Fed’s Surprise Rate Cut Ignites Risk-On Frenzy: Stocks and Gold Surge, Bitcoin Nears $64K

Asset traders were in full risk-on mode following yesterday’s surprise 50 basis point rate cut from the Fed as stocks, cryptos, gold, and silver all trended higher on Thursday amid the mad scramble to allocate before easy money propels markets higher.

“On Wednesday, the Federal Reserve cut its benchmark rate to a range of 4.75%–5%, down from 5.25%–5.5%,” said analysts at Secure Digital Markets. “This marked the Fed’s first rate reduction in four years. The decision, while expected, drew some criticism for its size, with many questioning whether it was enough.”

“The Fed’s projections, outlined in the ‘dot plot,’ suggest another 50bps worth of cuts through 2024,” they added. “They also anticipate a slight uptick in the unemployment rate by year’s end, now forecasted at 4.4%, compared to June’s estimate of 4%, with elevated levels extending into 2025 before improving. Futures markets are pricing in a 75bps cut by year-end, with a 65% probability of a 25bps cut in November and a 50% likelihood of a 50bps reduction in December.”

Secure Digital Markets joined the growing chorus of analysts warning that, “While rate cuts are generally considered bullish for risk assets, the timing of these moves could raise concerns.”

“If economic indicators deteriorate while rates are being cut, it may signal deeper economic trouble,” they said. “Traders should closely monitor key metrics like employment data and leading economic indicators. Historically, aggressive rate cuts, such as those in 2001 and 2007, preceded significant market downturns – with the S&P 500 falling over 40% in both instances within 350 days as unemployment rose sharply.”

“While this doesn’t guarantee a repeat scenario, being aware of these patterns is crucial, especially as we navigate this rate-cutting cycle,” they concluded. “In contrast to recent years, where weak economic data was seen as a positive catalyst for rate cuts, deteriorating data in this environment may have the opposite effect, potentially dragging the market lower.”

For now, traders are ignoring the warnings from history and jumping back into risk assets like there’s no tomorrow. At the closing bell, the S&P, Dow, and Nasdaq were all firmly in green territory, finishing up 1.7%, 1.26%, and 2.51%, respectively.

After pumping to a new record high of $2,600 on Wednesday before subsequently falling back to $2,550, spot gold charted a path higher on Thursday and traded at $2,584.70/oz at the time of writing, representing an increase of 1.04% on the session. Silver, meanwhile, gained 2.5% on the session and trades at $30.79/oz.

Data provided by TradingView shows that after the initial rate cut-inspired volatility dissipated, Bitcoin (BTC) bulls went to work, pushing King Crypto from support at $60,000 to hit a high of $63,903 in trading on Thursday, with bulls looking determined to reclaim $64,000 as support.

At the time of writing, Bitcoin trades at $63,080, an increase of 4.59% on the 24-hour chart.

Bitcoin bull market on with a break above $65,000

“In last week’s issue, I remarked how everything looked like the Fed was about to enter a nice, slow, orderly cutting cycle, as the market was pricing in a very high probability of a 25 bps cut,” said market analyst Bloodgood in his weekly update. “When the meeting finally happened, however, the Fed decided to cut by 50 bps, against most expectations. This might seem like it should be even better for the market – after all, we’re getting lower rates even quicker – but things aren’t that simple.”

“Normally, the expected course in an economy that’s doing well would be to initiate a soft landing with a 25 bps cut, because cutting any faster would mean that the Fed is afraid of a recession, which isn’t a good sign,” Bloodgood said. “Suffice it to say that the last two times the Fed started a cutting cycle with 50 bps were in 2001 and 2007.”

