Gold Takes a Hit as Inflation Pressures Mount: Here’s What It Means for You

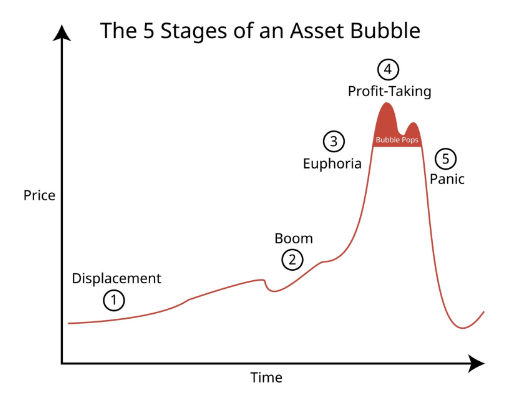

Gold prices took a tumble, slipping below $2,650 an ounce as stubbornly high inflation threw a wrench into the precious metal’s recent momentum. The U.S. Department of Commerce released fresh data showing the annual core Personal Consumption Expenditures (PCE) index—the Federal Reserve’s favorite inflation gauge—climbed 2.8% in October, up from 2.7% in September.

This persistent inflation is making waves, putting pressure on gold just as it had been gaining ground. December gold futures now sit at $2,642 an ounce, up 0.79% for the day but off earlier highs that had gold prices up over 1%.

What’s Driving the Numbers?

The PCE index ticked up 0.3% last month, right in line with economists’ expectations. Meanwhile, headline inflation—which includes all categories of goods and services—also rose 0.2% month-over-month, matching forecasts. Over the last year, headline inflation now stands at 2.3%, up from September’s 2.1%.

In plain terms, the cost of living isn’t coming down as quickly as anyone hoped, and gold markets are feeling the squeeze.

On the flip side, personal incomes saw a healthy bump, rising 0.6% in October compared to 0.2% in September. That’s higher than the 0.4% economists predicted. Consumers, however, are pulling back a bit—personal spending rose only 0.4%, slower than September’s 0.6% growth.

What the Fed Might Do Next

Economists like Stephen Brown, Deputy Chief North America Economist at Capital Economics, are keeping a close eye on this data. He points out that the Federal Reserve’s decision to either pause or hike rates next month hangs in the balance.

“With the Fed minutes showing some officials are open to a pause if inflation doesn’t cool, upcoming CPI and PPI data will be critical,” Brown said.

Translation? The Fed’s next move could keep rates steady or even push them higher, depending on what inflation does from here.

Why Gold Matters More Than Ever

Here’s the deal: inflation eats away at your buying power and the value of paper currency over time. Gold has always been a hedge against that, holding its value when everything else seems to crumble. Yes, it’s feeling some pressure from these inflation numbers, but don’t let short-term moves fool you—gold’s long-term track record is rock-solid.

Think of fiat currency like a car that loses value the second you drive it off the lot. Gold? That’s your classic collectible—its worth holds steady or even grows, especially in uncertain times like these.

What Should You Do Now?

If you haven’t started building your safety net with gold and silver, now’s the time. Inflation is showing no signs of letting up, and the Federal Reserve’s actions could send shockwaves through the economy. Take steps today to protect your wealth.

Start by downloading Bill Brocius’ free eBook, Seven Steps to Protect Yourself from Bank Failure. It’s packed with actionable tips to shield yourself from the storm.

And don’t forget to subscribe to Dedollarize News for insights on safeguarding your financial future. Stay informed, stay protected.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.