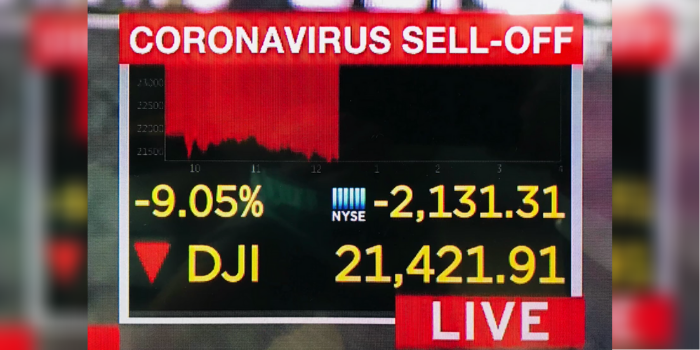

Dow Plunges 10 Percent Despite Fed Lifeline as Coronavirus Panic Grips Investors

The New York Fed will pump $1.5 trillion into the short-term lending markets that banks use to lend to each other on Thursday and Friday. The central bank also announced it will buy $60 billion worth of Treasury bonds for the next month (March 13 through April 13) to help keep that market functioning appropriately. Earlier this week, investors reported problems trading in U.S. government bonds. These irregularities echoed the types of freezes seen during the 2008 financial crisis, and the Fed appeared to want to act quickly to stop them.

The Fed’s action brought some relief to Wall Street on an especially tumultuous day that forced a brief cessation of trading. The sell-off began shortly after the open, following President Trump’s announcement that he would restrict nearly all travel from Europe for 30 days to stem the spread of the coronavirus. The Dow tumbled nearly 1,700 points, but it was the S&P 500’s 7 percent slide that triggered the so-called circuit breaker — a 15-minute break to stop the market free-fall and give traders time to recalibrate.

But by day’s end, the countermeasures did little to break the cycle. The Dow closed at 21,200.62, down 10 percent. The S&P 500 skidded 9.5 percent and the tech-heavy Nasdaq fell 9.4 percent.

Thursday’s dive follows the frenetic pace on Wall Street all week and comes a day after the Dow morphed into a bear market. The S&P 500 triggered the first circuit breaker of the week on Monday after falling 7 percent early into the session. By the end of the day, it had shed 7.6 percent and the Dow had lost a stunning 2,014 points or 7.8 percent. The markets bounced back Tuesday, posting across-the-board gains, only to recoil Wednesday after the World Health Organization declared the coronavirus a pandemic. The Dow cratered nearly 1,500 points to fall into a bear market.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.