Deep Economic Suffering Has Erupted All Over America, But Guess Who The Federal Reserve Is Helping?

As millions upon millions of Americans lose their jobs in the greatest wave of unemployment in U.S. history, the Federal Reserve has decided that now is the time to spend trillions of newly created dollars in a desperate attempt to protect financial asset values. In other words, as much of the country suddenly plunges into poverty, the Federal Reserve is working exceedingly hard to protect the wealth of the elite. Approximately fifty percent of all stock market wealth is owned by the wealthiest one percent of all Americans, and the amount of stock market wealth owned by the poorest 50 percent of all Americans is so small that it really doesn’t matter. And those running the Fed certainly understand that their reckless policies will create very painful inflation that will hit average American families extremely hard, but they don’t seem to care. At this point, they figure that asset values must be protected at all costs, and that is going to continue to expand the absolutely massive gap between the rich and the poor in this country.

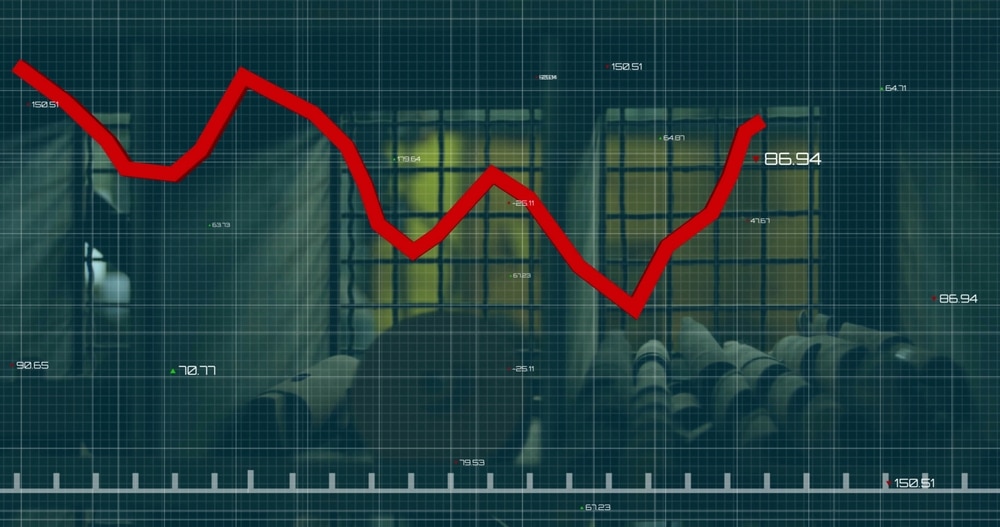

Over the past 3 weeks, more than 16 million Americans have filed new claims for unemployment benefits.

Prior to this year, the highest number that we had ever seen in any 3 week span in all of American history was about 2 million.

It is a collapse of unprecedented magnitude, and things have already gotten so bad that even “the Happiest Place on Earth” is conducting mass layoffs…

Walt Disney World Resort will furlough 43,000 union workers while its theme parks remain closed as authorities restrict large gatherings due to the coronavirus pandemic, according to the Service Trades Council Union.

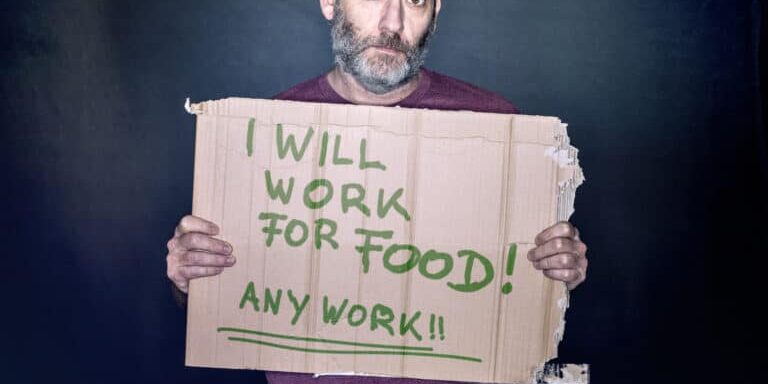

Because most U.S. workers live paycheck to paycheck, many of the newly unemployed have fallen on hard times very rapidly. Food banks all over the nation are seeing an alarming surge in demand, and in many cities people are literally lining up before the sun rises in order to ensure that they will get some food…

In many cities, lines outside food pantries have become glaring symbols of financial precarity, showing how quickly the pandemic has devastated working people’s finances.

In San Antonio, 10,000 families began arriving before dawn on Thursday at a now-shuttered swap meet hall to receive boxes of food. Normally, 200 to 400 families might show up during a normal food distribution.

For many other similar examples, please see my previous article entitled “America’s ‘Food Lines’ Are Being Measured In Miles As Desperation Sets In All Over The Country”. Yes, things got bad during the last recession, but they were never as bad as we are witnessing now. In fact, the CEO of Feeding America says that demand is already at the highest level that she has ever seen…

‘I’ve never witnessed a system being more strained,’ Feeding America CEO Claire Babineaux-Fontenot said.

‘For the first time probably in our history, we’ve had to turn some people away,’ she said, not that ‘We don’t want to do that, ever.’

