Digital Chains: How USDC Is Colonizing Africa’s Economy

The Trojan Horse Has Arrived in Africa

Picture this: a continent rich in culture, resources, and potential, now becoming the latest host for the synthetic dollar virus. Onafriq, a payment behemoth spanning over 40 African nations, has struck a partnership with Circle—the same outfit pumping USDC into the global bloodstream.

Circle calls it innovation. I call it infiltration.

When 80% of Africa’s intra-continental payments are funneled through foreign correspondent banks, it’s easy to see the allure of blockchain. But instead of forging sovereign rails, they’re digitizing their dependency. This isn’t decentralization. This is the dollar, updated for the blockchain age. A programmable collar, not a key to freedom.

Digital Dollarization: The New Colonialism

Let’s not mince words—this is financial occupation. We’re not talking about free-market solutions or African-led fintech revolutions. We’re talking about USDC—Circle’s synthetic dollar—plugging into African economies under the Fed’s silent watch.

Nearly 43% of crypto transactions in Africa already rely on stablecoins, largely tethered to the dollar. That’s not innovation. That’s a crisis. It’s desperation masked as development. And Circle, with its polished marketing and “inclusion” campaigns, is merely FedNow with a dash of African flair.

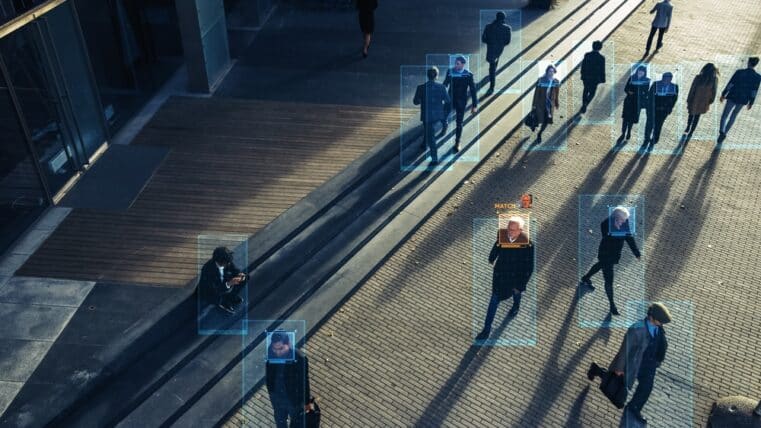

This isn’t about giving Africans tools for empowerment. It’s about building a blockchain cage—one that monitors, freezes, and controls money at the speed of code.

Who Builds the Future—and for Whom?

Dare Okoudjou of Onafriq says, “We’re building the future of payments.” But let’s ask: who holds the pen drafting these blueprints? Washington? Silicon Valley? Wall Street?

You see, the future they’re building isn’t for you. It’s for them.

This “future” wires every transaction to compliance nodes. It automates surveillance. It merges payment networks with centralized control centers. In this system, your savings can be deleted. Your access revoked. Your financial autonomy—gone.

It’s a Fed-controlled dystopia dressed in humanitarian drag.

Prediction: Africa as the First Domino

Africa is the test lab. The continent that once resisted the chains of physical colonization is now facing a digital rerun.

If USDC takes root across African economies, the blueprint will expand—Latin America, Southeast Asia, and then homeward, back to you. FedNow, CBDCs, and programmable U.S. Treasury-backed tokens are not isolated developments. They are chapters in the same script.

And that script ends with your money being conditional.

The Counter Move: Break the Rails Before They’re Built

So what now? Do we sit back and let the dollar metastasize into a digital dictator? Or do we take the harder path—the sovereign one?

Here’s what I recommend:

- Opt out of synthetic dollars by reducing exposure to stablecoins like USDC.

- Hold physical assets that can’t be frozen at the flick of a switch—think gold, silver, and local currencies with real value.

- Educate your network. Most people still believe that “stablecoin” means “safe.” Wake them up.

- Support alternatives rooted in sovereignty—not centralization. Whether that’s gold-backed digital assets or locally managed decentralized exchanges, we must build outside the grid.

The Grid Is Closing. Time to Choose Your Side.

Make no mistake—this isn’t just about Africa. This is about the future of money, and by extension, the future of freedom.

Because once your money is programmable, so are you.

Act Now—Before You’re Locked Out

The financial landscape is shifting faster than most realize, and those who fail to prepare risk being left behind. If you’re ready to take control of your financial destiny, I’ve got two resources that can help you start today:

👉 Download my free book, "Seven Steps to Protect Your Bank Accounts", and learn actionable strategies to shield your wealth from the coming economic storm. Get your copy here:

Download Here

📚 Prefer the feel of a hardcover? I’m offering Bill Brocius’ groundbreaking book, "The End of Banking as You Know It", at a special price of $19.95 (currently $49.95 on Amazon). Order your copy here:

Get the Hardcover