Citigroup Chaos: Banking on Instability

- Citigroup is planning a sweeping overhaul of its organization after years of lackluster stock performance.

- The reorganization efforts are expected to involve layoffs.

Citigroup is planning a huge overhaul of its business that will involve layoffs, representing one of the biggest organizational shakeups that the bank has seen in about two decades.

The bank, which previously had three regional chiefs overseeing its business globally, will be now be divided into five businesses, Citi said in a statement on Wednesday. Those will include units focused on services, trading, personal banking, banking, and wealth management.

Additionally, leaders of the business units will report directly to Citigroup CEO Jane Fraser in a move that's intended to speed up management decisions and increase accountability among staff.

The sweeping reorganization effort will also involve job losses, as implied by a portion of Fraser's press statement on Wednesday: "As Citi swiftly transitions to this new model, the firm is committed to retaining top talent and supporting employees who are leaving the company," she said.

People familiar with the matter confirmed the layoffs with Bloomberg on Wednesday, though it was unclear how many employees would be affected. Fraser said in a memo viewed by the Wall Street Journal that employees will know by the end of November if their roles are changing. Citigroup has already axed thousands of employees since the start of the year.

"We have taken hard, consequential tough decisions here. They are not going to be universally popular within our bank. It's going to make some of our people very uncomfortable. I am absolutely fine with that," Fraser said on the call.

"I am confident that our strongest performers are going to be fully supportive of these moves, and it is absolutely the right thing to do for our shareholders," she added.

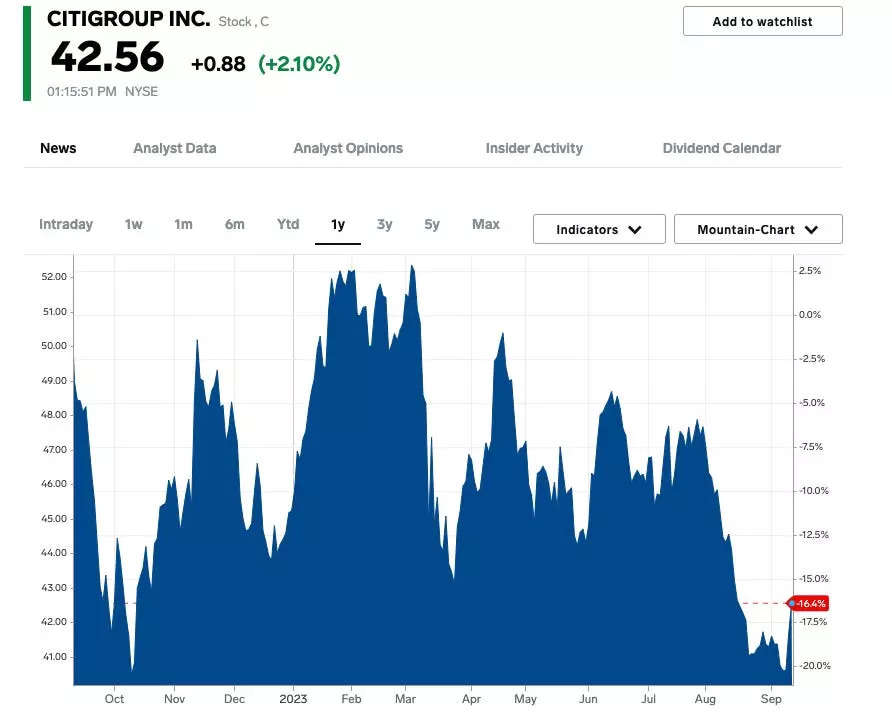

Citigroup stock rose 2% to $42.35 a share shortly after the reorganization was announced. But the company has already been weathered heavily by higher interest rates and tighter financial conditions over the past year.

Over the second quarter, its net income fell 36% to $2.9 billion. Shares of the stock are down 46% from their peak in late 2021.

Source: Business Insider

Originally published by Jennifer Sor at Business Insider