Collusion? CME Approves 267 LBMA Gold and Silver Bar Brands

EDITOR NOTE: A detailed but wonky article, the piece you’re about to read covers the delivery crisis between the London Bullion Market Association and COMEX gold and silver. Regulatory standardization made it nearly impossible for the LBMA to settle its contracts with its own standardized bars. There’s supposedly no “shortage” in the metal, but a shortage of standardized formats. Hence, The CME just added 267 gold and silver bar brands to fill this delivery and settlement gap. Will this move address the shortage in both metals in light of surging demand?

In a move which has gone entirely unnoticed in the precious metals markets, but which signals gold and silver bar delivery constraints for the COMEX gold and silver futures contracts, Chicago Mercantile Exchange Group (CME), operator of the New York based COMEX, has quietly and under the radar, hugely expanded its lists of eligible refinery gold and silver bar brands that can be delivered against the massively traded flagship GC 100 (100 oz gold) and SI (5000 oz silver) contracts.

These changes, which were implemented on 27 July and which are detailed below, also look to be serving an even bigger agenda of preparing for a radical change in the delivery procedures of these two famous contracts so as to facilitate gold and silver stored in London Bullion Market Association (LBMA) vaults in London, England, to be used in settlement against the GC 100 oz and the SI 5000 oz COMEX contracts. Note that the COMEX 100 oz gold futures contract is currently deliverable as either one 100 troy ounce gold bar, or three 1 kilo gold bars, while the COMEX 5000 oz silver futures contract is currently deliverable as five 1,000 troy ounce cast silver bars (with a weight tolerance of 10% either higher or lower).

To reiterate, these changes are to the gold and silver refiner brand lists of the big boy contracts GC 100 and SI. You may recall something similar happening for a new 4GC contract when it was rushed out in late March, but that was just a trial run. This is the main event.

From New York to London

As a reminder and as some background, CME (COMEX) and the LBMA began explicitly colluding on 24 March this year in an attempt to try to reign in the global precious metals markets following an Exchange for Physical (EFP) gold delivery failure in London which caused both a blow out between gold futures and gold spot spreads, as well as a bid-ask spread blowout in London spot gold, and which prompted the LBMA in a public statement to say that it had:

“offered its support to CME Group to facilitate physical delivery in New York”

On the same day, 24 March, Reuters, the embedded LBMA mouthpiece, reported that:

“The LBMA and executives at major gold-trading banks asked CME to allow 400-ounce bars to be used to settle Comex contracts, said the two sources, both of whom were involved in the discussions.”

Again, on the same day, 24 March, the CME Group hurriedly launched a new gold futures contract called the “Gold (Enhanced Delivery) futures contract” (ticker 4GC), a contract which is structured to allow delivery via 100 oz gold bars, or kilo gold bars, or 400 oz gold bars.

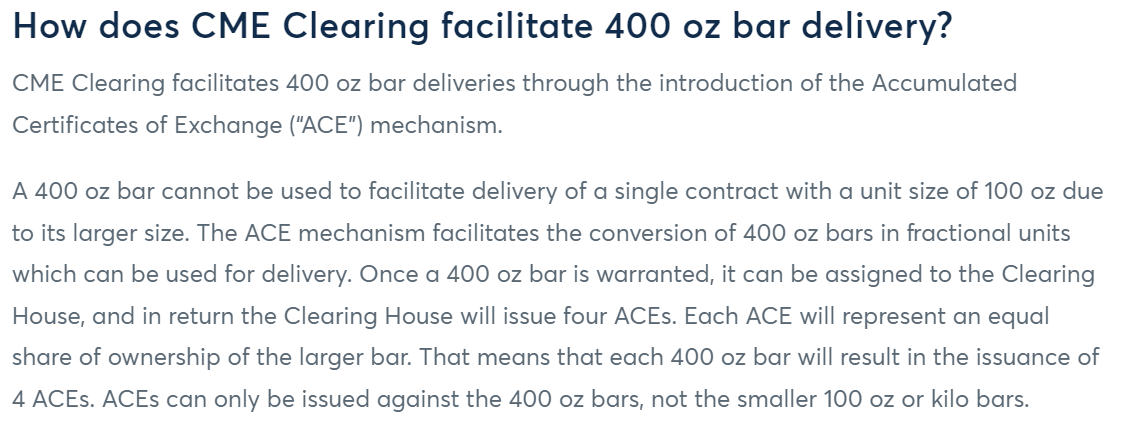

Notably, in the 4GC contract, a 400 oz gold bar can be delivered via “Accumulated Certificates of Exchange” (ACEs), a fractional paper construct created by the CME to, in its words, “facilitate the conversion of 400 oz bars in fractional units which can be used for delivery” where “the Clearing House will issue four ACEs. Each ACE will represent an equal share of ownership of the larger bar.”

