Gold Breaks $3,600 — But What Comes Next Will Shock the System

Well folks, here we are — $3,600 gold. I’ve been in this game a long time, and I’ve never seen Main Street and Wall Street so closely aligned on anything, let alone precious metals. Usually, the suits on Wall Street are five steps behind reality, too busy chasing AI stocks and crypto memes to notice the foundation crumbling beneath their feet. But now? Even they’re running for cover.

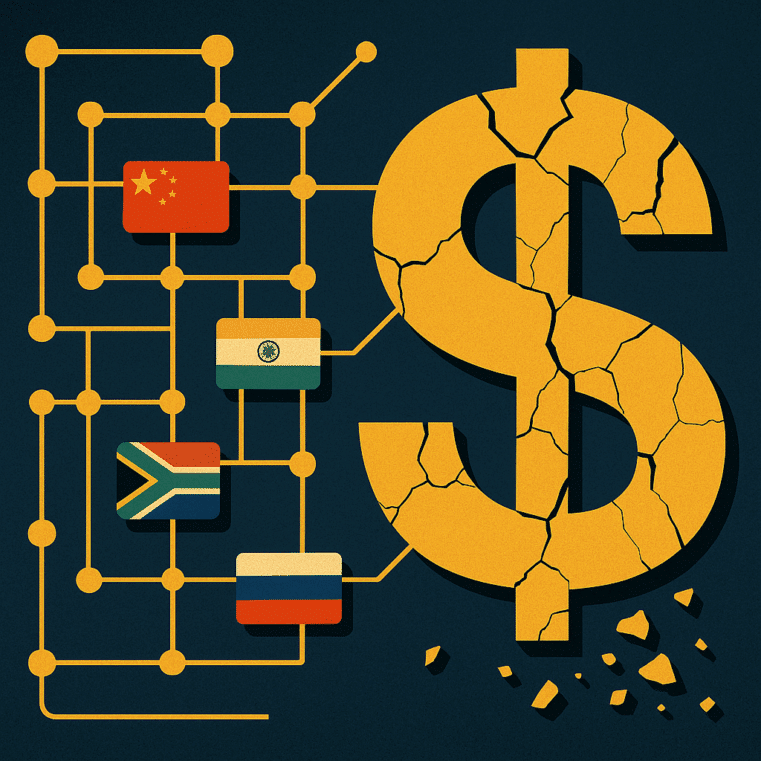

Let’s not kid ourselves: this isn’t just a price rally — it’s a referendum on the entire financial system.

The System’s Cracks Are Turning Into Canyons

This Kitco article gave us all the technical bells and whistles — tick charts, resistance levels, trading ranges — and while that’s all fine and good for the number crunchers, most folks just want to know: What the heck is going on?

Here’s what’s happening in plain English:

- The U.S. labor market is weakening — not just softening, but sputtering.

- Inflation is rearing its ugly head again.

- The Fed’s trapped — cut rates and stoke more inflation, or hold steady and risk total market collapse.

- The dollar is bleeding credibility.

- And the world? It’s watching, and more importantly, it’s acting.

Central banks across the globe — China, Turkey, India — are buying gold hand over fist. Why? Because they don’t trust the U.S. government to manage its economy, and neither should you.

The Dollar Is the Titanic — Gold Is the Lifeboat

I grew up in a working-class family where a dollar was a dollar — you could trust it. But today, that same dollar’s been gutted by decades of reckless spending, endless debt, and a central bank that prints like there’s no tomorrow.

We’ve been warning for years that the dollar was becoming Monopoly money, and now, as the mainstream finally catches up, gold is rocketing to the moon. But here’s the scary part: this is just the beginning.

When you see Wall Street strategists openly admitting that gold is the “only safe asset”, you know we’ve reached a tipping point. Michael Brown says we’re due for a pullback — maybe. But every dip from here is just another opportunity for those who get it to buy in before the real chaos starts.

Why This Rally Isn’t Like the Others

This isn’t 2011, or 2020. This isn’t a “fear trade” or a “temporary hedge.” This rally is built on global distrust in central banks, including the once-almighty Fed. It's built on the realization that fiat currencies are circling the drain, and people are waking up to the fact that gold and silver aren’t just investments — they’re survival tools.

Let’s look at the fundamentals:

- Record government debt and interest payments now outpacing defense spending? That’s not a policy error — that’s economic suicide.

- Real inflation (not the fantasy numbers the government spoon-feeds us) is eating away at every paycheck.

- Central bank digital currencies like FedNow are quietly rolling out, setting the stage for surveillance finance — where every transaction is monitored, every asset is trackable, and your freedom is traded for convenience.

People aren’t just buying gold to make a quick buck — they’re buying it because they’re scared. Scared of a system that no longer works for them. And rightly so.

Wall Street Might Finally Get It — But Don’t Wait for Them

According to Kitco, 78% of analysts say gold is going higher next week. And Main Street agrees — 73% of everyday investors are bullish. That’s no coincidence. That’s a signal.

A few analysts — like Michael Brown and Rich Checkan — still talk about “pullbacks” and “profit-taking.” Sure, maybe gold dips $20 or $30 here and there. But let me be clear: we’re headed to $4,000 and beyond, and anyone waiting for the perfect entry is going to be watching from the sidelines when it happens.

You don’t wait for your house to catch fire to buy a fire extinguisher. Same logic here. You don’t wait for the banking system to seize up before buying hard assets.

Silver — The Sleeping Giant

Now, don’t sleep on silver, either. It’s still lagging behind gold, but not for long. In every major gold rally in history, silver plays catch-up — fast and hard. When it moves, it moves violently, and those who got in early saw life-changing gains.

Silver is not just an industrial metal — it’s poor man’s gold, and with inflation roaring and trust evaporating, people are going to pile into it just like they did in the '70s and 2010s.

Final Thoughts from an Old Hand

I’ve lived through market crashes, currency crises, and banking collapses. And I’ve learned one thing: gold doesn’t lie.

You won’t hear this on CNN or from your local banker — they’re too busy toeing the line, pretending everything’s fine. But I’ll tell you the truth:

The system isn’t just broken — it’s weaponized.

Your savings, your income, your future — all of it is vulnerable.

Unless you do something about it.

✅ Here’s What You Need to Do Right Now:

- Download Bill Brocius’ free eBook: Seven Steps to Protect Yourself from Bank Failure

This guide is packed with actionable steps to get your money out of the line of fire before the next wave hits. - Talk to someone about physical gold and silver — not paper promises, not ETFs, but the real deal. Dedollarize has your back.

- Stop waiting. Start building your fortress now — before everyone else starts piling in.

Gold just broke $3,600 — not because of hype, but because the world is waking up. Don’t be the last to figure it out.

Stay safe. Stay sovereign. Stack smart.

– Frank Balm