China’s $8.2B Payback: How China Just Fired a Monetary Missile at Washington

Red Dragon, Golden Shield: China’s Silent War on the Dollar

Have you ever wondered what it looks like when a global superpower begins to quietly sabotage the system that once empowered it?

That’s precisely what’s unfolding as China, a founding member of BRICS, escalates its systematic retreat from U.S. dollar-denominated assets. The headlines may reduce it to a mere “$900 million sell-off,” but the truth is far more seismic: Beijing has dumped over $8.2 billion in Treasuries since April. This isn't a glitch in their strategy—it is the strategy.

The Unraveling Begins

In April 2025, mere days after Donald Trump reinstated sweeping tariffs in a bold act of economic nationalism, China answered with a different kind of weapon—not tanks, not tech, but treasury liquidation.

As of 2012, China held over $1.35 trillion in U.S. Treasury debt. Today? It’s down to $757 billion. That’s a 44% collapse in holdings—over a quarter-trillion dollars unwound. Imagine a friend who lent you money suddenly asking for half of it back. Now imagine that friend is your largest creditor, and you’re the United States government, addicted to deficit spending and dollar printing.

This is not just about bad blood or tariffs. It’s the long-anticipated divorce from dollar hegemony, spearheaded by BRICS and powered by gold.

Gold: The Currency of the Next World Order

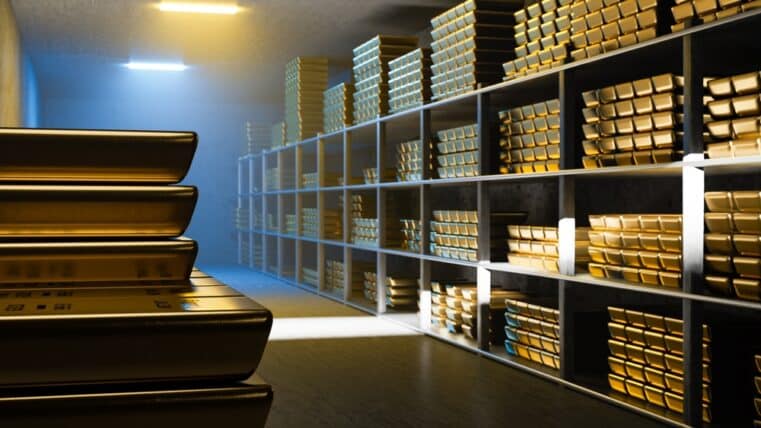

While selling Treasuries, China has been amassing gold at breakneck speed. $247.8 billion worth, to be precise. Why? Because gold, unlike fiat debt instruments, cannot be weaponized, frozen, or inflated away. It's financial sovereignty in physical form—and it’s the backbone of what BRICS envisions as a post-dollar global settlement system.

Look around: Russia, Brazil, India, South Africa, Egypt—they’re all offloading Treasuries and stockpiling precious metals. The XAU/USD index just broke $3,400. The DXY dollar index? It dipped below 98, a psychological red line. This is not a coincidence. It’s the consequence of empire overreach.

A Weaponized Dollar, A Backfiring Strategy

When Trump slapped tariffs on Beijing, he likely knew it would provoke a response. What he may not have expected—or perhaps he did—is how coordinated and sophisticated that response would be. China didn’t send warships. They sent a signal to the world: The era of funding America’s debt-fueled imperial machine is over.

And the math backs it up. As of today, China ranks third in Treasury holdings. If that selling accelerates—and others follow suit—the U.S. faces a catastrophic scenario: rising interest rates, shrinking dollar demand, and an unsustainable fiscal cliff.

Prediction: The Treasury Crisis of 2026

If China’s pace of dumping accelerates—and if BRICS nations coalesce around a gold-backed alternative—the U.S. will be forced into two bad choices: raise interest rates to attract buyers, or print even more money to cover deficits. Either route is a trap.

Here’s what I foresee:

- By Q2 2026, Treasury auctions will begin failing quietly, then publicly.

- The Fed will step in as buyer of last resort—reigniting inflation.

- Foreign demand for U.S. debt will flatline.

- And the gold-backed bond proposals floating within BRICS? They’ll gain traction.

In short: the trust underpinning the U.S. dollar is dying, and the body isn't far behind.

The Solution Is Not in the Fed. It’s in Your Hands.

The American people must realize what BRICS already knows: the fiat system is unsalvageable. The path forward isn't another rate cut or Fed program—it’s a return to real assets, decentralized finance, and personal sovereignty.

If you’re still holding your wealth in paper promises—bank balances, Treasuries, or dollar-denominated funds—it’s time to ask yourself: what happens when the world no longer wants what you're holding?

Because the BRICS nations just answered that question with $8.2 billion worth of truth.

The financial landscape is shifting faster than most realize, and those who fail to prepare risk being left behind. If you’re ready to take control of your financial destiny, I’ve got two resources that can help you start today:

Download my free book, "Seven Steps to Protect Your Bank Accounts"

Get a discounted hardcover of Bill Brocius' "The End of Banking as You Know It" for $19.95 (normally $49.95).

Because in a world where control of the money means control of the people—taking control of your money means taking back your freedom.