Federal Chair J. Powell & Mnuchin Testify About Emergency Lending

EDITOR NOTES: Stephen Mnuchin’s and Jerome Powell’s recent testimony before the Senate Banking Committee affirmed the government’s and central bank’s commitment toward using monetary and fiscal tools to keep the economy from sinking into greater depths amid the COVID-19 crisis. These are massive expenditures that are ultimately bullish for safe haven assets like gold and silver, as the “cure” may weigh significantly on the economy in the coming years. As far as the timeline for the end of this intervention is concerned, there’s none at the present moment--a potentially gloomy sign for the economy, but an equally bright prospect for “sound money” investors.

Both Treasury Secretary Stephen Mnuchin, and Federal Reserve Chairman Jerome Powell spoke to the Senate Banking Committee today. The primary purpose of the meeting was for the Senate Banking Committee to get the latest evaluation of the global pandemic that has greatly affected the United States economy.

Both the Chairman and Treasury Secretary were asked by the committee to give their first quarterly report regarding the $2.2 trillion CARES act.

In his written testimony, Treasury Department Secretary Stephen Mnuchin said, “I want to begin by acknowledging the unprecedented challenges the American people are communities across the nation. Through no fault of their own, the American people are also enduring economic challenges. I am inspired by our nation’s medical professionals and first responders on the front lines taking care of their fellow citizens. Thanks to their efforts and their unwavering commitment to their communities, I am confident that our nation will emerge from the pandemic stronger than ever before.”

Mnuchin also said that he was working to ensure that the SBA processes more than 4.2 million loans of over $530 billion, “to keep tens of millions of hardworking Americans on the payroll.”

He said that they have issued more than 140 million economic impact payments totaling over $240 billion to provide relief to millions of Americans. He also stated that they had distributed $150 billion to states, local, and tribal governments through the coronavirus relief fund for essential services.

In his written testimony Fed Chairman Jerome Powell said, “In discussing the actions we have taken, I will begin with monetary policy. In March, we lowered our policy interest rate to near zero, and we expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.”

His written testimony also stated, “The Federal Reserve’s response to this extraordinary period has been guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote stability of the financial system. We are committed to using our full range of tools to support the economy in this challenging time even as we recognize that these actions are only a part of a broader public-sector response.”

In the First Report of the Congressional Oversight Commission they responded to the pandemic with four economic stabilization and health funding bills.

- The Coronavirus Preparedness and Response Supplemental Appropriation

- The Family First Coronavirus Response Act

- The Coronavirus Aid, Relief, and Economic Securities (CARES) Act

- The Paycheck Protection Program and Health Care Enhancement Act

The first act provided $8.3 billion for emergency funding for public health measures. The second act increased Federal Medicaid funding by 6.2% an increase of approximately $35 billion annually. The third act (CARES) expanded unemployment benefits, funding for hospitals with $150 billion in direct aid, $349 billion of forgivable loans for small businesses through the PPP, and an additional $500 billion for lending to business and to states and local governments. The last act (PPP) increase the funding of PPP by$ 321 billion to total $670 billion of supplementing funding for healthcare providers and increase funding for Covid-19 testing.

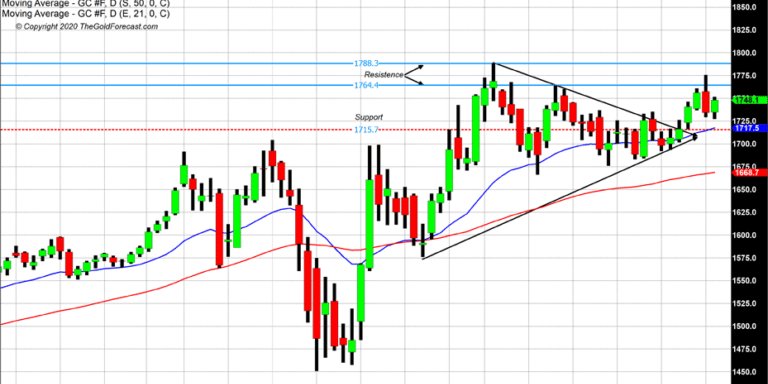

These incredibly strong measures to safeguard our economy in the United States and provide the greatly needed aid to citizens and businesses that have been adversely affected was very bullish for safe haven assets such as gold, which gained $14 in trading today.

As of 5:20 PM EST gold futures are currently fixed at $1748.10. U.S. equities traded lower on the accommodative actions by the FED and Treasury, with the Dow giving up 390 points or 1.59%. The Standard & Poor’s 500 lost over a full percent in value, while the NASDAQ composite lost .54% in trading today.

The take away from today’s testimony by Chairman Powell and Treasury Secretary Stephen Mnuchin were that they are allocating a tremendous amount of funds and even once the pandemic has ended the repercussions of the massive expenditures will continue to weigh heavily on economy.