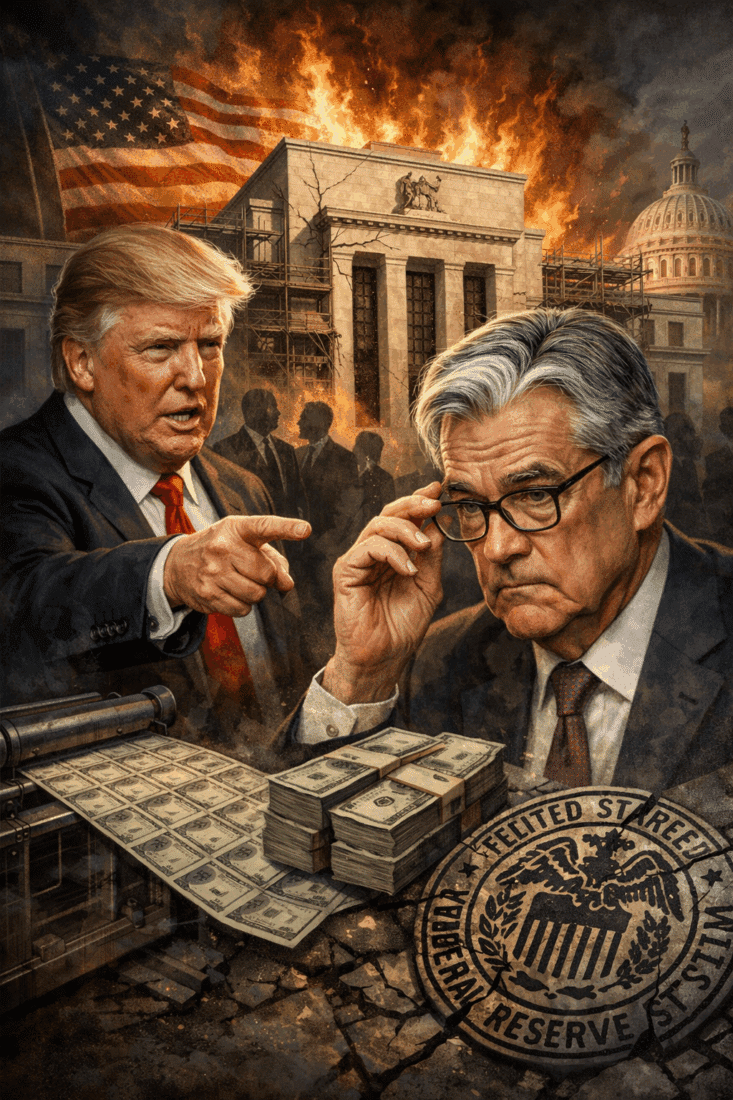

Wall Street’s Goldilocks Lie Exposed: The Fed's Fairy Tale Is Dead

Written by Derek Wolfe

October wrapped up with an ugly truth: Wall Street's illusion of a "Goldilocks" economy—neither too hot nor too cold, just right—is coming apart. As of today, disappointing tech earnings (Microsoft down 6%, Meta down 4%) and core inflation hit hard, eroding what little hope remained for a stable market rebound. That cushy, risk-free narrative Wall Street has been feeding investors? Dead on arrival.

Inflation Doesn’t Care About Rate Cuts—It’s Alive and Well

Despite the Federal Reserve's token rate cuts, inflation is creeping right back up. The core Personal Consumption Expenditures (PCE) index, a critical inflation measure, just posted its biggest spike since April. Now, the financial talking heads are scrambling, saying the Fed might need to slow down rate cuts to "maintain stability." But let's be real—the Fed lost control long ago. The illusion that they’re "managing" this crisis is laughable.

In this environment, big banks like Goldman Sachs aren’t reporting true liquidity—they’re selling you desperation dressed up as guidance. Their trading desk is noting strong volume, sure, but don’t let that fool you. The reality is simple: hedge funds and institutional investors are clinging to select tech stocks and industrials to stabilize portfolios bleeding from every other sector.

Hedge Funds and the Big Tech Wipeout: The VIP Longs Take a Hit

After months of being propped up by artificial optimism, the tech sector saw a brutal October. The so-called “MAG7”—Microsoft, Apple, Google, and the rest of Wall Street’s elite tech darlings—plummeted. The same stocks hedge funds have heavily invested in are now floundering, exposing their portfolios to massive losses. For the high-rollers betting big on these once-unassailable titans, this month was a painful wake-up call.

What’s more, hedge funds found their few gains on shorts countered by bleeding longs. The big money players aren’t smiling—they’re scrambling to survive, a clear sign that even the elite don’t believe in this rigged market anymore.

Treasury Yields and Dollar Surges Hint at a Coming Reckoning

The backbone of this market—the bond and currency dynamics—is cracking. With Treasury yields climbing 60 basis points in October alone, all thanks to a Fed whose rate cuts have backfired spectacularly, the bond market is now broadcasting fears of an outright policy failure. But if you listen closely, the Fed’s miscalculations aren’t just “errors.” They’re the inevitable fallout of trying to paper over a system built on fragile debt. The yield curve, which measures the health of economic expectations, has flattened, signaling that market insiders expect this so-called “resilience” to come crashing down.

Simultaneously, the U.S. dollar posted its largest monthly rise since September 2022, shaking the foundations of global markets that have been riding on cheap credit and low rates. But there’s a catch here. In an economy of soaring dollar values and Fed-induced rate cuts, the dollar's uptick should be a warning, not a vote of confidence.

Gold and Bitcoin Shine Through the Fog

Despite the dollar’s strength, gold—always a haven when the rest of the system teeters—hit a record high for the eighth time in nine months. It’s a clear sign that, beneath the surface, faith in the dollar is dwindling fast. People know the system’s a house of cards, and they're flocking to tangible assets outside Uncle Sam’s control. And Bitcoin, the people’s hedge against central banks? It surged too, closing in on record highs, with massive ETF inflows in October. Gold and Bitcoin aren’t merely “alternative assets” here—they’re insurance policies against a collapsing monetary regime.

Oil Prices, Sovereign Risk, and an Economy on Edge

As tensions ratchet up in the Middle East, oil prices are ticking up again. And with every international crisis, the true cost of U.S. foreign policy—tied to our endless debt machine—looms larger. That brings us to the USA's sovereign risk, which has skyrocketed since the last rate cut. No amount of Wall Street sugar-coating can cover up the fact that this is the most serious indication yet that international markets are losing faith in the U.S. government’s ability to manage its own fiscal health. The next time the market tells you it’s safe to jump back in, consider this risk—and the mountain of debt it represents.

What’s Next? Higher Volatility and Lower Confidence

Wall Street may try to keep the optimism alive, but the reality is clear: volatility is only going to grow. As we move into November, the so-called VIX, a measure of stock market risk, is primed to spike. This isn’t just a Halloween scare—this is the new normal.

Final Thoughts

In a time of soaring inflation, failed Fed policy, and increased sovereign risk, ask yourself this: Who's benefiting from your faith in this system? The truth is, this "Goldilocks" market was always just an illusion—a fairy tale spun by central banks and investment firms to keep people compliant. Now that the facade is crumbling, it’s high time to protect yourself. Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius here.

The message is clear: there’s no “just right” economy in this nightmare. Take control of your financial future before it’s too late.