Importantly, in late March, CME created an entirely new and huge list of eligible gold refiner brands whose bars would be acceptable for delivery against this new ‘Enhanced Delivery’ 4GC futures contract, a list which comprised every gold refiner brand on both the current and former LBMA Good Delivery lists of gold refiners, and every gold refiner brand already on the GC 100 contract eligible gold refiner list at that time.

Whatever it Takes – Add the whole Goddam List

As the CME said in its 24 March press release for the 4GC contract:

“The approved brand list for this product will have complete convergence with the approved brand list for CME Group’s existing gold futures and the LBMA gold good delivery list.”

While this 400 oz 4GC contract launched in late March has hardly traded since then, its primary purpose now looks to have been a trial run to test out linking COMEX precious metals contracts to the London vaults and to the LBMA Good Delivery refiners lists, and to test implement the construction technique for the expanded eligible gold and silver bar brand lists of the GC 100 gold and SI (5000) silver contracts.

As the CME and the LBMA said in another joint statement on 1 April, they “will continue to coordinate efforts as market circumstances evolve”. And continue to coordinate they have.

For those who might not be familiar, the COMEX approved brand list for gold and the LBMA Good Delivery lists for gold were (up until recently) two entirely unrelated lists and concepts. The same was true of the COMEX approved brand list for silver and the LBMA Good Delivery lists for silver – they were two entirely unrelated lists and concepts.

The COMEX approved gold refiner brand list (up until 27 July) was a list of refiners which produced either 100 oz gold bars or 1 kilo gold bars which COMEX judged to be of a sufficient standard to be physically deliverable against the GC 100 gold contract. On the other hand, the LBMA Good Delivery List for gold lists those gold refineries around the world which produce the far larger 400 oz gold bars (central bank gold bars) and whose gold bars are deemed by the LBMA Good Delivery referees to be of a high enough quality for inclusion.

Likewise, the COMEX approved silver refiner brand list (up until 27 July) was a list of silver refiners which produced 1000 oz silver bars, bars which COMEX deemed worthy to be deliverable against the SI silver contract. In contrast, the LBMA Good Delivery List for silver is a far larger list of silver refineries which produce 1000 oz silver bars, including many Chinese refineries, that have been accredited by the LBMA Good Delivery referees.

When at the end of March, CME rushed to create a new gold bar refiner list for the 4GC (400 oz) gold contract, there were 68 gold bar brands listed on the existing GC 100 approved gold bar brand, and this list had not changed in any material way for a long time save for a few additions and deletions of refineries along the way.

In late March for the new 4GC contract, CME took this existing COMEX GC 100 refiner list and merged it with the LBMA Good Delivery List for gold, adding in all the gold refinery brands that were on the LBMA Good Delivery list that had not already been on the GC 100 list. This was a whopping 51 bar brands on the LBMA Good Delivery gold list that were not on the GC 100 refiner list. When these two lists were added together and merged, it resulted in a combined list of 119 approved bar brands, an exact 75% increase over the 68 refineries which were on the GC 100 COMEX gold bar brand list.

4GC Test Run

Next, and this too is very important, the CME also added to the 4GC list all of the gold refineries that are listed on the former LBMA Good Delivery List for gold. For those who don’t know, the LBMA maintains two refiner bar brand lists for gold as well as another two refiner bar brand lists for silver. The current LBMA Good Delivery List for gold lists gold refiners which currently produce 400 oz gold bars which have been accredited by the LBMA.

The former LBMA Good Delivery List for gold lists gold refiners which at some point in the past produced 400 oz gold bars which had been accredited by the London Gold Market referees, such as the Royal Mint’s refinery and Johnson Matthey, which previously administered the London Good Delivery list. This former list is a list of refineries, including historic and long gone refiners, which don’t currently make Good Delivery gold bars (400 oz gold bars) but whose gold bars, before they stopped making them or were taken off the list, are still accepted as London Good Delivery. Note that the history of the Good Delivery list stretches back all the way to 1750. The LBMA has only been in existence since 1987.

