China’s Gold Buying Frenzy Drives Prices Higher as Americans Miss Out

China remains firmly in control of price action in the global gold market, and the latest data indicates that this is likely to continue, while Western investors will likely join the precious metals party soon, according to the latest analysis by Gainesville Coins’ Jan Nieuwenhuijs published on Wednesday.

Nieuwenhuijs pointed out that China’s private sector imported 543 tonnes of gold in Q1 2024, and the People’s Bank of China (PBoC) added another 189 tonnes to its reserves during the same period. However, “Most of the PBoC’s purchases are ‘unreported,’” he warned.

“China continues to be the marginal buyer in the gold market, driving up the price. I expect that China will remain a robust buyer of gold going forward in support of the price.

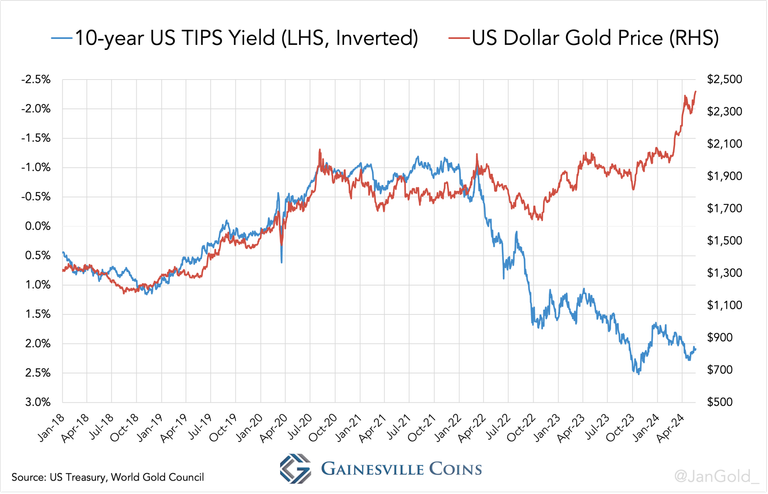

In his previous analysis published in March, Nieuwenhuijs explained how China had broken the longstanding correlation between the dollar-denominated gold price and real yields to become “a driving force of the gold price” beginning in 2022.

“The data at my disposal ran until December 2023 which made me hesitant to conclude the sharp increase in the gold price since late February was also caused by the Chinese,” he said. “However, as new data has been released, I can confidently say that China initiated the current bull market.”

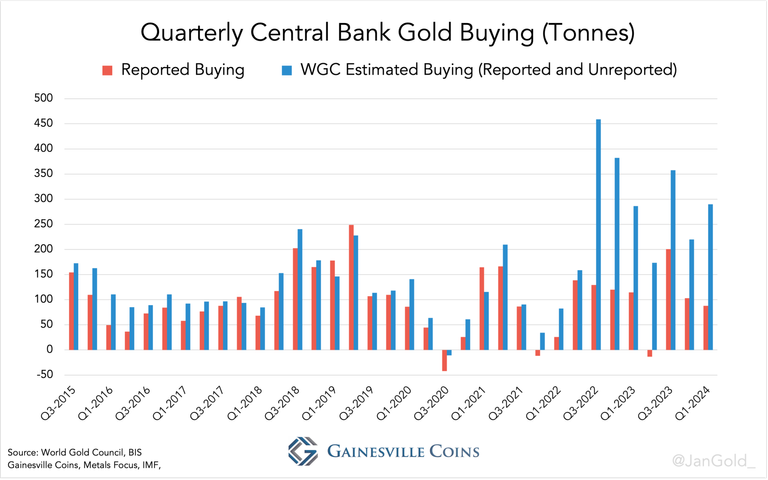

“The media is aware that since 2022 central banks mostly buy gold covertly (often referred to as “unreported” purchases),” he said. “By now, it’s widely known that the World Gold Council (WGC) publishes a single statistic on aggregate central bank buying each quarter, which is markedly higher than what all monetary authorities combined report to have bought.”

The problem, Nieuwenhuijs said, is that it remains unclear which central banks are accounting for that discrepancy, which has widened significantly since the Russian invasion of Ukraine.

Field research from the World Gold Council indicates that central banks bought 290 tonnes of gold in the first quarter of 2024. “Most of the difference—I use eighty percent—between the WGC’s estimate and total purchases as disclosed by the IMF is 162 tonnes,” he wrote. “When we add what the PBoC has reported to have bought during this period, total purchases come in at 189 tonnes, 38% more than the previous quarter. Possibly, the PBoC had a stake in boosting the price since late February.”

