Debt Spiral: Is Dollar Debasement the Only Way Out for the U.S.?

The U.S. economy is stuck in a debt trap and the only way out is through ‘printing’ more money, further debasing the U.S. dollar and accumulating more debt, according to Jack Mallers, Founder and CEO of Strike, who sees a massive flood of liquidity coming before the year-end.

"We're living in a fiscally dominant time … and what we're seeing right now is liquidity dry up in the dollar," Mallers told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "You'll see it from the U.S. Treasury before this year's over in a major way … They cannot fix this problem, they can only print through this problem."

For Mallers' insights on how much dollar liquidity the U.S. is likely to see before the year-end and its impact on assets, watch the video above.

In the meantime, the macro situation in the U.S. is deteriorating, heightening recession worries. The latest development saw the Bureau of Labor Statistics revise down the total number of jobs created over the 12 months ending in March by 818,000. This was part of the preliminary annual benchmark review of payroll data and marked the largest downward revision since 2009.

Based on the revised data, the economy added an average of 174,000 jobs per month during that time period – below the previous estimate of 242,000.

Financial markets are now increasingly signaling a higher probability of an impending recession.

Goldman Sachs noted that the market-implied odds of an economic downturn have risen significantly, estimating a 41% probability of a U.S. recession, up from 29% in April. Similarly, JPMorgan's model showed the odds have increased to 31%, up from 20% at the end of March, largely due to a sharp repricing in U.S. Treasuries.

Going back to the printing press

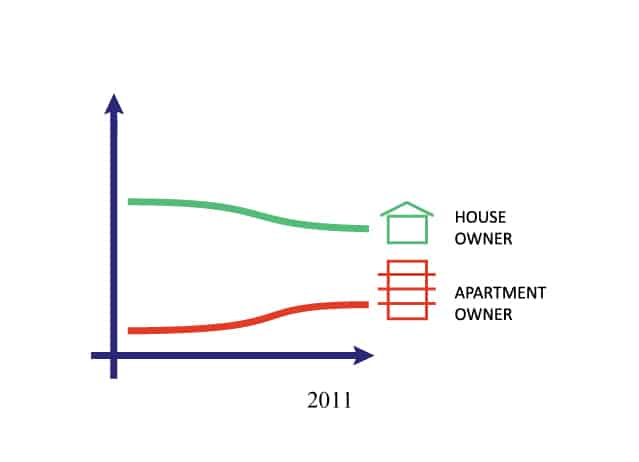

Given this macro outlook and the swelling national debt of over $35 trillion, the U.S. government's options are extremely limited.

"They cannot default. And they also can't pay it back. The debt-to-GDP ratio in the U.S. is almost 130%. That is the amount of debt they have versus the amount of growth they're producing to pay that back," Mallers explained. "[We are looking at] the Treasury and the Federal Reserve that's focused solely on making sure that the United States debt situation doesn't collapse the world reserve currency."

However, Mallers is not ruling out the Fed choosing to keep rates steady come September. Watch the video above for his full take.

Mallers also pointed out that U.S. Treasury Secretary Janet Yellen will find a way to introduce more dollar liquidity in the form of a swap line, something similar to another Bank Term Funding Program.

"The only thing that actually matters is making sure that the debt crisis doesn't collapse this country and the world's reserve currency. Yellen will provide the dollar liquidity," Mallers said. "The U.S. is going to create a massive asset bubble because they have to inject so much dollar liquidity into the system because there is no other choice."

Capital gains are how the U.S. has been financing its debt, Mallers stated. "They're financing it on the S&P 500 going up. They can not afford equities to go down. It is 'a number go up' at all costs," he said. "They need assets to go higher, especially in an election year."

Bitcoin – 'the only release valve left'

Gold and Bitcoin are the two assets that will do well as the U.S. dollar continues to get debased, according to Mallers, who sees BTC as a better version of gold.

"They're going to cause another asset bubble," he said. "Bitcoin is the better version of gold. It's the more performant version of gold. Bitcoin is the best expression of currency debasement. It's the only release valve left. It's the only smoke alarm alive today. And so my macro thesis has been a stronger dollar, bullish Bitcoin. A weaker dollar, bullish Bitcoin."

How is that possible? Watch the video above for insights.

Mallers also weighed in on what it would mean for Bitcoin and the dollar if BTC was granted a strategic reserve status in the U.S. Watch the video above for details and whether the move would jeopardize the image of the greenback as the world's reserve currency.

What's next for Bitcoin?

Mallers outlined his Bitcoin price target for the next 12-18 months. Watch the video above for his outlook and price range.

"I think it ends the year around $100,000, and then it really goes off to the races because the U.S. is going to create a massive asset bubble. They have no other choice," he said. "Bitcoin will be the best performer."

This article originally appeared on Kitco News.