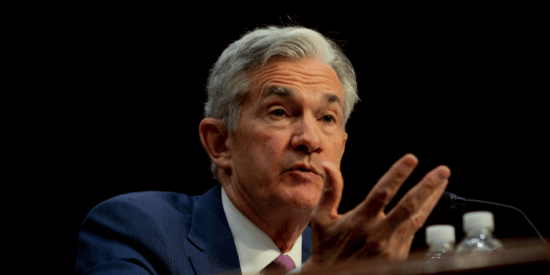

“Nevertheless, Powell kept on repeating the word ‘recalibrate,’ trying to drive home the point that this is a 50 bps thoughtful adjustment and not a panic move,” he noted. “Judging by the market so far, it seems like the reactions are mixed, although fears of a recession are dampened quite a bit by very solid economic data.”

Bloodgood said that Bitcoin bulls’ ability to “break above a key weekly level without dropping below the previous low at $49k” could be “a sign that the trend is shifting from bearish to bullish.”

“Time will tell, but I’m now looking for a higher high, which would mean breaking above $65k,” he said. “As discussed in the previous letter, the recent drop towards $50k wasn’t as significant as the one in early August, indicating that buyers were more aggressive. Whether that’s due to expectations of an interest rate cut or simply a perceived buying opportunity doesn’t matter – what matters are the levels and how we will trade them.”

If a break above $65k happens, Bloodgood said he “expects more money to flow in, and $70k is possible within a couple of weeks. If $65k is rejected, we’ll likely test $60k again, and if that’s lost, months of pain could follow.”

TradingView analyst Arman Shaban also highlighted $65,000 as a key level to watch and is leaning towards the bullish outcome laid out by Bloodgood based on Bitcoin’s past performance.

“By analyzing the Bitcoin chart on the weekly timeframe, we can see that, based on the previous analysis, Bitcoin did not stabilize below the $57,870 level,” Shaban wrote. “After a short-term corrective wave, it was once again met with strong demand.”

“Last night, following the announcement of a half-percent interest rate cut by the Federal Reserve, this cryptocurrency saw even more demand and managed to rise to $62,500,” he observed. “Now, we have to see if the price can break above $65,000 by the end of this weekly candle. It’s likely that Bitcoin and other altcoins will soon begin their main bullish wave, with Bitcoin's potential target in the mid-term being $80,000.”

And previously bearish TradingView analyst Xanrox has also flipped bullish following the Fed rate cut and sees the potential for Bitcoin to rally to $130,000.

“Bitcoin has been going sideways for more than 6 months, but this should end,” Xanrox said. “On the chart, we can see a bullish flag, and the price action in recent days dramatically increased the probability of a bullish breakout! Even though I was bearish pretty much since May (72,000 USD) until now, this recent price action changed my mind to switch to a full bullish mode.”

“From the Elliott Wave perspective, we are starting another strong impulse wave (5),” he noted. “It looks like the sideways price action (wave (4)) is a very complex WXYXZ triple-three corrective pattern. On the chart, you can see the whole price action of this bullish cycle from 15476 USD. From a time perspective, it makes sense as the timeframe is pretty much the same as wave (2).”

To determine his price target, Xanrox utilized the Fibonacci extension tool to determine the 0.382, 0.618, 1.000, 1.382 or 1.618 extensions. “Waves (5) always measure from the begging on the uptrend to the end of wave (4),” he said. “I estimated the target for around 130,000 USD.”

Altcoins breakout with double-digit gains

Further evidence that traders are in risk-on mode could be found in the altcoin market as only two tokens in the top 200 recorded losses on Thursday, while several dozen tokens saw double-digit gains.

Daily cryptocurrency market performance. Source: Coin360

Altlayer (ALT) was the biggest beneficiary of the return of bull market sentiment, gaining 42.1%, followed by increases of 27.5% for Popcat (POPCAT) and cat in a dogs world (MEW). A 2.63% decline for UNUS SED LEO (LEO) was the largest for the day, while BinaryX (BNX) lost 1.7%.

The overall cryptocurrency market cap now stands at $2.19 trillion, and Bitcoin’s dominance rate is 57.3%.

This article originally appeared on Kitco News.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.