumping physical gold into the markets to hold down its price.

But collusion to suppress gold was also handled clandestinely. For instance, between 1979 and 1980, a time when gold prices began to soar, the BIS, US Treasury, US Federal Reserve, and the G10 central bank governors formed a pool to reign in gold prices.

Here are a few phrases that transpired from a meeting in 1980:

- “There is a need to break the psychology of the market...”

- "No question of any permanent stabilization of the gold price, merely at a critical time holding it within a target area..."

- “It would be easy and nice for central banks to force the price down hard and quickly.”

The Bank of England also played a role in the 1980’s in controlling gold’s price, what one Bank staffer referred to as “stabilizing operations.”

But the most influential changes came in 1975 and 1980.

- In 1975, gold futures were introduced in the US.

- And in 1980, the London OTC (over the counter) market allowed people to trade cash-settled gold positions based on fractionally-backed gold holdings.

In either case, it is doubtful whether bullion banks even had enough gold to back the claims on it.

But since most of these trades were cash settled, the lack of physical gold backing became somewhat immaterial to the trading activities.

The problem is that “paper gold” ended up dwarfing the physical market. As futures are fractionally-backed, this means that people are trading huge multiples of gold that may not even exist.

And this paper market also brought with it increased volatility, deterring most investors from entering the gold markets.

Another negative effect of this paper market is that the “price discovery” of gold no longer takes place in the physical market; it takes place in a “fictional” market, where paper gold is circulating without any real backing.

Central banks are aware of this fake market; yet they do nothing about it because in the long run, this market helps suppress activity in the "real," that is, physical, gold market.

In addition to these markets, the secretive gold lending market in London is also another means by which central banks can cap gold prices. Essentially, these loans or swaps create an extra supply of gold which serves to depress price action.

Should any of this be a surprise? Here’s a quote from former Fed Chair, Alan Greenspan, testifying in 1998 before the US Congress: “Central banks stand ready to lease gold in increasing quantities should the price rise.”

Or William White of the BIS in 2005, mentioning that a primary aim of central bank cooperation was “to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful.”

And in a 2008 presentation, BIS stated that price intervention in the gold markets is an important component of their services and functions.

So now you understand why gold is a threat to central banks and what they are doing to suppress its price and circulation.

Referring back to the opening of this article, many investors want “gold exposure” through paper assets. Again it’s not the same thing.

Proof? Should the financial system collapse to the point where the dollar becomes worthless, try going to a bullion bank and trading in your certificate of ownership over a gold ETF (or whatever else you have) for physical gold. It’s not going to happen.

Paper gold is not a safe haven. But paper gold is what central banks want you to hold.

This is because physical gold is what central banks fear.

They fear physical gold because it is the only sound currency that can not only compete with fiat currency but also revalue their national fiat currency and bonds.

That is why they are suppressing it.

And that is why you should own it; that is why you should buy gold.

Because central banks know that gold is the only form of money that has true power over the value of every currency in existence.