Gold Prices Pressured by Global Run on Reserves

The US Gold Depository

Approximately 6,000 tons of gold are being held in a depository under the Federal Bank of New York. As the US holds the largest gold reserves in the world, most Americans probably assume that this depository is where the nation’s gold is being held under lock and key. But what most don’t realize is that almost none of it belongs to the United States. US gold is kept at separate locations, split between the Denver mint, West Point, and Fort Knox. The gold reserves stored in the NY Fed Bank depository belong to the IMF and several other foreign nations. In other words, we’re holding foreign government’s gold for “safekeeping.”

The Bank of England Gold Depository

Another 6,000 tons of gold is being stored in the Bank of England’s vaults, the second-largest third-party depository in the world. Among its total holdings, 10% of it actually belongs to the United Kingdom. Similar to the US, most of the gold belongs to foreign nations.

A Matter of (Mis-)Trust

For decades, foreign nations have kept their gold in the US and UK for safekeeping. It was presumed that under conditions of a severe financial crisis, neither nation would take the inconceivable step of confiscating the gold they have been entrusted with for their own accounts. This trust is, of course, predicated on confidence in the political, economic, and moral integrity of both nations. But over the last few years, we have seen evidence of that trust and confidence waning, as foreign gold outflows have been increasing.

Trends in Gold Repatriation

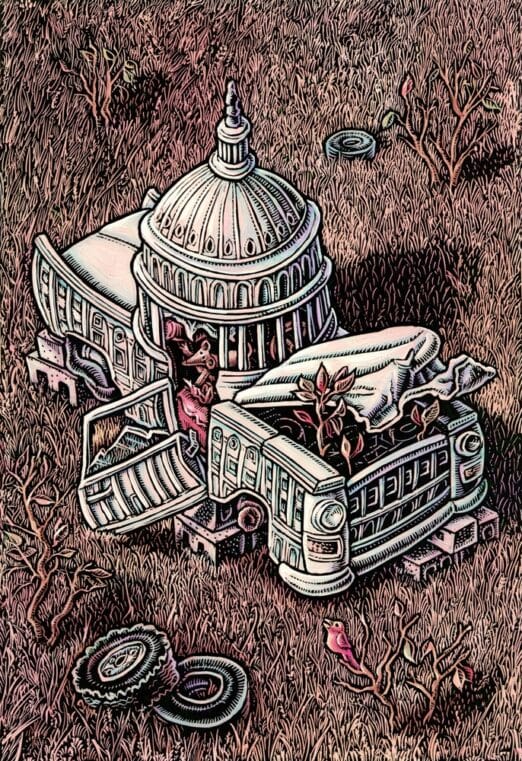

Poland's President proudly holds repatriated gold.

Recently, a number of foreign central banks have been demanding their gold back from the US and UK. The catalyst for this “run on the bank” trend was Germany’s repatriation of gold from the Bank of France and the US Federal Reserve. Soon thereafter, Austria, Azerbaijan, Hungary, and the Netherlands began pulling out and repatriating their gold. Most recently, Poland joined the repatriation trend, having decided it was less of a risk to keep gold in their own national vaults than to trust the Bank of England for its storage and safekeeping. Some nations, notably China and Russia, have long opted out of storing their reserves with third-party depositories--a decision that seemed to have served both nations well with regard to their own monetary and political interests.

Gold Derivatives and Price Manipulation in the US and UK

Both New York and London serve as primary centers for gold trading. But as with most commodities, physical gold may be secondary to its derivatives market. Foreign gold sitting in central bank deposits are not static assets. They can be leased to trading banks or pledged as a security without delivery of title or possession, a process known as “hypothecation.” What do banks do with leased or hypothecated gold? They use it to back up their short sales on derivatives (paper gold) aimed at artificially suppressing the price of “physical” gold. But now that nations are repatriating their gold from the US and UK, there is less gold available to support the manipulation of gold prices. Perhaps the rise in gold prices have had something to do with this, as it would have allowed gold prices to rise, naturally reflecting its true state of supply and demand. Whatever the case may be, we’re seeing the beginnings of a bank run on gold. And at what point might this current bank run on gold end? Possibly, when most of the foreign-held gold in US and UK deposits have been withdrawn.

In 2018, we’ve seen central banks making record-setting gold purchases. We see this massive buying spree continuing into 2019. Now that foreign nations have begun repatriating their gold from US and UK depositories, leaving very little physical gold to hypothecate to banks involved in gold market manipulation, it will be interesting to see what kind of upward pressure this will exert on gold prices in the near term.