Gold’s Wild Ride: From Record Highs to a Much-Needed Breather

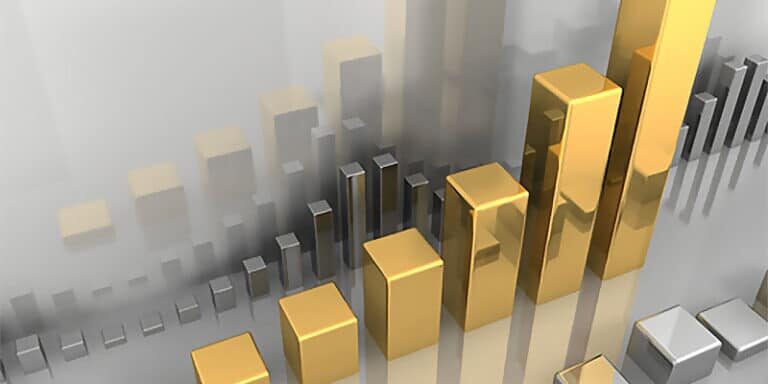

Alright folks let’s talk about gold and its wild ride recently. Picture this: Gold prices have been on a surge, and for good reason. On September 26, 2024, gold futures blew past $2,700 an ounce, hitting an all-time high. That’s after a crazy two-month run, where prices shot up from $2,400 in August—marking a solid 12.7% gain. And if you zoom out a bit, the story gets even better. Back in October 2022, gold was hanging out under $1,900. So, in less than two years, we’re looking at a whopping 42% climb. That’s a lot of momentum for a metal that people have turned to for centuries when times get tough.

What’s Fueling Gold’s Rally?

Now, you might be wondering, what’s behind this surge? Let me break it down for you:

- Inflation Woes: The Fed’s been doing its dance with inflation, trying to bring it under control after it shot up past 9%. And whenever inflation rears its ugly head, gold becomes the go-to asset. It’s like putting your money in something that doesn’t lose its value as fast as the dollar. Gold, in times of inflation, becomes a financial life jacket.

- Geopolitical Storms: Between Russia’s invasion of Ukraine and the recent conflicts in the Middle East, the world’s got a lot of uncertainty. And when things feel shaky, people flock to safe-haven assets like gold. It’s the same old story: when the world’s a mess, gold holds its ground.

The Inevitable Pullback

But here’s the kicker—gold’s rollercoaster ride hit its first drop. After that historic $2,700+ peak, prices have pulled back to around $2,625. That’s about a 23.6% dip from the high, and for those of you who like to follow technical analysis, it lines up with the Fibonacci retracement levels. So yeah, we’ve hit a speed bump, but this pullback was bound to happen. Markets never go up in a straight line, right?

What’s Next for Gold?

So, where does gold go from here? Well, even though we’re seeing some short-term volatility, the long-term outlook is still solid. Inflation is still very much a thing, geopolitical tensions aren’t going away anytime soon, and the economy’s still on shaky ground. All this keeps gold in demand. But buckle up—there might be more bumps ahead. The key is to stay alert and keep an eye on how things play out.

If you’re looking to get deeper into this stuff, or you’re wondering how to protect your own wealth in times like these, I highly recommend checking out Bill’s book or joining the Innercircle NEWSROOM for more insights. You can find it all right here: Seven Steps to Protect Yourself from Bank Failure.

At the end of the day, gold’s like that dependable old truck—it might rattle a bit along the way, but it’ll get you where you need to go when the world feels uncertain. Stay the course, and protect what you’ve worked so hard for.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.