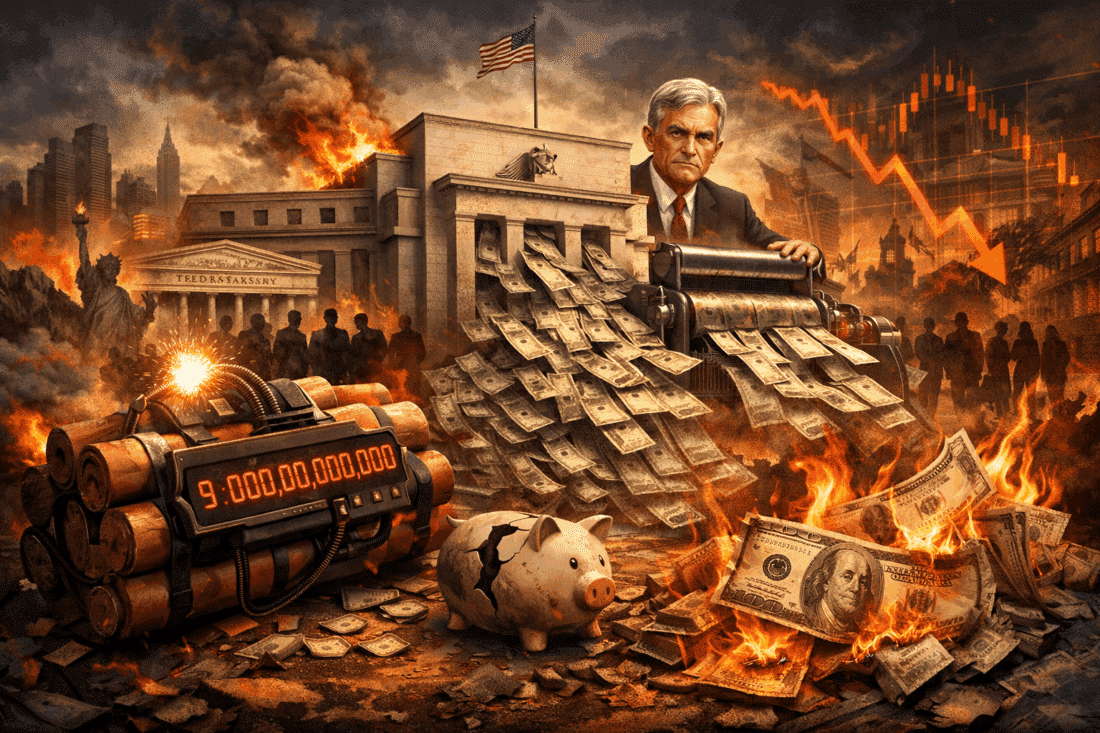

Decline Of The Dollar: The Unraveling Of A Global Powerhouse

-

IMF data showed the dollar's share of global reserves dipped to 59.2% in the third quarter.

-

That's down from 59.4% in the prior quarter and more than 60% a decade ago.

-

Holdings of the Japanese yen rose slightly, while the euro's share dipped.

The US dollar's share of currency reserves shrank slightly in the third quarter amid a long-term slide in its dominance on the world stage.

Data out last week from the International Monetary Fund showed the buck accounted for 59.2% of global central bank reserves, down from 59.4% in the prior three-month stretch and the lowest level since the fourth quarter of last year.

To be sure, the greenback remains the world's leading reserve currency with the euro a distant second, as its share slipped to 19.6% from 19.7%.

Meanwhile, the yen's proportion of reserves grew to 5.5% from 5.3%. Below that, the Chinese yuan, British pound, Canadian dollar and Swiss franc were little changed.

But the US dollar's standing has been less dominant over the longer term. While its share of global reserves has hovered about 59% in the last few years, that's down from more than 60% a decade ago and roughly 70% in 2000.

At the same time, currency rivals such as the yuan have gradually been chipping away at the greenback, as Beijing seeks to elevate its currency to be an international alternative.

In fact, even as the yuan's share of global reserves remained steady, its use in payments has increased. The yuan's share of international payments hit a record high and became the fourth most used currency last month, according to data from the SWIFT Financial System.

Cross-border yuan lending has jumped as well, while the People's Bank of China holds over 30 bilateral currency swaps with foreign central banks, such as Saudi Arabia and Argentina.

Western financial sanctions against Russia for its invasion of Ukraine have also prompted more countries to de-dollarize and reduce their vulnerability to any currency actions.

BRICS nations — Brazil, Russia, India, China, and South Africa — have said they intend to challenge the dollar as they grow membership to more and more emerging economies.

Earlier this month, Moscow said Russia and China have almost completely phased out the dollar from their bilateral trade as they switch to the yuan and ruble.

Despite the gradual erosion in the dollar's dominance, most experts agree full-blown de-dollarization remains unlikely.

"Historical experience thus suggests that if China were to overtake the US as the world's largest economy around 2030, dollar dominance may persist even into the second half of the 21st century," JPMorgan strategists wrote in a note in June.

Originally published by: Phil Rosen on Markets Business Insider