Dimon's Warning: The Economic Iceberg Ahead

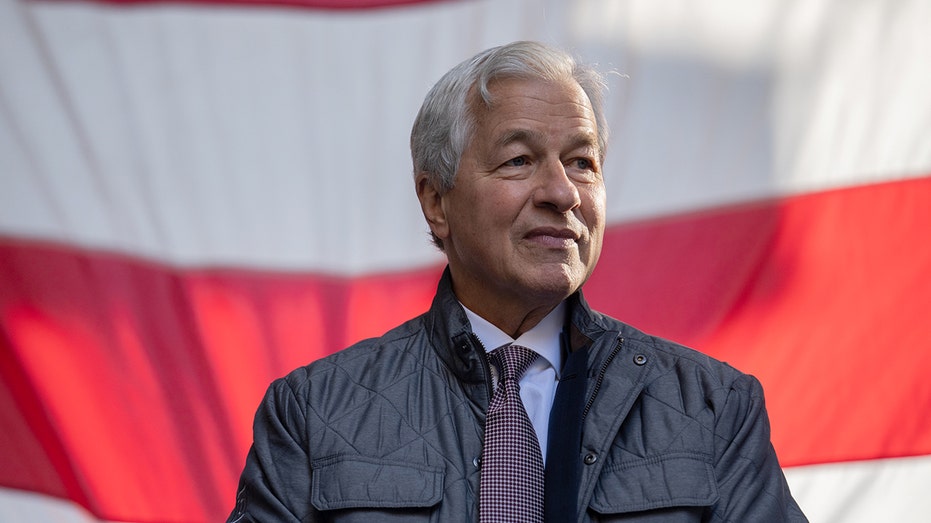

JPMorgan Chase CEO Jamie Dimon said the market sentiment is improving for equities as well as mergers and acquisitions, even as he maintained a cautious outlook about the economy at large in an interview on Monday.

"Confidence is up, there is more M&A chatter," equity markets are strengthening and high-yield markets are open, Dimon said in an interview on CNBC. "Markets are high, people feel it, so far so good."

Dimon added that "there are things out there which are concerning," and cast doubt on the probability of a soft landing for the U.S. economy. While market participants are pricing in 70% to 80% odds of a soft landing, Dimon said he thinks the likelihood is "half of that."

The U.S. economy has so far avoided sinking into a recession amid the Federal Reserve's effort to tamp down stubbornly high inflation. Dimon has previously warned that geopolitical tensions, such as Russia's ongoing war against Ukraine and the conflict between Hamas and Israel, could weigh on global growth. In October, he said that "this may be the most dangerous time the world has seen in decades."

JPMorgan Chase CEO Jamie Dimon said market sentiment is improving but he remains cautious about the prospects for a soft landing. (Jeenah Moon/Bloomberg via Getty Images / Getty Images)

Dimon, the CEO of the largest bank in the U.S., welcomed more regulatory scrutiny of private market participants competing with banks for deals.

Wall Street lenders have been raising billions of dollars to regain ground in lending to companies in debt-backed deals as competition from giant private equity and asset management firms has risen in the last two years.

JPMorgan has set aside $10 billion of its capital for private credit, but that could grow significantly depending on demand, sources told Reuters earlier this month.

JPMorgan Chase will face new competition if Capital One's acquisition of Discover is approved. ( Michael M. Santiago/Getty Images / Getty Images)

Dimon also weighed in on the deal announced last week that will see Capital One acquire Discover for $35.3 billion, saying that companies should be allowed to grow, merge and innovate.

The pending merger would create the largest U.S. credit card issuer with $250 billion in card balances and a market share of 22% — an amount larger than JPMorgan's.

"I am not worried about it," Dimon said. However, he noted that Capital One's debit network could have an unfair advantage following the merger.

Dimon acknowledged different pricing standards for cards provided by banks versus those from car issuers and said, "Of course I have a problem with that."

Reuters contributed to this report.

This article originally appeared on Fox Business