Economic Red Alert: Money-Markets Swell as Fed’s Emergency Measures Hang by a Thread

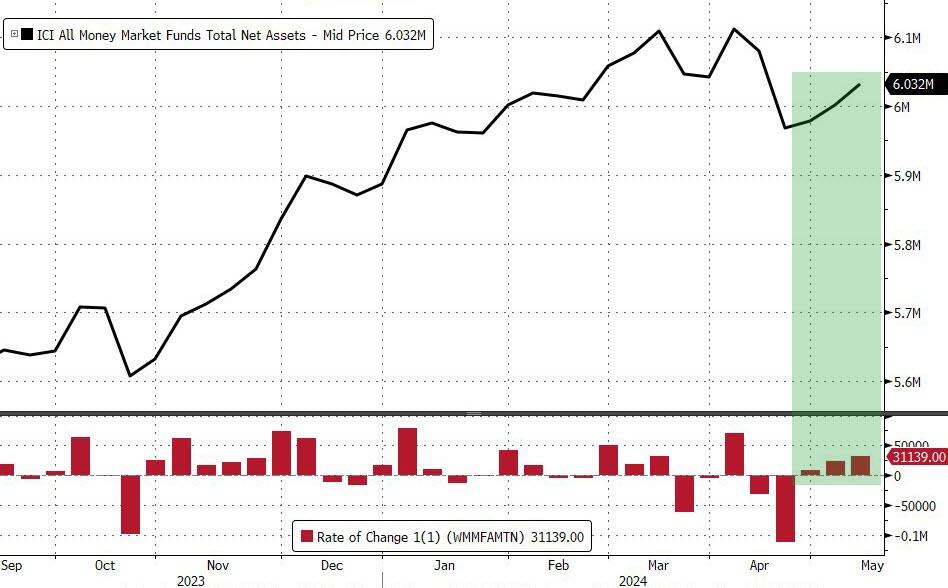

Money market funds saw inflows for the third straight week (up $31.1BN) pushing the total assets to $6.03TN – the highest level in a month…

Source: Bloomberg

In a breakdown for the week to May 8, government funds – which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.88 trillion, a $20 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $1.03 trillion, an $8.6 billion increase.

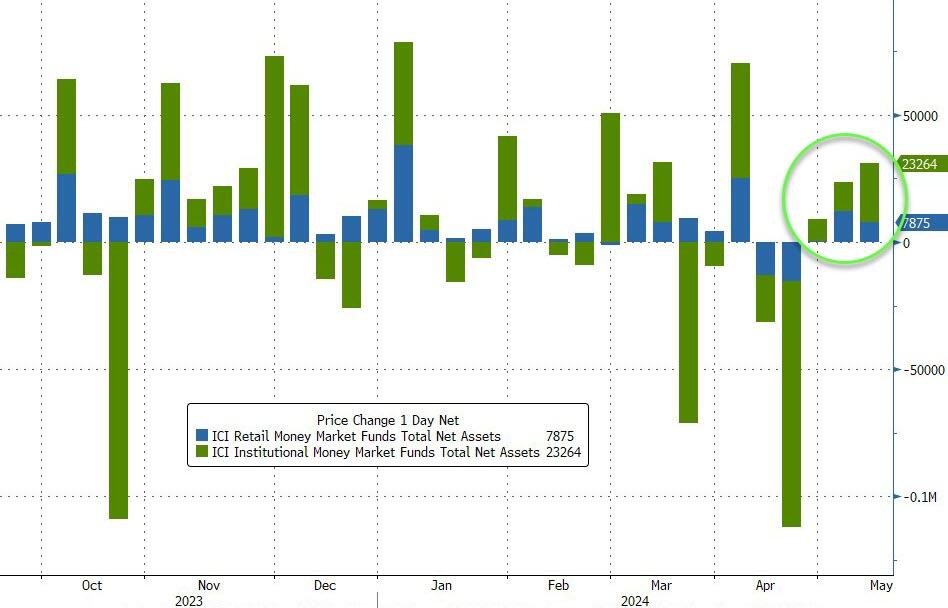

Both Retail and Institutional funds saw inflows (+7.8BN and +23.3BN respectively)…

Source: Bloomberg

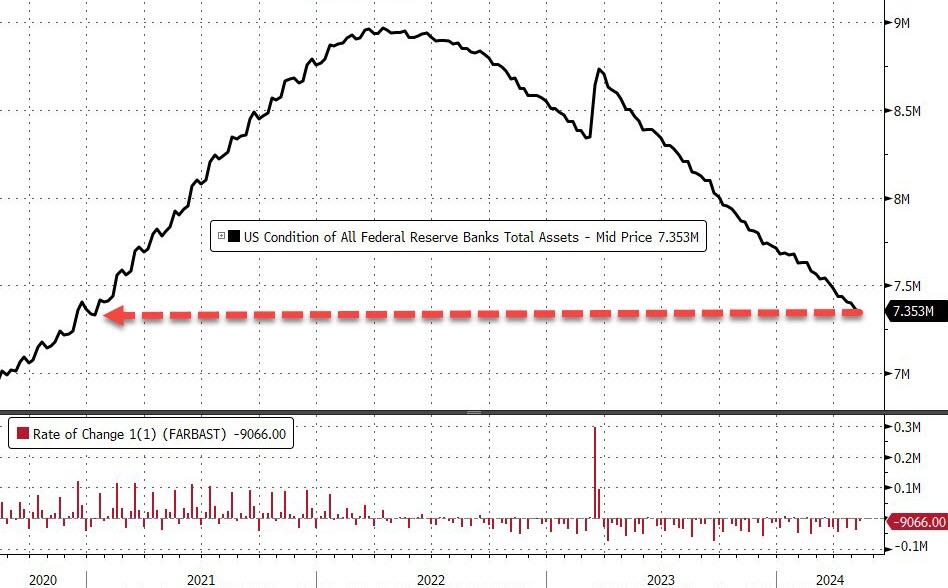

Amid all the chatter about tapering QT, The Fed balance sheet continued to contract (though only $9.1BN)…

Source: Bloomberg

Additionally, The Fed’s (now expired) bank bailout scheme continues to decline (as the 12-month term loans run off), dropping by a sizable $11.5BN last week – erasing all the arb-driven usage. However, the facility still has a whopping $112.8BN left outstanding filling holes in bank balance sheets somewhere…

Source: Bloomberg

Finally, bank reserves at The Fed continues to contract, while US equity market cap remains dramatically decoupled…

Source: Bloomberg

Which makes us wonder, is Powell’s acquiescence to a bigger, sooner ‘QT taper’ (in the face of not-under-control inflation) to soften the blow when this crocodile mouth snaps shut.

This article originally appeared on Zero Hedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.