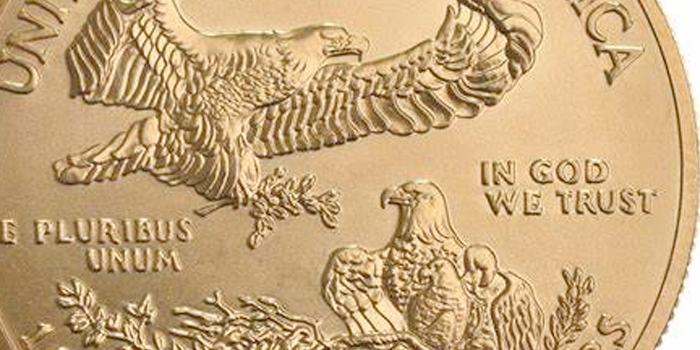

Gold Buyers Are Forking Over Lofty $135 Premiums for U.S. Coins

EDITOR'S NOTE: This is an unprecedented set of circumstances that are pushing the increase in premiums. Very clearly the spot market for PHYSICAL is vastly different than for PAPER ( COMEX Contracts) Gold. Many in the precious metals industry have been calling for a complete decoupling from the COMEX and London Exchanges, simply because those are the two locations with the most opportunity to artificially suppress gold ( and silver) prices in an attempt to manipulate the overall markets.

(Bloomberg) -- Retail investors can’t seem to get enough of gold during the coronavirus crisis, and they are willing to pay staggering amounts to get their hands on it.

Consumers who want to buy gold coins typically have to pay more than the per-ounce prices quoted on financial markets in London and New York. That premium has jumped to $135, more than tripling from two months ago, said Robert Higgins, chief executive officer at Argent Asset Group LLC in Wilmington, Delaware.

“There has never been a time for American Gold Eagles at this premium level,” Higgins said in an interview, referring to the popular U.S. bullion coin.

The surge is being exacerbated by coronavirus-related lockdowns, which have led to a squeeze in the supply of coins and bars available for shipment around the globe. At the same time, bullion’s status as a haven is luring investors rattled by worldwide market and economic turmoil.

“Until the world catches up with the imbalance and gets back to a normal balance of supply and demand, the premiums will stay,” Higgins said.

Read Original Article at investing.com