There are, wait for it, 111 additional refiners on the former LBMA Good Delivery List for gold that are not on the current LBMA Good Delivery list for gold. This means, in total, when the COMEX 4GC contract went live in early April this year, its approved refiner list of gold bar brands contained the names of a massive 230 refiner bar brands, 68 + 51 + 111 = 230. That’s a 238% increase in the number of refineries compared to the 68 refiners which were on the pre-April GC 100 approved refiner gold list. Ironically, the new 4GC contract has never traded, but was it ever meant to, or was it a red herring to set up the 400 oz London deliverable infrastructure for the GC 100 contract?

GC 100 and SI 5000 – A Live Exercise, Conjob-27

Now fast forward to 27 July, and what do we find? Well on 27 July, the CME (COMEX) in a very low key way and without any media announcements or press releases, quietly slipped in a market regulation filing (MKR) on its website titled “Regularity Approvals for Gold and Silver Brands”, with a short statement as follows:

“From Registrar’s Office

# MKR07-27-20

Notice Date 27 July 2020

Effective Date 27 July 2020

The Commodity Exchange, Inc. (“COMEX” or “Exchange”) has approved certain London Bullion Market Association (“LBMA”) good delivery brands for delivery against the Exchange’s Gold Futures (GC) and Silver Futures (SI) contracts. The list of brands are located in the “Gold (GC) Brands” and “Silver (SI) Brands” tabs in the service providers table at the end of Chapter 7 of the COMEX Rulebook.

These approvals will increase the brands of available material that can be used to satisfy delivery requirements of the Gold Futures (GC) and Silver Futures (SI) contracts and will afford market participants expanded delivery options.

These approvals are effective immediately.”

When one consults the said “Gold (GC) Brands” and “Silver (SI) Brands” tabs of the latest CME service providers table (which is published as a spreadsheet in XLS format here), one sees the following.

On the Gold (GC) Brands worksheet for the flagship GC 100 oz contract, we now find that:

-> 51 LBMA approved gold refineries have been added to the eligible brand list for the COMEX 100 (GC 100) gold futures contract. These 51 additional refinery brands are listed directly under the existing refiner list with a subheading of “(Added as of 27 July, 2020)” There were 69 brands on this list prior to 27 July. There are now 120 current brands on the GC 100 gold list. 69 + 51 = 120

-> Of the 51 refiner brands, the top three countries represented are 12 refineries are from China, 10 from Japan, and 7 from Russia.

-> An additional 111 gold bars brands from the LBMA ‘former’ Good Delivery List for gold have been added to the Gold (GC) brands tab as a separate list beside and to the right of the first list. In total 162 LBMA approved gold bar brands have been added to the COMEX approved gold bar brand list.

-> Overall, there are now 231 brands on the COMEX approved gold bar brand list. That’s a 235% increase in the number of gold bar brands that are now on the GC 100 list compared to the 69 that were listed before the 27 July change.

Note that the current LBMA Good Delivery List for gold lists 71 refiner gold bar brands. The former LBMA Good Delivery List lists 115 refiner bar brands.

Silver Panic – Under the Radar

An even bigger bombshell arguably is that the CME and LBMA’s actions are now signaling panic about future physical silver delivery. Turning to the Silver Futures (SI) Brands worksheet, we find that on 27 July, the COMEX SI eligible silver refiner brand list, which up until then had listed 75 silver bar refiner brands, has also been hugely expanded.

On the Silver (SI) Brands worksheet tab of the same service providers XLS, we now find that:

-> 65 LBMA approved silver refineries have been added to the eligible brand list for the COMEX SI (5000 oz) silver futures contract. These 65 additional refinery brands are listed directly under the existing refiner list with a subheading of “(Added as of 27 July, 2020)”

-> There were 75 brands on this list prior to 27 July. There are now 140 current brands on the current SI silver refiner list. 75 + 65 = 140

-> Of the 65 silver refiner brands added, the top three countries represented are 26 silver refineries from China, 11 from Japan, and 5 from Russia.

-> An additional 40 silver bars brands from the LBMA ‘former’ Good Delivery List for silver have also been added to the Silver (SI) Brands tab as a separate list beside and to the right of the first list.

In total, 105 LBMA silver bar brands were added by COMEX on 27 July, taking the COMEX SI silver list to a total of 180 eligible silver bar brands. That’s a 140% increase in the number of silver bar brands compared to prior to 27 July, or in other words, 2.4 times more brands on the SI silver brand list than there had been prior to 27 July.

