The Hidden Bubble That Nobody Sees

It seems as if everywhere we turn, asset prices are bubbling up in every market. The stock and bond markets are at unprecedented highs. Real estate prices are on the rise. Bitcoin and other cryptocurrencies have surged to astounding levels. Various non-traditional assets like art objects and even collectible cars have also skyrocketed.

And although the Fed’s inflationary measures are within expected range, more or less, we feel the rising costs of our basic necessities, and it doesn’t feel good.

Gold and silver seem to be one of the few assets that aren’t in a bubble. But let’s step back for a second and try to figure out what is going on.

Isn’t it the case that the some of the biggest risks (and opportunities) take place behind our backs; they originate where everyone is not looking?

So let’s ask ourselves: where are we not looking; what are we not seeing? And does the current market bubble environment point to something larger; something that remains more or less hidden?

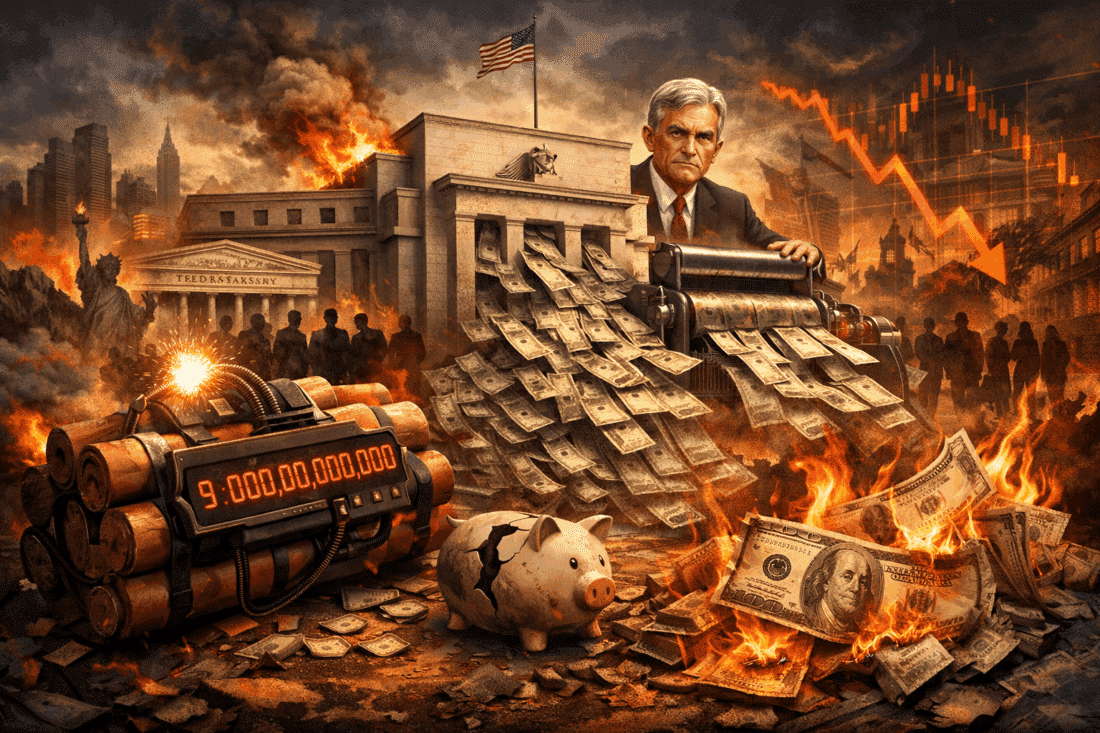

The answer may seem rather obvious. The monetary system is awash with debt and credit creation. This ought to be a bold statement, if not for the fact that every market alarmist has been repeating this for years.

But how true is it? Shouldn’t we at the least evaluate the signs and assess whether such a claim is potentially true?

Let’s go ahead and do that, starting with the US debt problem (that aberration we all know exists but try to ignore).

US Dollar Drop is Being Embraced.

The US Debt Problem:

In isolated situations, national debt and imbalances pose problems that are reasonably adjustable. But when the entire world economy is funded by international US bond purchases, and when global energy products are priced in US dollars, then we have a problem, particularly when nations approaching near-superpower status decide that the value of the dollar is no longer advantageous.

De-dollarization is the inevitable result, and we will be seeing the effects of this in a matter of time. The US may be forced to pump more money into the system; devaluing the dollar and creating even higher levels of inflation.

The Euro-dollar Crisis:

The Euro-dollar is a short-term money market to facilitate the lending and borrowing of US dollars outside of the US. Currently, the market has turned into a “short squeeze” brought about by the scarcity of dollars. As CryptoCoinsNews writes, “even if this mechanically means tides of ‘a rising dollar or a falling counterpart currency’ in the short term, it is not a net positive-bullish for the US dollar as a reserve currency.” The liquidity crisis that struck the markets in 2014 could just as well happen again quite rapidly.

Exiting the Petrodollar:

Let’s talk more about the de-dollarization process. Here’s the scoop: for both China and Russia, US dollar exposure has become more than just a chronic economic burden, it has become a matter of national security.

So what are they doing about? Actually, something quite clever: they’re moving in two directions at once--increasing the dollar supply while maneuvering to decrease dollar demand by repricing oil in Yuan, which is exchangeable for gold. As China and Russia work toward the expansion of non-dollar bilateral trade with various African and Eurasian countries, the Petroyuan may emerge to become one of the greatest--if not THE greatest--threat to the US dollar.

The Return of Gold:

In 2010, World Bank President Robert Zoellik called for a return to gold among the world’s top five currencies. In 2011, the IMF’s Dominique Straus Kahn made a similar announcement, suggesting that SDR’s be linked to gold.

China had already begun moving in that direction as early as 2013, reducing their dollar stockpiles in favor of gold imports. Russia has also been following suit, as their oil trade has been shifting toward the new Oil-Petroyuan-Gold system. The price of oil barrels per gold had more than doubled, from 13 barrels for an ounce of gold to 30 per ounce. So if Russia exports massive amounts of oil, say 1,000 tons, then this only strengthens Russia’s gold reserves, making them even wealthier--a trade setup that makes Russia’s economy virtually unsinkable.

But this also reveals a long-term play, one that requires more patience than aggressiveness on the part of China and Russia: as long as they continue with their current strategy, the US dollar, unable to support its own weight, will eventually collapse.

The bottom line is that the US dollar is quickly losing its status.

How can we gauge the rapidity of the dollar’s demise? Here are a few things to watch out for:

- Watch for the volume and open interest in the new CNY denominated Oil Futures.

- Watch the decoupling between treasury yields and the dollar index; if yields rise as the index goes down, things are getting worse, and fast!

- Watch for declines of US dollar reserves among global central banks, especially those of China, Russia, and Saudi Arabia. Further declines mean that the US cannot maintain its state of indebtedness.

So how should US investors invest in light of the dollar’s rapidly increasing state of demise?

The answer is simple: buy precious metals and diversify into a portfolio of Bitcoins and altcoins; preferably those with large market caps and strong fundamentals.