The Economic Red Flag No One is Talking About: Consumer Confidence Plunges – What Comes Next?

The Confidence Crisis: Just the Beginning

The latest numbers from The Conference Board reveal a chilling reality: the Consumer Confidence Index plunged by 7 points in February to 98.3, its lowest since mid-2024. The most concerning metric? The Expectations Index, which measures how people feel about the economy six months from now, collapsed to 72.9—officially entering recession territory.

This isn't just a minor dip. This is the third consecutive month of decline, and history tells us that once this index drops below 80, a recession is virtually inevitable. It last hit this level in June 2024, and we all saw what followed—layoffs, market turmoil, and a Federal Reserve scrambling to fix what it had broken.

The cause? People are waking up.

Despite the mainstream narrative that "everything is fine," Americans are feeling the real impact of the policies forced upon them: higher prices, stagnant wages, and a Federal Reserve playing whack-a-mole with interest rates, desperately trying to contain the inflation monster it unleashed.

Inflation vs. Recession: The Real Threat

The media is hammering the idea that inflation is the primary concern. But here’s the inconvenient truth: recession, not inflation, is the real danger.

Sure, inflation expectations just jumped from 5.2% to 6%, and people are noticing the rising cost of basics like eggs and rent. But the more significant issue is that people aren't spending anymore.

- Stock market optimism has dropped to its lowest since April 2024.

- More than 51.7% of Americans expect interest rates to rise, further squeezing borrowing and spending.

- Over 32% of consumers believe stocks will decline, showing waning confidence in the financial casino we call Wall Street.

Ask yourself this: If the economy were doing well, why would people across every income bracket—except the extremely poor and the well-off—be pulling back? Why are small businesses cutting jobs, homebuilders growing worried, and recession fears hitting a nine-month high?

Because they know something is coming.

The Federal Reserve’s Dangerous Game

The Federal Reserve has played a reckless game for decades—printing money, manipulating interest rates, and creating boom-and-bust cycles that strip wealth from everyday Americans while enriching Wall Street and government elites.

They've tried to fix inflation by raising interest rates, but in reality, they’re engineering the next collapse. History has shown us that when rates rise too fast after an inflationary spike, the economy breaks. Every major financial crisis has started with a Fed-induced bubble—and we’re watching it happen in real-time.

And let’s be clear: The people in power don’t care if you suffer in the process.

What Happens Next?

The writing is on the wall:

- The recession is unavoidable. Consumer confidence data confirms it, and historical patterns back it up.

- Layoffs will increase. Businesses are already hesitating, and major corporations will start cutting jobs to protect profits.

- The Federal Reserve will be forced to act—again. First, they'll pretend everything is fine. Then, when things unravel, expect more money printing and bailouts for the banks, not you.

- The stock market will become more volatile. We've already seen investors lose faith. The worst is yet to come.

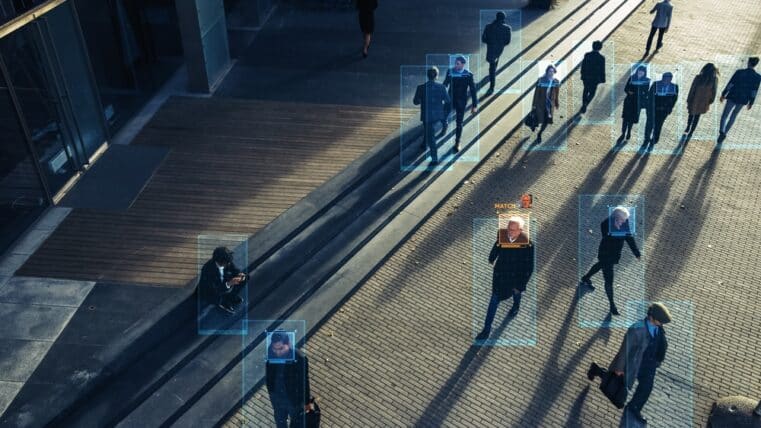

But here’s the kicker: the final play is digital control. When the collapse comes, they won’t let a good crisis go to waste. Expect moves toward Central Bank Digital Currencies (CBDCs), more surveillance, and tighter restrictions on how you can use your own money.

How to Prepare—Before It’s Too Late

The masses won’t act until it’s too late. But you’re not the masses.

Here’s how you get ahead of the collapse:

✅ Move away from the fiat system. The dollar is being devalued at an alarming rate. Convert part of your savings into gold, silver, and other hard assets before the next wave of money printing wipes out your purchasing power.

✅ Get your wealth out of the system. Banks will impose withdrawal limits when the next crisis hits. Learn how to secure your assets outside of traditional banks now.

✅ Educate yourself on decentralization. CBDCs are coming, and they’ll be used to control your spending. Learn how privacy coins and decentralized finance can give you an escape route.

✅ Prepare for market shocks. If you have stocks, consider defensive sectors and assets that thrive in downturns. The traditional 60/40 portfolio isn’t going to save you.

Final Thought: You Still Have Time—But Not Much

Consumer confidence isn’t just a number—it’s a warning. When people stop believing in the system, the system crumbles.

The collapse is engineered. The question is, are you prepared?

Take Action Now

I’ve put together two critical resources for those who refuse to be victims of the next financial meltdown:

📕 FREE Book: "Seven Steps to Protect Your Bank Accounts"—Your playbook for keeping your wealth safe. Get it here:

🔗 https://offers.dedollarizenews.com/?utm_source=7steps_ebook&utm_medium=ebook&utm_campaign=gsi&utm_term=static&utm_content=mr_anderson

📗 Hardcover Discount: "The End of Banking as You Know It"—The roadmap to surviving and thriving in the coming economic upheaval. Order now for just $19.95 (was $49.95).

🔗 https://offers.dedollarizenews.com/eotnews/book?utm_source=DedollarizeNews&utm_medium=article&utm_campaign=gsi&utm_term=static&utm_content=mr_anderson

The next phase of financial control is already in motion. You can either prepare now—or be caught in the storm.

What will you do?