How Your Food and Wealth is Shrinking Before Your Eyes

Dear Reader,

If you share the same sentiments and values that we do, then you believe in the benefits of capitalism.

You understand that market competition is a key element that provides consumers with a great advantage, as it allows each and every one of us to choose the products and services that benefit us the most.

Naturally, the winners in a market are businesses that can provide the best goods and services at the most competitive costs.

But what we don’t approve of, what hurts the markets and consumers, is any form of “trickery, from lack of transparency to outright fraud.

And this form of trickery has been taking place for some time, from basic goods and services to the our monetary system.

Have you noticed that some of the goods you’ve been stocking in your pantry have shrunk?

Skippy Peanut Butter: Did you notice that the bottom of the jar has a curved design, whereas years ago the bottom was flat? Skippy wanted to raise their price by 10%. They knew the customers wouldn’t go for that price hike.

Instead, they decided to hide their price markup by giving you 10% less peanut butter by curving the bottom of the jar. That’s trickery. That’s plain out cheating.

Kellogg’s Cereal: Cereal is typically displayed facing out to the customer. So although the customers see the height and width, which are the same, what may not so easily be noticed is the depth of the cereal box. That’s another sneaky price hike that customers didn’t notice.

Soap Bars: Dial and Zest bars used to have flat surfaces. Now both companies are cutting curves into the bars. In short, you pay the same (if not a higher) price while they are robbing you of soap.

These are just three examples in which businesses have been charging you more by giving you less. They are hidden price markups.

As with any business, they have the “right” to price their products however they wish. BUT, they also have the “responsibility” to be transparent about it.

Anything less than transparent in this circumstance is fraud.

And if you look at most of your basic household items, you may find plenty more instances where your basic necessities have been “shrinking.”

Check out the video below to see the source from which we took this information:

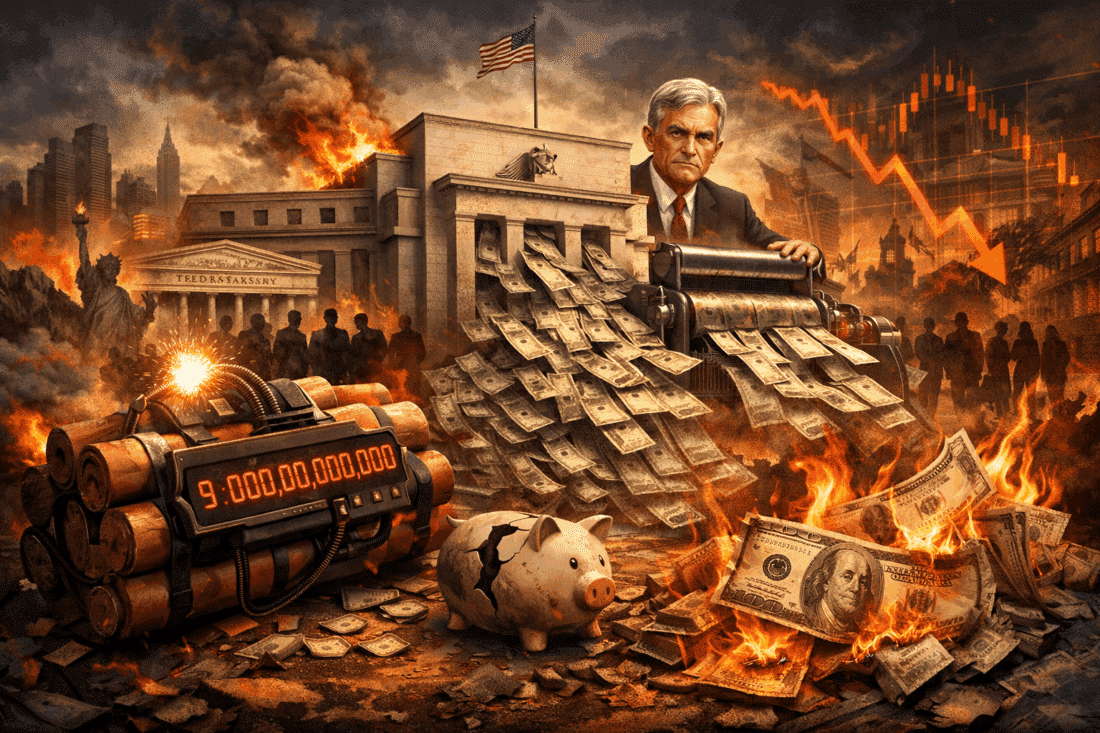

But hidden price hikes aren’t limited to basic household goods. This has been going on for the longest time in our monetary system.

If you have been paying attention to food costs over the last decade, you probably noticed that the food that you put on your table is costing more.

It’s not just your food, the purchasing power of your hard-earned dollars has been shrinking.

For many hard-working Americans, the cost of basic goods to support themselves and their families is starting to put a serious hole in their budgets.

And that’s unfair. Because unlike most products and services in a healthy and competitive market, we have very few choices when it comes to seeking alternatives to the dollar.

The inflationary effects of QE over the last decade amounts to a hidden tax that all Americans are forced to pay.

This is evidenced by the US Dollar which recently sank to a 3-year low. According to Reuters, “Gold prices hit the highest in more than four months on Wednesday after a U.S. official

welcomed a weaker dollar and investors sought insurance against uncertainty.”

Fortunately, the only safe haven against this uncertainty happens to be an asset that cannot be inflated (like money) or reduced (like the basic household goods in the examples above).

Last week, spot gold rose 0.7% to $1,350.43. From a technical perspective, we are eying the next big level of $1,400.

As Ole Hansen, head of commodity strategy at Saxo Bank says, “It's the weaker dollar, it's the inflation focus and it's also to some extent the market is continuing to look for a hedge against a world that's becoming incredibly complacent with stocks at record highs."

With markets expectating another US interest rate hike in March, the opportunity cost of gold is rapidly increasing.