Gold Confiscation: There’s No Reason to Believe That it Won’t Happen Again

The claim that the government can one day confiscate your private gold holdings under special circumstances may seem not only remote but utterly ridiculous. It’s true that such a draconian action did take place in the early 20th century, but so did many other things that would now be considered mere precursive stages in our historical progress--cumulative “lessons learned” that ultimately led us to a more evolved way of thinking.

But the fact remains that many gold investors still consider this an issue. As money becomes increasingly digitized, the fear that anyone can monitor and potentially seize your (digital) cash assets, illegally or legally, remains a legitimate concern. Hence, many gold investors invest a portion of their wealth in physical gold (and silver) assets to avoid the vulnerabilities that digitization introduces to cash. Why then are many gold investors afraid of the government seizing their gold (and silver) coins and bullion? Is such a fear irrational, or is it sensible and prudent?

Let’s take a look at the history of gold confiscation in the US. Let’s closely examine that laws that allowed and (eventually) prevented such a heavy-handed act. Perhaps then we can come to a conclusion as to whether gold confiscation is an idea to be dismissed, or whether it remains a likelihood, warranting the concerns that many sound advocates seem to harbor.

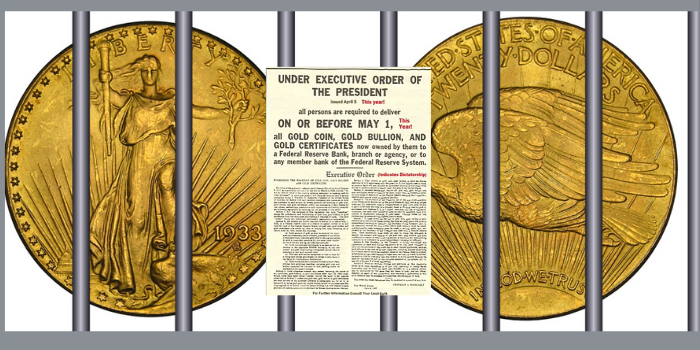

1933

On May 1, 1933, President Roosevelt issued Executive Order 6102, requiring all citizens of the US to hand over a majority of their private gold coin, bullion, and certificates to the Federal Reserve in exchange for cash. This order was legitimized through a recent (March 9, 1933) amendment of the Trading With the Enemy Act initially passed in 1917.

Failure to comply with this order was punishable by a fine up to $10,000 ($197,958.46 in 2019 dollars when adjusted for inflation), prison time for up to 10 years, or a combination of both. The order may have allowed for a few exceptions, such as rare numismatic coins, but overall, the federal confiscation of private wealth was a blatant overreach of power, one that had no legal recourse, despite whatever necessity the Roosevelt administration claimed to have justified it.

1934

On January 30, 1934, the Gold Reserve Act passed into law. It required all gold and gold certificates held by the Federal Reserve to be handed over to the US Department of Treasury at an exchange rate between $20.67 and $35 per ounce. Twenty years later, exemption rules in the initial executive order were extended and slightly altered to include a wider category of rare numismatic coins.

1971

President Nixon abolished the gold standard, announcing that the dollar was no longer convertible to gold at a fixed rate.

1974

President Ford issued Executive Order 11825, repealing Roosevelt’s executive order which limited the amount of gold that people can privately accumulate and store. American citizens were now given back their right to own gold without limitation. However, this did not repeal the Gold Repeal Joint Resolution which made it illegal for businesses or individuals to draw up contracts for transactions specifying the monetary use of gold. In other words, you can’t enforce the use gold as a form of money to settle transactions.

1977

Congress stripped away the president’s powers to regulate gold transactions during any period of national crisis besides wartime. The 1933 Joint Resolution was amended, meaning that after 1977, gold clauses can once again be used in contracts between parties.

1985

President Reagan signed the Gold Bullion Coin Act. authorizing the US Mint to create gold coins from domestic sources. Hence, the production of Gold American Eagle gold coins.

2020 and Beyond

None of the historical instances presented above answer the question as to whether the government will once again give itself the right to confiscate gold in the future. Can the government repeat those actions? Sure it can. Might there be any conditions to compel the government to take such actions? Nobody knows.

But what we do know is that the laws have been and can be altered. The government has done it before, and there’s no reason to believe that it won’t do it again.

But one thing that has changed, making it easier for the government to confiscate gold and silver coins and bars, is the CUSIP tracking system. Buying gold or silver with a CUSIP number essentially plays into the hands of the government and the banking system.

So, if your aim is to purchase gold as a private asset, you may want to purchase numismatic coins or bullion that are not trackable within the CUSIP system. Remember, a safe haven should be capable of hedging not only negative economic environments but also various conditions in which your wealth and private assets are at risk.