China’s Monopoly Over Rare Earth Cesium Poses a Serious Threat to the US

Ask people about a rare metal called cesium and they’ll probably say it’s the first time they’ve even heard about it. But ask them about atomic clocks, ion propulsion systems (for spacecraft), photoelectric cells, and infrared lamps, and they’ll say that these technologies will likely shape our future (even if they don’t fully understand them).

Well, they’re right. These technologies not only sustain our current technological state, we need to continue developing them to remain competitive on a global scale. And these technologies are made possible through cesium.

The problem is that China has a monopoly on this rare earth metal. And unless we find a way to circumvent cesium, China arguably has full control over these future technologies.

A Kind of Global Dominance Unseen

A nation can be globally dominant in various ways--financially, militarily, technologically, and industrially. But what’s often overlooked is global dominance through rare natural resources. Truth is, most people can’t name one rare metal.

China’s monopoly over cesium and other rare earth materials is quickly becoming a major threat. The reason for this is that cesium and other rare earth elements play a critical and strategic role as the backbone of current and future technologies.

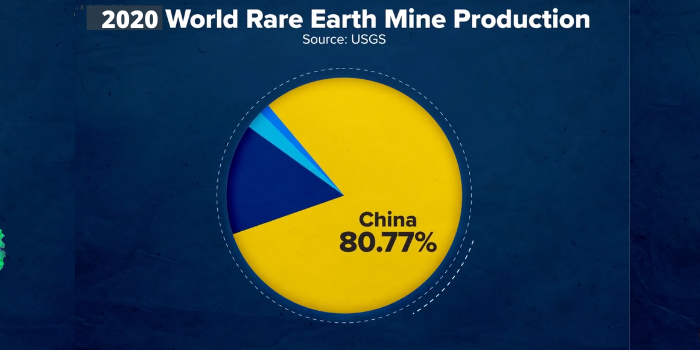

How many rare earth metals are we talking about? Approximately 16 of them. As far as cesium goes, China is both the main supplier and main producer.

They control around 96% of its mining, production, and distribution.

Can the US get out from under China’s cesium monopoly? Can the US find new cesium mines? Well, these are the big questions. We do know that there are a few deposits being mined in Canada, Australia, and Zimbabwe by a number of small mining companies. But ultimately, there’s no clear picture as to their output.

The Cesium Standard

We’re all familiar with the gold standard. The cesium standard is something else. It doesn’t directly concern most individuals, but it can indirectly and significantly affect the way we go about their daily lives.

How so? The cesium standard refers to the accuracy of atomic clock measurement. What relies on these devices? The internet, GPS, mobile networks, and even national defense applications. But cesium demand extends even further to encompass a wider range of technologies such as night vision goggles, infrared detectors, optics, and a host of other commercial and military applications.

In 2019, the US imported 100% of its cesium, according to the US Geological Survey. Since cesium is not exchange-traded but bought mostly from China, the price of the metal is determined by the issuer based on demand. Right now, 1 gram of 99.98% cesium is $2,299.18 an ounce, or $81.10 per gram.

Yes, cesium costs more than gold.

This reliance is a serious problem. More than that, it’s a critical vulnerability--a leverage that a foreign nation has over our ability to manufacture necessary technologies for commercial markets, and national security and defense.

What if China Decided to Hold Back Our Cesium Supply?

What other recourse would we have in such a scenario? We don’t really have any cesium mines undergoing adequate production. We might not even have an adequate stockpile of cesium. Our industries would be severely disrupted, and so would our military capacity. Fortunately, the rare metal was not one of the items in dispute during the US-China trade war.

It’s important to understand that China’s dominance in rare-earth materials is far greater than OPEC’s dominant hand in the oil trade. It’s a significant monopoly that media has largely ignored since the 1990s when China began dominating the trade.

Because cesium is often cheaper in China (using their domestic currency) than in other nations, manufacturers decided to establish manufacturing plants in China to reduce costs. During the trade war, this posed a difficult situation for many manufacturers, as American companies would have to rely on imported cesium, driving up not only supply costs but consumer costs as well.

The nationalistic sentiment to “buy American” is understandable. But in the case of cesium, there is no “American” to buy.

Currently, there are only three known mines that can yield cesium outside China: in Australia, the Sinclair mine, in Canada, the Tanco mine, and in Zimbabwe, the Bitika mine. That’s it. And unless the small private companies can mine enough cesium to challenge China’s dominance, nations will have to innovate in order to find a way to circumvent cesium demand--an endeavor whose time frame and the outcome are currently unknown.

China’s Long March Toward Global Economic Dominance

If any of you have read the Chinese military classic The Art of War by Sun Tzu, you’d recognize China's indirect maneuvers toward achieving its goal of economic dominance. The moves are often discrete, relatively “formless” (as in de-dollarization + rare-earth monopoly + gold-backed yuan etc.), but all come together like pieces of a puzzle.

The American way has always been more or less direct: carve out a direct path, outline the steps, and achieve the goal. Whereas China’s intention seems to have been less direct: instead of achieving a goal directly, they would cultivate the conditions for a particular outcome. When the time is right, the goal, like ripe fruit ready to fall, will materialize under the right conditions.

Global monopoly over cesium is just one leg of China’s long-term strategy. And its leverage over the rest of the world is something we may see in years to come unless other nations find a way somehow to make cesium reliance irrelevant.

We don’t know the full extent of economic implications in light of this vulnerability. We’re not sure how it might affect the dollar and other dollar-denominated assets.

Besides the safe haven that China and all other nations turn to, that is Gold and Silver, what other hedge do you really have?

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.