Note that the current LBMA Good Delivery List for Silver lists 84 refiner silver bar brands. The former LBMA Good Delivery List lists 82 refiner bar brands.

In summary, on 27 July, across the GC 100 contract and SI contract refiner lists, COMEX stealthily added 267 LBMA gold and silver refiner brands to the COMEX approved refiner lists using one small paragraph in an obscure hidden filing on its website. Critically, these changes were approved and ‘effective immediately’ on 27 July, the same day that they were announced. How’s that for covert behind the scenes dealings? With COMEX and LBMA hoping no one would notice.

The Old Normal

Previously, CME always announced each addition or removal of an approved gold or silver refiner brand separately in a distinct filing, for example, when the ABC Refinery (Australia) brand was added to the GC 100 gold approved refiner list on 5 June this year, or when, CME removed the approval of the gold bar brand of the North Korean central bank from the 4GC approved brand list on July 23 July (the Pyongyang gold bar brand had slipped through the cracks in COMEX’s rush to blanket list all former LBMA brands, this obviously did not go down well in New York, or perhaps in Washington DC).

Another example is the tragicomic addition and subsequent removal of Dubai DMCC’s Al Ethihad Refinery from the GC 100 gold brand list in July, approved and added by CME on 9 July, and then mysteriously removed by CME three weeks later on 31 July without explanation, but market rumor has it that Al Ethihad was kicked off the COMEX gold refiner list due to intervention by JP Morgan.

In contrast to all of these individual additions and deletions, now COMEX has added 267 gold and silver bar brands to its approved in one fell swoop. Nothing like this has ever happened before. So why now?

New Normal – We’re Going to Need A Bigger List

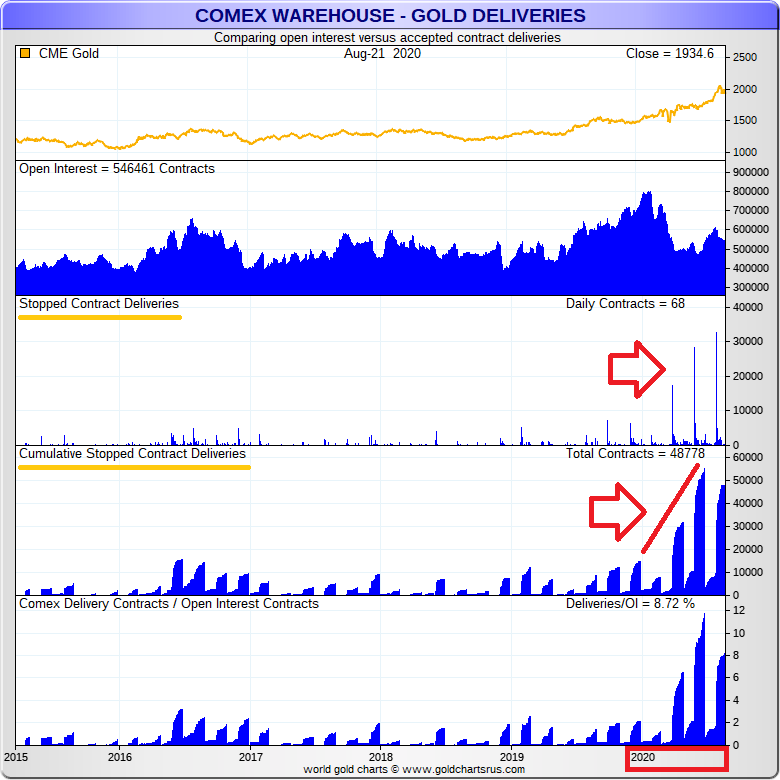

Traditionally, the COMEX futures markets in New York has been known around the world as a venue which trades gargantuan volumes of futures contracts (GC 100 oz gold and SI 5000 silver) that while deliverable, were rarely delivered. This therefore gave the COMEX the reputation of being a relative backwater for physical gold and silver activity. But with contract holders now demanding physical delivery of both gold and silver, that is increasingly less the case.

Since late March 2020, a net 879 tonnes of gold has arrived into COMEX approved New York vaults, with total gold stocks more than quadrupling from 271 tonnes to 1151 tonnes. Of these net additions, 461 tonnes have ended up as registered gold inventories, the eligible gold inventories have swelled by other 418 tonnes.

Since April inclusive, a massive 155,430 GC 100 gold contracts have been delivered (warrants changing hands), predominantly across the April, June and August contracts, representing 483 tonnes of gold.