Unfortunately, this economic collapse is still in the very early chapters. If you can believe it, JPMorgan is actually projecting that U.S. GDP “will fall by 40 percent” on an annualized basis during the second quarter…

According to CNBC, JPMorgan economists are forecasting that the GDP will fall by 40 percent through the spring months. They also predict unemployment will reach 20 percent in April, with 25 million jobs lost overall.

Such a drop would be, by far, the worst in U.S. history. For context, according to Credit Suisse (via Business Insider), the worst quarterly drop of the 2008 crash was 8.4 percent.

And even once the “shelter-in-place” orders are finally lifted, that will not mean that things will go back to normal. As Nobel-prize winning economist Robert Shiller has noted, fear of the coronavirus is going to cause many Americans to avoid restaurants, sporting events and other businesses where public interaction is required for a long time to come…

“The shortage of supplies is generating horrible news stories that put us all on edge,” said Shiller. “It may mean people won’t go to restaurants or sporting events in good numbers for years. You know the disease might not well be eradicated for several years from now.”

So the truth is that we are heading into a very deep economic depression, and the economic suffering in this country is going to be off the charts.

As events have begun to spiral out of control, the Federal Reserve has sprung into action on a scale unlike anything that we have ever seen before, and this has pushed the Fed’s balance sheet above 6 trillion dollars…

The Federal Reserve’s balance sheet increased to a record $6.13 trillion this week as the central bank used its nearly unlimited buying power to soak up assets and keep markets functioning smoothly, even as efforts to contain the coronavirus pandemic cut deeply into employment and economic output.

In the four weeks since the Fed slashed interest rates to zero, restarted bond purchases and rolled out an unprecedented range of programs to limit the economic damage from the outbreak, the central bank’s balance sheet has jumped by about $1.7 trillion.

Let me try to put those numbers in perspective.

During QE3, the Fed’s balance sheet increased by 1.7 trillion dollars over the course of an entire year, and now the Fed has achieved that same feat in just four weeks.

What the Fed is doing is completely and utterly insane, but to a certain extent it is working.

Even though we are in the midst of the most dramatic unemployment spike in American history, last week was the best week for the stock market in decades thanks to the Fed.

Isn’t that nuts?

I know that this also sounds incredibly absurd, but last week’s surge actually pushed P/E values back near record highs.

In other words, stock prices are incredibly overvalued at this moment.

And if everything that we have already witnessed was not enough, on Thursday the Fed announced that it will now be spending trillions of dollars to voraciously buy up bonds of all types…

The Federal Reserve is not leaving any corner of the U.S. bond market behind in this crisis.

There’s no other way to interpret the central bank’s sweeping measures announced Thursday, which together provide as much as $2.3 trillion in loans to support the economy. It will wade into the $3.9 trillion U.S. municipal-bond market to an unprecedented degree, can now purchase “fallen angel” bonds from companies that have recently lost their investment-grade ratings, and has expanded its Term Asset-Backed Securities Loan Facility to include top-rated commercial mortgage-backed securities and collateralized loan obligations.

In other words, moving forward we will no longer have a “bond market”. What we will have is a Fed-manipulated sham in which the Fed picks winners and losers.

Of course many believe that it is only a matter of time before the Fed starts buying stocks as well.

Those that love free markets should be absolutely disgusted by all of this, because the Fed is coming up with lots of new ways to give handouts to the very wealthy.

Meanwhile, the poor are rapidly getting poorer.

But don’t worry too much, because you will soon receive your $1,200 socialist handout from the federal government.

Try not to spend it all in one place.

Needless to say, $1,200 won’t last very long in the hands of most Americans, and one recent survey found that “63% of respondents said they will need another check within the next three months”.

Like I warned from the very beginning, these sorts of direct payments set a very dangerous precedent, and if a Democrat wins the presidency in November they may become permanent.

That may sound really good to you, but what are you going to do when it gets to the point where you have to spend 500 dollars a week just to feed your family?

At that point many of you will also be lining up at the crack of dawn to receive whatever the food banks have available to give you…

Outside of Pittsburgh, Danielle Small pulled up 90 minutes early to a food distribution, but found two long rows of cars already ahead of her. Money was getting tight after her boyfriend had to take a pay cut, and she decided to make her first trip to a food bank this week.

She said the line moved efficiently as cars pulled ahead in clusters of 10. After Ms. Small, 32, received a box filled with chicken fajita strips, preserved peaches, fruit, nuts and juice, she mouthed, “Thank you,” to the volunteers and drove away.

Millions of Americans driving nice vehicles and wearing nice clothes are suddenly being forced to spend hours waiting in food lines because fear of the coronavirus has crashed our economy.

A day of reckoning has finally arrived, and a lot more pain is on the way.

Sadly, many Americans will just go along with whatever “solutions” are proposed as long as it looks like they may provide short-term relief. What remains of our free markets is being obliterated, Congress is openly embracing socialism, and our rights are being stripped away at a staggering rate, but most people don’t seem concerned by any of this.

Most people just want the pain to end and for life to go back to normal, but that is simply not going to happen.

Read Original Article at themostimportantnews.com