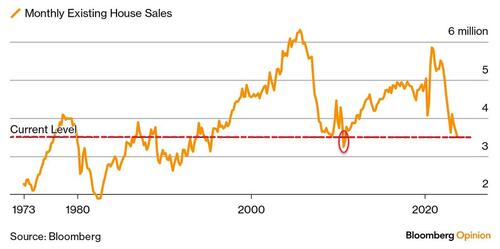

Home Sales Plummet to Crisis-Era Lows with Worst Yet to Come

Existing home sales plunged back below 4mm SAAR last month for the first time since the foreclosure crisis in 2010. Outside of the fallout from the Great Financial Crisis, home sales are the lowest in 27 years...

Source: Bloomberg via ZeroHedge

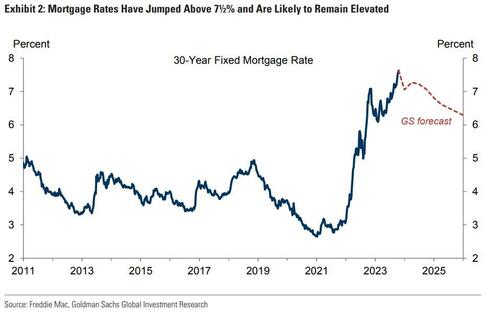

But, if Goldman Sachs' Jan Hatzius and his team are right, worse is to come.

Meanwhile, prices are not reflecting the sales pressure - doubling relative to sales in the last four years... just like they did into 2008's peak...

Source: ZeroHedge

Goldman's strategists expect mortgage rates to remain elevated for the foreseeable future, warning that these sustained higher rates will have the most pronounced impact in 2024 on housing turnover.

Source: Freddie Mac, Goldman Sachs Global Investment Research via ZeroHedge

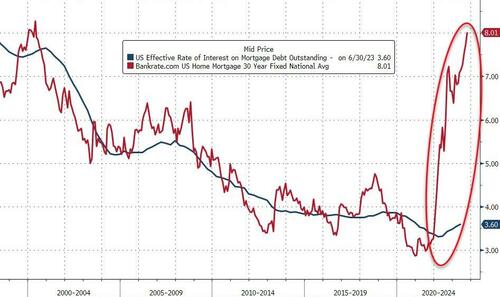

Essentially all borrowers have mortgage rates well below current market rates, and even a sharp decline in mortgage rates will leave a historically large share of homeowners with a financial disincentive to move...

Source: ZeroHedge

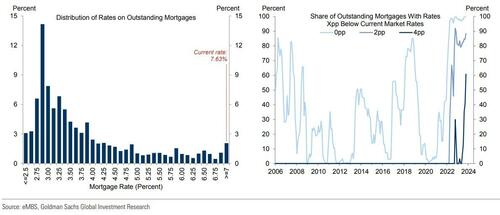

Almost 90% of homeowners have rates more than 2pp below and (over 60% have rates more than 4pp below) current rates..

Source: eMBS, Goldman Sachs Global Investment Research via ZeroHedge

The combination of mortgage borrowers refinancing at low rates en masse either last cycle or early in the pandemic and the high current level of mortgage rates has created a significant implicit financial cost for a substantial share of households that otherwise might consider moving, as buying a new home would require them to prepay their current mortgage and take out a new mortgage at a significantly higher rate.

Goldman therefore expects this “lock-in” effect to push existing home sales even lower in the coming months and to limit any rebound next year: we expect existing home sales to decline to 3.8mn in 2024, the lowest level since the early 1990s.

“The slide in home sales is far from over,” says Nancy Vanden Houten, lead US economist at Oxford Economics.

“Keep in mind that recorded sales of previously owned homes are based on contracts signed a month or two earlier. Since those contract signings, mortgage rates are up another half-percentage point and it’s doubtful that the squeeze on affordability from higher rates has been offset by declines in home prices.”

With few transactions happening, current prices may be illusory.

Hatzius' team suggests home prices are likely to decline this winter before potentially rebounding only modestly in 2024.

The projections of Goldman's housing model (that jointly considers supply, demand, affordability, and home prices), suggests that home prices are likely to continue increasing rapidly for the next couple of monthly readings - owing in part to the Case-Shiller home price index’s delayed release time and three-month moving average design mean - before slowing sharply and turning negative into year-end.

Source: S&P Global, Goldman Sachs Global Investment Research via ZeroHedge

Thereafter, our model projects a rebound to below-trend home price growth (Dec. 2024 year-over-year: +1.3%) as rates decline modestly but remain at elevated levels.

The good news - this will likely weigh on inflation signals, help The Fed make the case for being done (but as we noted above - even a relatively large decline in rates will not make much difference to the current cohort of homeowners).

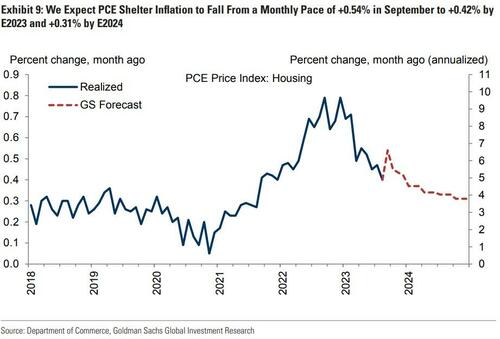

Goldman expects shelter inflation to slow to +0.42% by December 2023 and +0.31% by December 2024, implying a decline in the year-on-year rate to 4.1%, as the gap between new- and continuing-lease rents closes further.

Source: Department of Commerce, Goldman Sachs Global Investment Research via ZeroHedge

The bad news - as Bloomberg's John Authers concludes: "The constipated market, with the sudden surge in mortgage rates taking many houses off the market, will have to resolve itself somehow. US consumers have stayed remarkably enthusiastic and active. That might be hard for them to maintain if and when house prices correct."

Originally published by Tyler Durden at ZeroHedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.