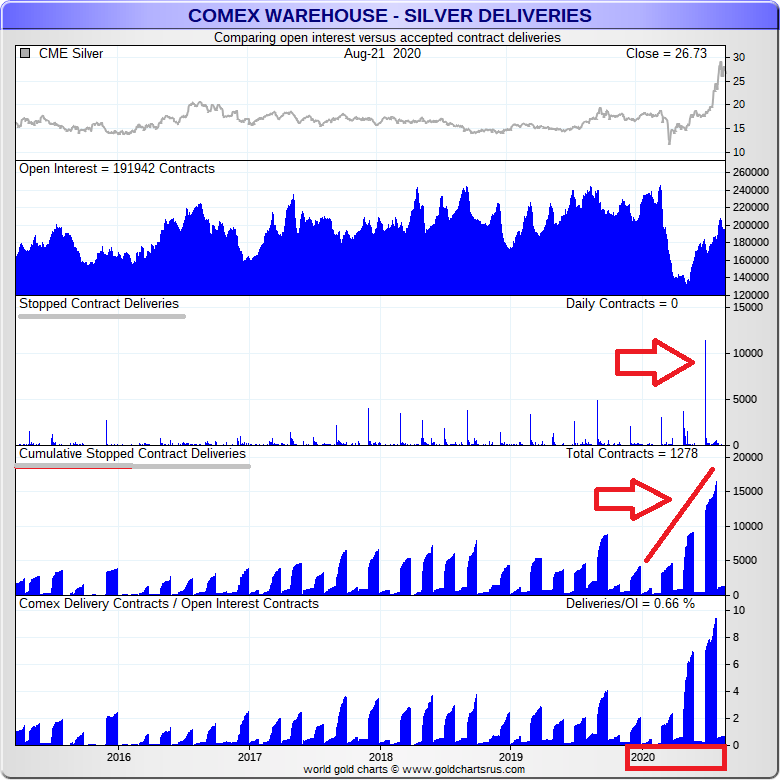

Silver net inflows into COMEX vaults since 23 March have been more subdued, both in terms of size and a percentage of existing stocks, with the net additions totaling about 16.8 million ozs of silver, which has raised total COMEX silver holdings from 323.4 million ozs to the current 340.3 million ozs. But within that, there has been a marked increase in registered silver stocks from less than 3000 tonnes to currently over 4000 tonnes.

Silver SI 5000 oz contracts moving to delivery have also increased massively in the last few months, with vault warrants 9,044 contracts changing hands in May and 17,294 contracts in July. Between April and August to date, 28989 SI contracts, each for 5000 oz of silver have gone to warrant delivery, that’s 144.95 million ozs of silver, or 4500 tonnes. The next active delivery month in SI silver is September, followed by December. Both months currently have huge Open Interest, 59,000 contracts and 120,000 contracts respectively, far larger than available COMEX silver stocks.

Kilo Bars Do Not Explain the Changes

The billion dollar question now is why, on 27 July, did CME blanketly and surreptitiously add 162 LBMA gold bar brands to the COMEX GC 100 eligible gold refiner list and 105 LBMA silver bar brands to the COMEX SI 5000 eligible silver refiner list?

For the GC 100 gold futures contract, the deliverable unit of the 100 oz gold bar is not only not common, it is not usually a gold bar size produced by gold refineries around the world. While the 1 kilobar unit is popular, many of the gold refinery brands added to the GC 100 approved list on 27 July, not to mention those on the former gold LBMA Good Delivery gold list, don’t and never did produce kilo gold bars, let alone 100 oz gold bars.

For example, there is a gold kilobar Good Delivery List maintained by the Singapore Bullion Market Association (SBMA) which only lists 15 refinery brands of gold kilobar. The Dubai Good Delivery Standard (DGD), a 1 kilogram bar standard operated by Dubai Multi Commodities Centre (DMCC) in Dubai only lists 13 refiner gold brands on its active DGD list, and another 18 on a former list.

So why were 162 LBMA Good Delivery refiner bar brands added to the COMEX list? The large Swiss gold refineries of PAMP, Valcambi, Metalor and Argor-Heraeus were already on the GC 100 gold brand refiner list. As were the Perth Mint, Royal Canadian Mint, Rand Refinery, and Johnson Matthey. Adding a large list of refiners could give a bit of juice in terms of extra kilobar gold brands that could be delivered against GC 100. But not hugely.

