China Just Pulled the Pin on a Rare Earth Grenade — And U.S. Military & Economic Security Are Now in the Blast Zone

It’s easy to miss the real headline here if you’re only skimming for stock market noise or short-term trade developments: China has officially weaponized the world’s most strategically important supply chain — rare earths — and U.S. national security is now on a ticking clock.

Let me say this plainly: this move by Beijing is not just a trade maneuver — it’s a direct strategic strike on America's defense and economic backbone. It puts every inch of the so-called Trump–Xi “truce” at risk and exposes glaring vulnerabilities that Washington has failed to address for decades.

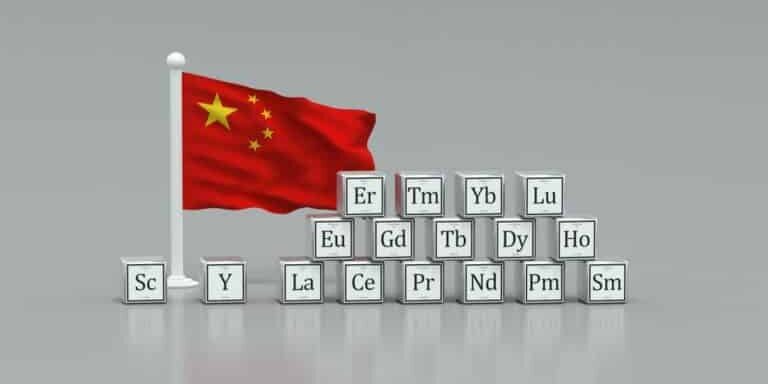

Rare Earths: The Hidden Fuel Behind America's Defense Muscle

Rare earth materials aren’t just industrial inputs — they’re essential to the guidance systems in missiles, the stealth tech in fighter jets, the sonar in submarines, and the motors that power drones and satellites. No rare earths, no modern military.

That’s why the VEU system announced by China is so dangerous. On paper, it sounds like a bureaucratic tweak. In reality, it gives Beijing the ability to decide — on a case-by-case basis — whether the U.S. military can receive critical materials. And they’re already making it clear: no access for defense-linked companies.

This means defense contractors like Raytheon, Lockheed Martin, and Northrop Grumman — whose components power everything from the F-35 to missile defense systems — could be cut off without warning from the resources they need to build and maintain our military infrastructure.

That’s not a supply chain risk. That’s a national security emergency.

The Deal Is Already Cracking — Here's Why

The Trump–Xi “rare earth truce” was already shaky. Now it’s functionally dead. China is promising general licenses for exports while quietly introducing selective blockades that target the U.S. military. That’s not a compromise — it’s economic warfare with a silk glove.

We’ve seen this game before: delay, restrict, blame “logistics,” and then retaliate with plausible deniability. As of September, U.S. imports of Chinese rare earths had dropped by 29% despite so-called “relaxed” restrictions. Even European firms are seeing only half of their export license applications approved. And that’s after months of begging and bending.

If you're still hoping this deal holds, you're ignoring every warning sign on the radar.

This Isn't Just About Warfighting — It's About Economic Survival

Rare earths aren’t just military-grade; they’re also the guts of the green tech transition: electric vehicles, wind turbines, advanced batteries, robotics, and AI-driven automation. That means America’s so-called “economic future” is riding on supply chains controlled almost entirely by China.

Let’s be clear: China processes over 90% of the world's rare earths and magnets. The U.S. can’t “reshore” this overnight. Environmental restrictions, lack of refining capacity, and supply bottlenecks make rapid domestic production nearly impossible.

That means American manufacturers — from Ford to Boeing to Tesla — are now dependent on a rival nation’s political discretion just to keep factories running.

If China chooses to fully enforce this VEU system with the same iron grip it used during its tech crackdowns, we could see:

- Defense delays on critical weapons systems

- Massive inflation in EV and renewable energy supply chains

- Job losses in aerospace and advanced manufacturing

- Collapse of investor confidence in “made-in-America” tech

We’ve Let This Happen — Now It’s a Race to Secure What’s Left

What’s most shocking isn’t that China’s doing this — it’s that our leaders knew this day would come and still did nothing. Every major intelligence assessment in the last decade warned that rare earth dependence was an existential threat.

But the U.S. chose short-term profits over strategic redundancy. Now we are paying the price.

The solution isn’t wishful thinking or another empty trade deal. The solution is:

- Immediate diversification of supply sources (Australia, Africa, South America)

- Rapid investment in domestic refining and rare earth processing

- Rebuilding U.S. stockpiles for both commercial and military use

- Hardening our financial defenses against the domino effect these shocks will trigger

Final Word: This Is Just One Battle in a Much Bigger War

China just reminded the world that supply chains are the new battlegrounds. The U.S. military may still have more carriers and aircraft, but Beijing has something far more potent — control over what makes those weapons function.

And unless we act now, we’re heading into a future where America’s superpower status depends on a Communist regime’s export license approval process.

If you think this ends with rare earths, you’re not paying attention. Next could be lithium, cobalt, nickel, semiconductors — the entire tech ecosystem is built on fragile foundations.

This is why I urge every reader to not only follow these developments — but prepare. These shocks will ripple into banking, supply chains, inflation, and markets. When defense contractors can’t meet contracts and manufacturing slows, the financial system will feel it.

✅ Download my free guide — 7 Steps to Protect Your Account from Bank Failure

📘 Grab my book End of Banking As You Know It

🔒 Join my Inner Circle for $19.95/month and get exclusive strategies to insulate your savings from what's coming next.

👉 Click here to get started

💡 Join the Inner Circle

This is not a drill. This is the slow-motion collapse of a fragile system — and it’s accelerating.

Don't be the last to act.

—

Bill Brocius

Founder, DedollarizeNews.com

"The banks may not warn you. I will."