Dow drops in 4th straight day of losses

EDITOR NOTES: Thursday’s losses brought the Dow’s weekly decline to more than 5%. At one point the Dow was down more than 400 points. The losses are driven by higher than expected unemployment insurance claims. A record of 20.5 million jobs were lost in April alone. The unemployment rate is 14.7%

Stocks fell on Thursday, extending their steep losses this week, after the latest jobless data underscored the coronavirus’ devastating toll on the U.S. economy.

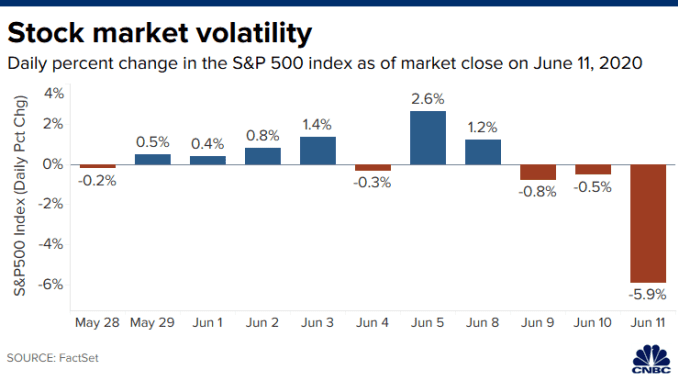

The Dow Jones Industrial Average dropped 185 points, or 0.9%, and was headed for its fourth straight day of losses. Thursday’s losses brought the Dow’s weekly decline to more than 5%. Earlier in the day, however, the Dow was down more than 400 points. The S&P 500 and the Nasdaq Composite traded lower by 1% and 1.2%, respectively, and were on track for their third consecutive negative session.

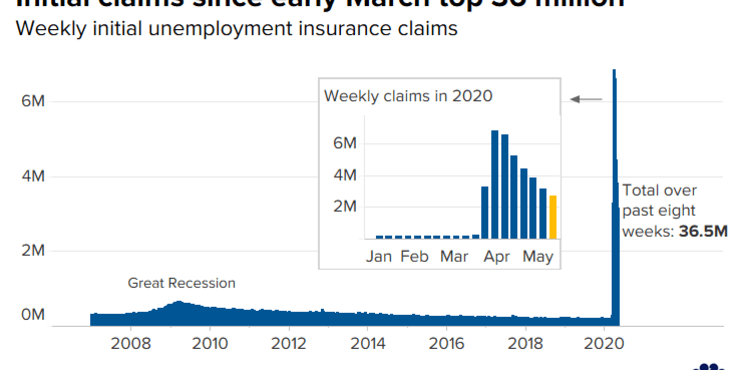

The Labor Department reported Thursday a total of 2.981 million Americans filed unemployment insurance during the week ending May 9. The number came in worse than expectations of 2.7 million new claims, according to economists polled by Dow Jones.

The new claims also brought the coronavirus crisis total to nearly 36.5 million over the past two months, by far the biggest loss in U.S. history. A record of 20.5 million jobs were lost in April alone as the coronavirus-induced economic shutdown tore through the economy, sending the unemployment rate skyrocketing to 14.7%.

Raytheon Technologies and Travelers were the worst-performing Dow stocks, with each falling more than 3%. Real estate drove the S&P 500 lower, by falling 1.9%. However, gains across the big banks helped the market keep losses in check. Bank of America and JPMorgan Chase both climbed more than 2% while Wells Fargo advanced 7.3%. Citigroup gained 2%.

On Wednesday, the Dow and S&P 500 fell 2.2% and 1.8%, respectively, while the Nasdaq Composite lost 1.6%. Those declines followed a stark warning from Federal Reserve Chairman Jerome Powell. So far this week, the Dow has lost more than 6%, while the S&P 500 dropped over 5%.

“While the economic response has been both timely and appropriately large, it may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks,” he said, noting more needs to be done to support the economy amid the coronavirus pandemic.

Powell made his comments as several states begin to reopen their economies.

“There are a lot of variables in terms of really how the economy opens here. It’s going to be very uneven,” said Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. In terms of additional efforts, Faranello said the Fed could implement some “yield curve control,” among other measures.

“From a capital perspective and a leverage perspective, the Fed can grow the existing programs that they have online,” Faranello said.

Market sentiment was also dented after two major investors raised questions about the market’s current valuation. Appaloosa’s David Tepper told CNBC’s “Halftime Report” this is the second-most overvalued market he’s seen, behind only the one in 1999. Meanwhile, Stanley Druckenmiller of Duquesne Family Office said Tuesday said: “Risk-reward for equity is maybe as bad as I’ve seen it in my career.”

Despite the sharp drop on Wednesday, the S&P 500 remains more than 28% above its March 23 low. The Dow has also rallied more than 27% since then as shares of major tech companies surged.

“Those stocks that were doing well before all this are the ones that did well” after the initial sell-off, said Aaron Clark, portfolio manager at GW&K Investment Management. “It’s like the big get bigger and stronger.”

Still, Clark highlighted the uncertainty investors currently face, noting: “Nobody’s ever been through anything like this. … For now, we’re just hoping we’re finding the right businesses that can continue to grow and take share and come out stronger.”

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.