Plug in London

The more likely and logical explanation is that the COMEX, in conjunction with the LBMA, is planning to change the GC 100 delivery procedure to allow delivery of 400 oz gold bars in London, and the associated paper fractional scheme of Accumulated Certificates of Exchange (ACEs). That’s what they originally wanted and that is the holy grail for the bullion banks.

A telling sign it that CME specifically added 111 gold bar brands on the former LBMA Good Delivery List for gold when many of these refineries are no longer in existence and never ever produced 1 gold kilo bars or 100 oz gold bars. Are the COMEX and LBMA bullion banks that desperate that they are now scraping the proverbial bottom of the London gold vaults, planning to deliver the GC 100 contract into long forgotten 400 oz gold bars in deep storage under the Bank of England?

As noted by Bloomberg in an article in early July:

“CME, which owns Comex where the main gold futures contract is listed, said in March it would offer a new futures contract with expanded delivery options that included 400-ounce bars, which is the size that’s accepted in the larger spot market in London.

On Tuesday [30 June], it announced that traders will also be able to deliver gold in London vaults against the new contract, saying the move would “provide market participants greater opportunity to make and take delivery.”

However, the move falls short of what some market participants had been hoping. The main “GC” gold contract is still only deliverable in the US using 100-ounce bars or kilobars.”

Why too has COMEX added 65 LBMA silver bar brands to the approved silver bar brand list for the SI contract? This entire change in the deliverable brand list for the SI silver contract has completely come in under the market’s radar. Does COMEX plan to push through silver delivery in the London vaults for its SI contract too? It would appear so.

The same question can be asked about why CME (COMEX) has added 40 former silver refineries to its SI approved silver brand list. Is there such an upcoming shortage of physical silver that the COMEX needs to approve every silver refinery on the planet, both current and former, so as to have a large enough universe of silver bars to tap including long forgotten silver bar brands?

The LBMA – CME spin from March to May was that coronavirus lockdowns caused gold delivery logistical delays which were responsible for the price spread blowout between COMEX gold futures and London spot gold. This was also, said the duo, the reason why they needed to launch the 4GC (400 oz) contract, to give market participants ‘enhanced’ delivery options in London from an extended refiner brand list.

Then why has this 4GC contract never been used? And why has COMEX now railroaded through the exact same refiner list changes to the GC 100 contract, as were implemented for the 4GC contract. The only logical explanation is that as the GC 100 refiner list expansion has now occurred so too soon will the additional of London gold vaults as a GC 100 delivery option.

If it wasn’t for those Pesky Rules

As to why COMEX created the 4GC contract in March and didn’t change the GC 100 contract specs to allow 400 oz gold bar delivery, the official line from CME was that it cannot change contract that have Open Interest. As CME said in its 4GC FAQ:

“There are significant legal and regulatory concerns with making changes to any existing contract with significant open interest, and we always work to preserve the integrity of each contract for all open interest holders – short and long”

According to the Stone X daily gold market commentary on 1 July, changes to permit gold bar delivery in London against the 4GC contract also require a contract that has no Open Interest:

“The Chicago Mercantile Exchange has announced that it will permit delivery against its new 4GC contract into London vaults. This will be effective as of the September contract, which is the earliest contract in which there is no current open interest (or beyond). Contracts are not allowed to be modified where there is open interest.”

COMEX has already added in the reference to London depositories (vaults) for the 4GC into chapter 7 of its “Delivery Facilities and Procedures", where the relevant section now reads as follows, with the sentence in bold having been inserted:

“The depository for gold deliverable against the Gold futures (GC) contract must qualify and be designated a weighmaster and must be located within a 150-mile radius of the City of New York. The depository for gold deliverable against the Gold (Enhanced Delivery) futures (4GC) contract must qualify and be designated a weighmaster and must be located within a 150-mile radius of the City of New York or in London, UK."

A previous version of this Chapter 7 text, from 23 April, had no mention of London, nor of the Gold (Enhanced Delivery) 4GC contract.

It will be interesting to see how COMEX, the LBMA and the bullion banks will get around the “significant legal and regulatory concerns with making changes" to GC and SI contracts that have significant open interest, but with the expanded approved refiner lists now done and dusted, the next step will be to get the CME lawyers, in league with an as always compliant CFTC, to change the GC and SI contract specs. As they used a stealthy and covert approach when implementing the refiner list changes, expect similar such attempts with the contract specs.

Originally posted on BullionStar