Here's What a Full-On Global Trade War Might Look Like

The good news is that the tariff on steel and aluminum imports might be rather small in the big scheme of things, applied to goods that comprise only 1.8% of total U.S. imports and raising the average US import tariff to 0.3%.

And although it may affect a number of our trading partners and allies, namely Canada, Brazil, and South Africa, the effect of the tariffs, though not negligible, are still rather small. For instance, the tariffs would affect only 2.9% of Canada's total exports.

Nevertheless, nations across the world are riled-up over them, and the market response has been one of panic.

Why such a global response? And what is causing so much fear among market participants?

On the one hand, Trump's move goes against the grain of a historical trend--one that has seen a declining progression of the tariff rate in the US from approximately 20% in the 1930's to 1.5%, the rate at which it has been hovering for some time.

On the other hand, there's the real threat of retaliation, as nations across the globe may decide to impose tariffs on a number of US goods, most of which are likely to include jeans, motorcycles, and bourbon whiskey.

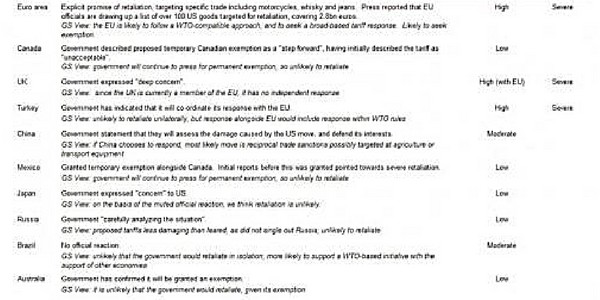

Goldman Sachs produced an interesting study identifying the nations that are most likely to retaliate and estimating the severity of their response:

Source: Global Sachs Investment Research via FT, Reuters, Bloomberg

The effect of the tariffs on trade may be quite small: according to Goldman's chief economist, Jan Hatzius, "the announced tariffs will result in a 0.2% fall in US imports when Canada and Mexico are exempt, and 0.4% when they are included."

But that's the narrow view, one focused on the tariffs' direct effect on trade. Even the smallest of economic actions have the potential for a much wider chain reaction. And this brings us to the crux of Goldman's study.

If a trade war were to break out, the costs on a macro level would rise significantly.

- "A severe trade war—in which everyone imposes a tariff on everyone else—leads to higher world inflation, tighter monetary policy, and slower growth."

- "This drag is amplified if equity prices drop around the world: financial conditions provide an important channel for negative spillovers. "

- "Open economies with trade surpluses—such as the Euro area—are hit hardest in this scenario."

According to the Goldman study, 4 consequences can materialize, enumerated according to a level of severity:

- There may be no retaliation to US tariffs: the announced tariffs will cover around 1% of US imports. Interest rates and exchange rates will respond accordingly, but overall, equity prices will most likely remain stable.

- A trade war breaks out, the US its main focus: Retaliation from trading partners prompts the US to further increase its tariff rates. The total rate, rising to around by 5 percentage points, may be targeted at the US; trade among US partners, in this scenario, will continue without trade barriers.

- A global trade war breaks out: In this scenario, each nation decides to impose a 5% tariff on every other nation.

- Global trade war sparks an equity sell-off across the globe: Equity markets across the globe plunge by 10% in response to a 5% global tariff rate.

Goldman Sachs simulated each scenario to measure its potential impact on the global economy. Here's what they determined might happen:

The consequences:

Scenario 1: The positive effect of the tariffs on the US real GDP will be small: possibly only 0.01% stronger after year one with core inflation rising by 2 basis points.

The tariffs will boost domestic production, giving slight rise to GDP.

This growth may lead to higher interest rates, countering the effect of higher inflation while boosting the dollar.

Scenario 2: US exports are significantly hampered by foreign tariffs.

As compared with the baseline before the tariffs, the inflation rate is higher.

The Federal Reserve may hike rates faster in response, strengthening the dollar even more.

Foreign tariffs against US exports may help cushion the impact of US tariffs, but higher interest rates lead to slower growth.

Overall, a tariff rate at or below 5% among the US and its partners may still yield a small impact.

Scenario 3: The impact of global protectionism becomes severe as global inflation depresses consumer spending.

Nations with trade surpluses, such as Europe, will take the brunt of the impact.

Central banks are forced to raise interest rates.

In this scenario, the US dollar will no longer strengthen.

Scenario 4: Markets across the globe will respond adversely to the global trade war.

The US and other nations with large equity markets will be impacted the most.

The dollar weakens significantly.

As it stands now, and as some Fed speakers have concluded, the tariffs pose a "modest risk."

But in the event of a global trade war, this perspective will invariably change.

Interestingly, a global trade war, qualifying as a major risk event, may stave-off further interest rate hikes on the part of the Fed.

This would be a "prudent" decision, yet one that will serve only to delay the inevitable: the worst-case scenario in which the US equity markets take a disastrous plunge...along with every other global market.

But there's another scenario which, focusing strictly on economic impact, may appear laterally to what's going on.

In this scenario, the high consequences will no longer count as they stand.

This scenario, a much more serious one, may just be what Trump is after.

And it makes strategic sense, but it also sounds a warning, as this solution WILL significantly impact you and your wealth.

To find out, click here