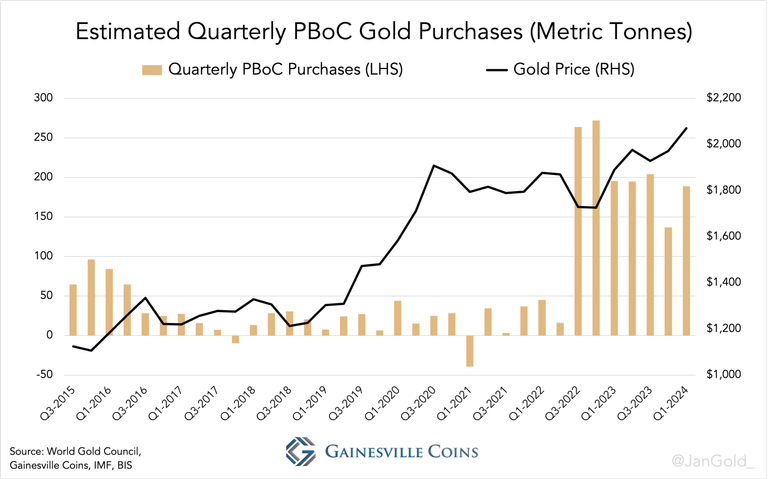

Nieuwenhuijs provided the following chart showing his own estimates of reported plus unreported PBoC gold purchases by quarter.

“Taking into account unreported purchases, the Chinese central bank now holds gold reserves weighing 5,542 tonnes, according to my research,” he said.

Turning to private demand, Nieuwenhuijs said the Chinese private sector’s net gold imports have been extremely strong. “From January through March imports accounted for a mammoth 543 tonnes, up 74% from Q4 2023,” he said. “This is definitely what pushed up the gold price. Import in April decreased somewhat to 125 tonnes.”

Nieuwenhuijs noted that Hong Kong saw significant net inflows of gold in recent months, which “mainly reflects strong demand in China,” he believes.

“In Q1, the UK and Switzerland both were net exporters, and Western ETF inventories declined,” he said. “At the time of writing the West has not yet joined the bull market, which primarily has its roots in China.”

Nieuwenhuijs referenced the recent report that Beijing sold a record $53 billion in U.S. Treasuries and agency bonds in the first quarter of this year, which he said “illustrates the PBoC is selling dollars for gold,” and with China’s foreign exchange reserves totaling $3.2 trillion, “there is plenty of firepower left for gold.”

He also expects Chinese private-sector gold demand to remain strong given the ongoing real estate slump on the mainland which has seen home prices fall in 30 of the last 33 months.

“The State Council is floating a plan to buy unsold houses through local governments, but these are already drowning in debt,” he said. “The Chinese public, which doesn’t have many investment options due to capital controls, will continue to invest in gold and support the price.”

Nieuwenhuijs predicts that the West will finally join the gold bull market in short order. “ETF outflows appear to have stopped, and it would only be logical for Western investors to rotate into gold at some point because of high asset valuations and an overconfidence in credit instruments,” he said.

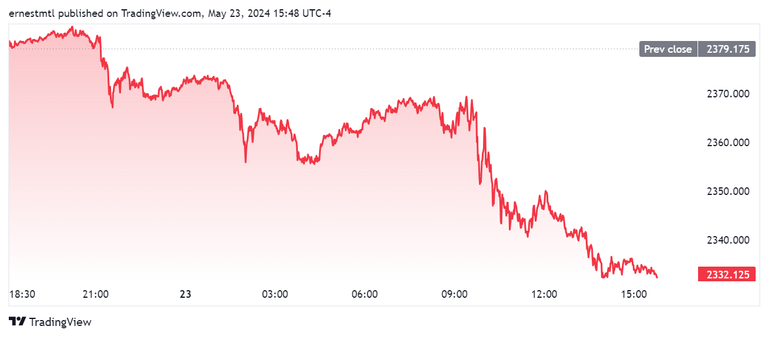

Gold prices have seen a pullback following last week’s strong price action, and the steady decline continued on Thursday. Spot gold last traded at $2,332.12, and is down nearly 2% on the day

This article originally appeared on Kitco News

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.