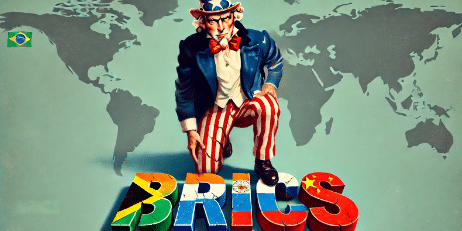

Donald Trump Unveils Hardline Stance on BRICS De-Dollarization Agenda

Written by Bill Brocius

In a fiery appearance at an economic forum, former President Donald Trump laid out his vision for tackling the BRICS alliance’s aggressive push to de-dollarize. With the 2024 election showdown against Kamala Harris just weeks away, Trump minced no words about what awaits countries that abandon the U.S. dollar for trade. His warning was clear: if the BRICS bloc — spearheaded by Russia, China, and other emerging economies — continues their shift toward local currencies, they’ll face devastating consequences in the form of a 100% tariff on all goods entering the U.S.

This stance marks an escalation in Trump’s economic rhetoric, reinforcing his commitment to keeping the dollar’s global dominance intact. His ultimatum sends a clear message: if you drop the dollar, you pay the price.

“You Drop the Dollar? You Pay 100% Tariffs” – Trump’s Bold Threat

“If a country tells me, ‘Sir, we like you very much, but we’re no longer adhering to the U.S. dollar,’ I’ll say, ‘That’s okay. But you’ll pay a 100% tariff on everything you sell into the United States.’ We love your product. We hope you sell a lot. But you’ll have to pay that 100% tax,” Trump said, laying out his plan to counter de-dollarization.

Trump’s message is clear: by weaponizing tariffs, he aims to pressure BRICS nations back into the dollar system. He suggested that this economic squeeze would make abandoning the U.S. dollar unfeasible for any nation relying on U.S. markets. “It would be an honor to stay with the reserve currency,” Trump quipped, implying that countries will think twice before aligning fully with BRICS’ multicurrency system.

The BRICS De-Dollarization Momentum

The BRICS bloc has been working tirelessly to break free from dollar dominance, spurred on by U.S. sanctions against Russia in 2022. Both Russia and China have spearheaded the movement, rallying other nations to settle trade in national currencies instead of the greenback. The strategy aims to erode U.S. economic hegemony and build a new financial framework that minimizes reliance on American financial infrastructure. Already, 65% of BRICS trade is now conducted in local currencies, reflecting the bloc’s growing influence and determination.

Trump’s proposed tariff policy, however, threatens to derail these efforts by hitting BRICS economies where it hurts most—trade with the U.S. The question remains: will this hardline approach be enough to stop the de-dollarization wave?

Election Impact: What’s at Stake for the Global Financial Order?

If Trump is elected in November, his 100% tariff plan could reshape the financial landscape. While BRICS has made significant strides in building an alternative system, the U.S. remains a critical trading partner for many of its members. Trump’s threat would force these nations into a painful calculation: pursue financial independence from the dollar or risk losing access to the world’s largest consumer market under crushing tariffs.

As the November election draws near, Trump’s tough talk on BRICS underscores the high stakes of the U.S. presidency for global trade and finance. With de-dollarization efforts advancing rapidly, Trump’s return to power could create new fault lines in the international economic system.

The Bottom Line:

Trump’s ultimatum to BRICS nations highlights the fragility of the global financial system and the lengths to which the U.S. will go to defend the dollar’s supremacy. With BRICS advancing a multicurrency agenda, the outcome of the U.S. election could determine whether the dollar maintains its role as the global reserve currency—or if the world shifts toward a new financial order.

Prepare for the coming financial storm. Download my free ebook, “7 Steps to Protect Your Account from Bank Failure,” and get ahead of the curve. For deeper insights, join my Inner Circle program for $19.95/month—because in uncertain times like these, knowledge is power. Click here to download your copy today!